Telcos as a Bank – Renewed Launch into the German Market

KEY FACTS

-

O2 launches a digital checking account in collaboration with Fidor Bank

-

The failure of previous telco initiatives for financial services are due to a lack of acceptance

-

Current account services might be the first step towards a new payment solution at the POS using an account connection

REPORT

1. Telefónica startet „O2 Banking“

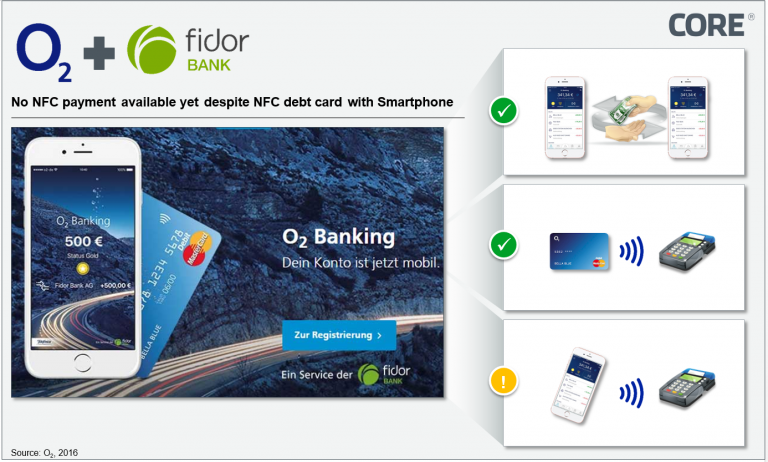

Telefónica Deutschland launched the “O2 Banking” app in partnership with the Munich-based Fidor Bank at the end of July, by offering a fully-fledged current account which includes a MasterCard debit card. An app, developed in-house, provides customer-friendly access to all online banking applications. Furthermore, transfers can be carried out by means of a cellphone number or email address without the need to know the recipient’s bank account number. Telefónica recognizes the frequent use of the account by increasing mobile data volume and eliminating the account’s monthly costs. As neither Fidor Bank nor O2 has the necessary infrastructure in place, cash withdrawals are provided by third-party ATMs, whereby customers are not charged any fees, provided that there is sufficient usage.

Figure 1: The O2 banking app offers mobile banking including a P2P application, but NFC payments using a smartphone are not yet available

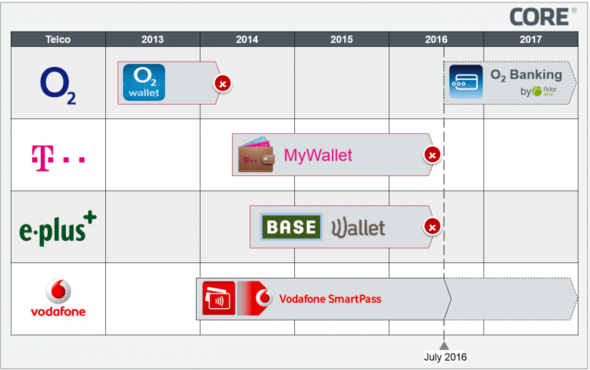

2. Telcos’ previous attempts failed to secure a market share for payment service

Telefónica attempted to set up the “O2 Wallet” in the German payment transactions market back in 2013. A virtual prepaid credit card, provided by Wirecard Bank AG, was stored in the Wallet which enabled payment transactions to be made using an NFC SIM card at NFC-enabled terminals.

Other companies such as Deutsche Telekom, Vodafone and E-Plus (now owned by Telefónica) launched similar solutions in the past. The cellular operators of the aforementioned systems all cooperated with a credit card network operator – mainly MasterCard or Visa – and a proprietor of an e-money license. The latter is required in accordance with EU Directive 2000/46/EC, as none of the providers are licensed credit institutions in their own right.

Nevertheless, with the exception of the “Vodafone Wallet”, all these initiatives were discontinued due to insufficient acceptance by customers, whereby even the Vodafone Wallet has not been able to reach any kind of critical mass to date. As with all the other mobile payment initiatives, there is a host of reasons why success has not been forthcoming to date and criticism mainly focused on the lack of convenience: The payment solutions offered by the telcos are based on a prepaid concept, i.e., an amount must be credited to a specially issued virtual credit card before it can be used.

