Insights

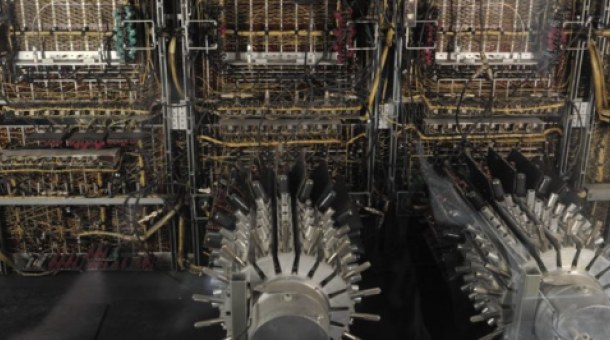

Modern business intelligence architectures provide high potential for Analytics in Insurance Company

Contact our experts

Expert EN - Maxim Polikarpov

Dr. Maxim Polikarpov is a Senior Manager at CORE with extensive experience in strategy, M&A, IT integration, and AI-driven projects across healthcare, manufacturing, and banking industries. A certi...

Read moreDr. Maxim Polikarpov is a Senior Manager at CORE with extensive experience in strategy, M&A, IT integration, and AI-driven projects across healthcare, manufacturing, and banking industries. A certified PMP and PhD holder.

Read lessExpert EN - Mara Wiltshire

Mara Wiltshire is Senior Manager at CORE, leveraging her background in physics to fuel a profound interest in all things tech and an unwavering commitment to continuous learning. Within CORE, Mara ...

Read moreMara Wiltshire is Senior Manager at CORE, leveraging her background in physics to fuel a profound interest in all things tech and an unwavering commitment to continuous learning. Within CORE, Mara specializes in project management of complex IT transformations and technology-driven M&A deals, with a particular focus on the financial services sector.

Read lessExpert EN - Nicola Deon

Nicola Deon is a Senior Consultant at CORE. Nicola focusses on project management of complex IT transformations in the context of M&A activities by supporting clients in managing sales, carve-out o...

Read moreNicola Deon is a Senior Consultant at CORE. Nicola focusses on project management of complex IT transformations in the context of M&A activities by supporting clients in managing sales, carve-out or

acquisition projects.