Blogpost

Security in card-based payment

Meet our authors

Reference items

Expert EN - Dominik Siebert

Managing Partner

Dominik

Siebert

Dominik Siebert is Managing Partner at CORE and has extensive experience in complex transformation projects in the financial industry, from strategic conceptualisation to implementation management....

Read moreDominik Siebert is Managing Partner at CORE and has extensive experience in complex transformation projects in the financial industry, from strategic conceptualisation to implementation management. At CORE, Dominik focuses on projects for the development and strategic positioning of digital payment solutions.

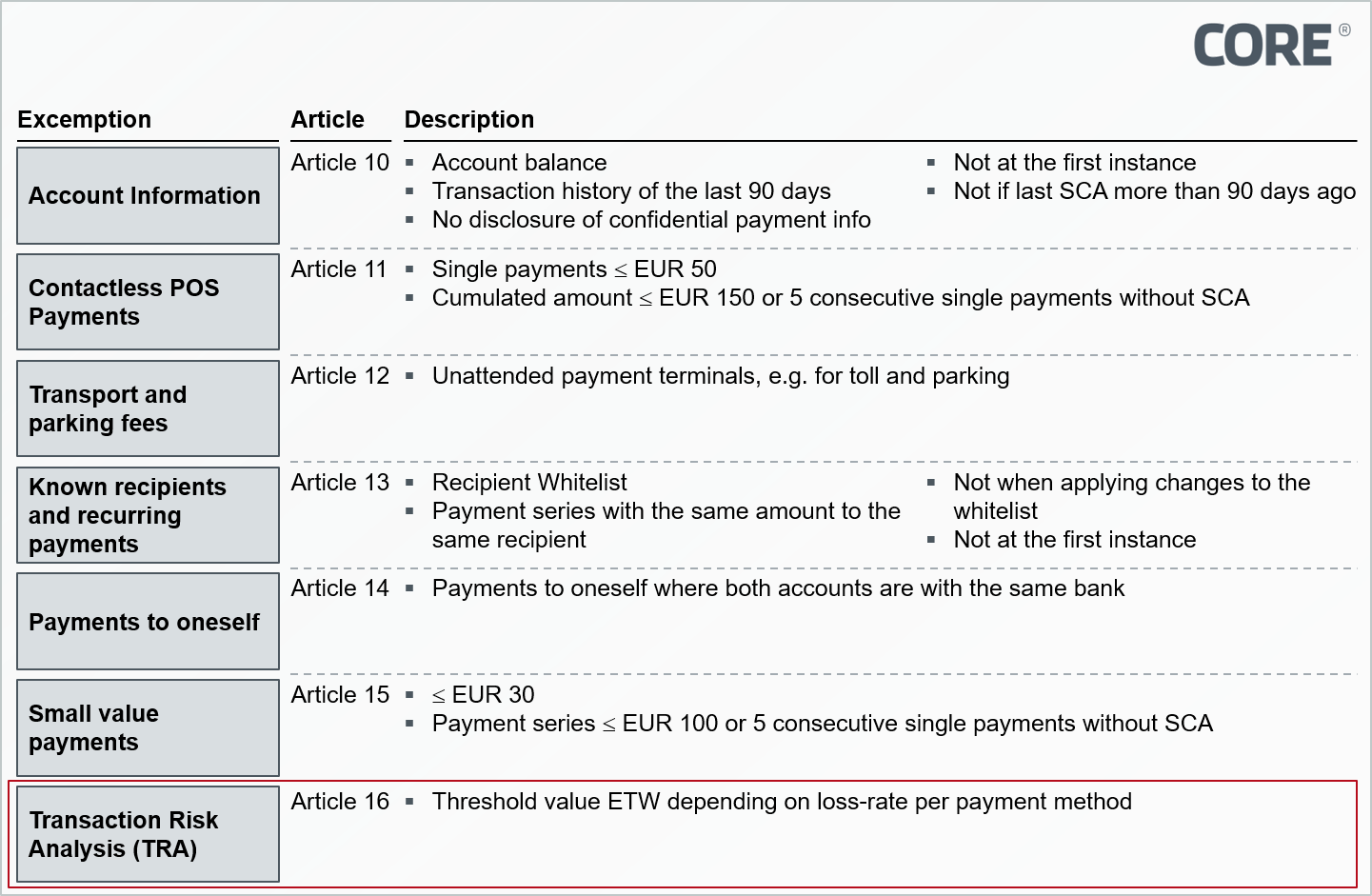

Figure 1: Exemptions to the use of strong customer authentication

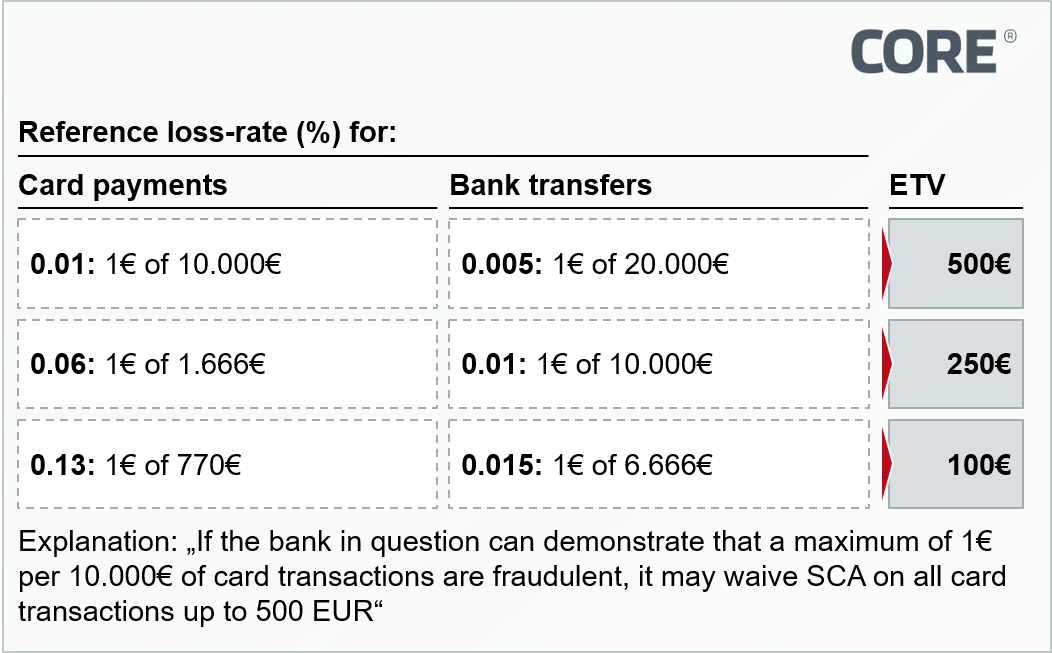

Figure 1: Exemptions to the use of strong customer authentication Figure 2: ETV depending on loss rate and payment instrument

Figure 2: ETV depending on loss rate and payment instrument