Figure 2: O2 is once again attempting to position itself as a financial services provider on the German market, albeit with a different concept

3. New attempt featuring a different concept

In comparison to international markets, the German market boasts a characteristic feature which plays a major role in the successful launch of cashless payment processes. With a market share of over 61.7%, the debit card dominates cashless payment transactions at the POS and the owner’s checking account is debited straight away or within a couple of days. In contrast, only one out of three Germans possess a credit card and with a market share of just 18%, credit card transactions play a minor role in cashless payments.

The fact that Telefónica now offers a checking account together with a debit card could be interpreted as a conscious adjustment to the German market, even though “O2Banking” does not currently offer any features for digital POS payments. Nevertheless, back in February Telefónica, Telekom and Vodafone voiced their intention to work on integrating digital debit cards into their Wallets in order to enable NFC payments to be made. NFC payments, using a digital girocard, were presented as a proof of concept by the Federal Association of Cooperative Banks in Germany, or Bundesverband der Deutschen Volksbanken und Raiffeisenbanken (BVR), at the CeBIT fair.

Telefónica is the first telecommunications company in the German market to offer personal checking accounts with “O2 Banking”. Further to the announcement, it seems only logical that this will soon be followed by a virtual debit card for NFC payments using a smartphone, which would make Telefónica not only the first provider of a virtual NFC debit card on the German market, but would also offer a payment account from the same bank and thus complying with the payment option preferred by Germans. With more than 43 million cellphone users, Telefónica also has a sufficiently large customer base to achieve a disruptive spread of the new services.

4. Conclusion

Previous attempts by telcos to establish themselves in the market as financial service providers have failed. Driven by market changes and regulatory constraints – such as, for instance, the caps on roaming fees – Telefónica is relaunching “O2 Banking” in order to tap into new market potential in the banking sector.

The main difference since the past, is how to service on offer is made up. For the customer, O2 appears as a fully-fledged bank (at least in terms of account management) and no longer as a provider of a niche solution.

Besides technology providers like Apple and Google, telcos are renewing their aspiration of attacking the banks’ current net added value. The fact that the French banking group BPCE announced the takeover of Fidor Bank only a few days after the launch of “O2 Banking”, referring to the partnership with Telefónica, certainly shows that even traditional banking institutes have recognized the potential offered by mobile-only banking. The developments of “O2 Banking” as well as competitors’ comparable offers needs to be watched closely by the European banking industry.

SOURCES

Telefónica – facts & figures (German)

https://www.telefonica.de/unternehmen/zahlen-fakten.html

E-Plus Mobile Wallet – das Smartphone wird zur digitalen Brieftasche

Vodafone Wallet – Mach Dein Smartphone zur Brieftasche

https://www.vodafone.de/privat/service/vodafone-wallet.html

Telefónica stärkt mit Mpass und O2 Wallet Finanz-Ökosystem

http://onetoone.de/de/artikel/telefonica-staerkt-mit-mpass-und-o2-wallet-finanz-oekosystem

O2 Banking: Das Smartphone wird zur Bankfiliale

http://www.heise.de/newsticker/meldung/O2-Banking-Das-Smartphone-wird-zur-Bankfiliale-3207389.html

O2 Banking – das mobile Bankkonto fürs Smartphone

https://www.o2online.de/banking/#/id-12621502

Revolution des Mobile Banking: Fidor Bank und Telefónica Deutschland starten mit O2 Banking das erste komplett mobile Bankkonto

https://www.fidor.de/documents/2016_05_12_Fidor_Bank_Telefonica_DE.pdf

Mobile Payment Praxistest: Telekom MyWallet Cards

http://www.mobile-zeitgeist.com/2014/06/27/mobile-payment-praxistest-telekom-mywallet-cards/

Girocard kommt ins Smartphone: Deutsche Telekom, Telefonica und Vodafone ermöglichen mobiles Bezahlen

Die Deutschen lieben ihr Bargeld

Handelsblatt, 22/23/24. July 2016, No. 140

Französische Bank BPCE kauft Fintech-Pionier Fidor

Press release: Groupe BPCE has announced the signing of an agreement regarding the acquisition of Fidor Bank AG