Blogpost

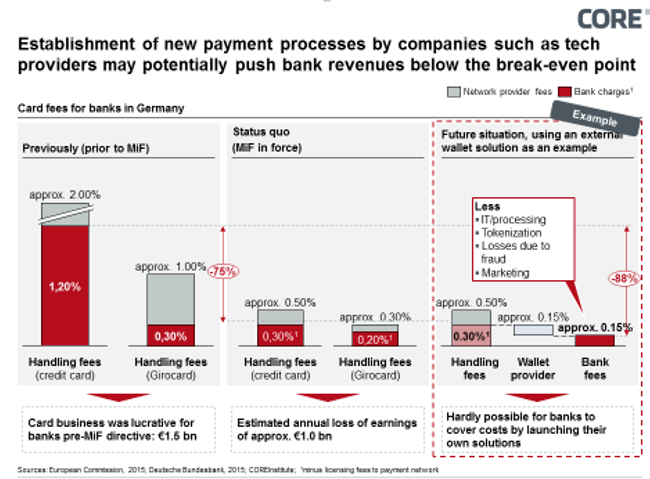

Market entry strategies of technology providers with own mobile payment solutions – opportunities for banks through a cautious approach

Meet our authors

Reference items

Expert EN - Fabian Meyer

Managing Partner

Fabian

Meyer

As Managing Partner at CORE, Fabian Meyer is responsible for the implementation of complex IT projects with a focus on digitalization projects in the banking industry. He has several years of consu...

Read moreAs Managing Partner at CORE, Fabian Meyer is responsible for the implementation of complex IT projects with a focus on digitalization projects in the banking industry. He has several years of consulting experience in the banking sector and in transformation engineering.