Blogpost

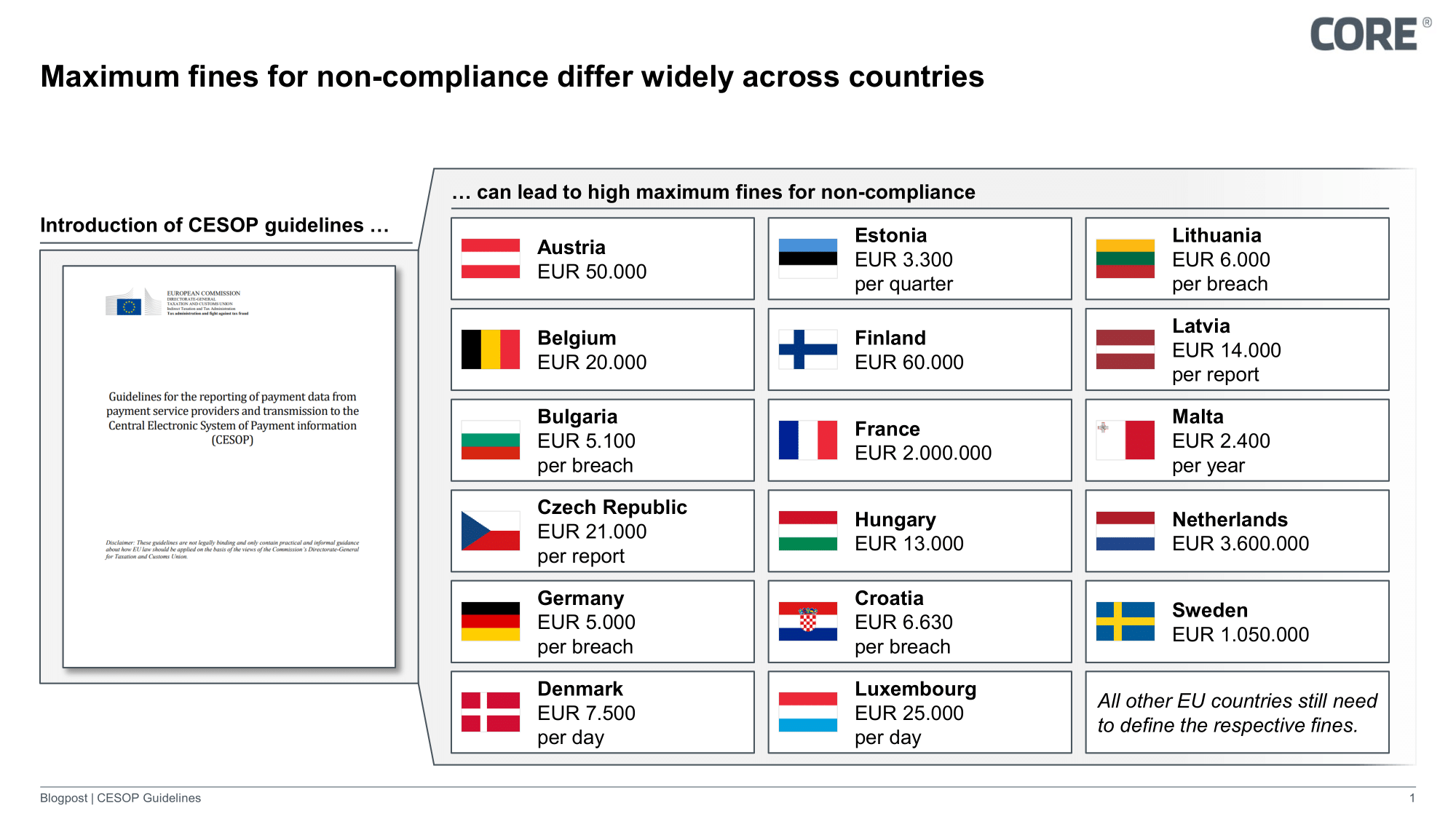

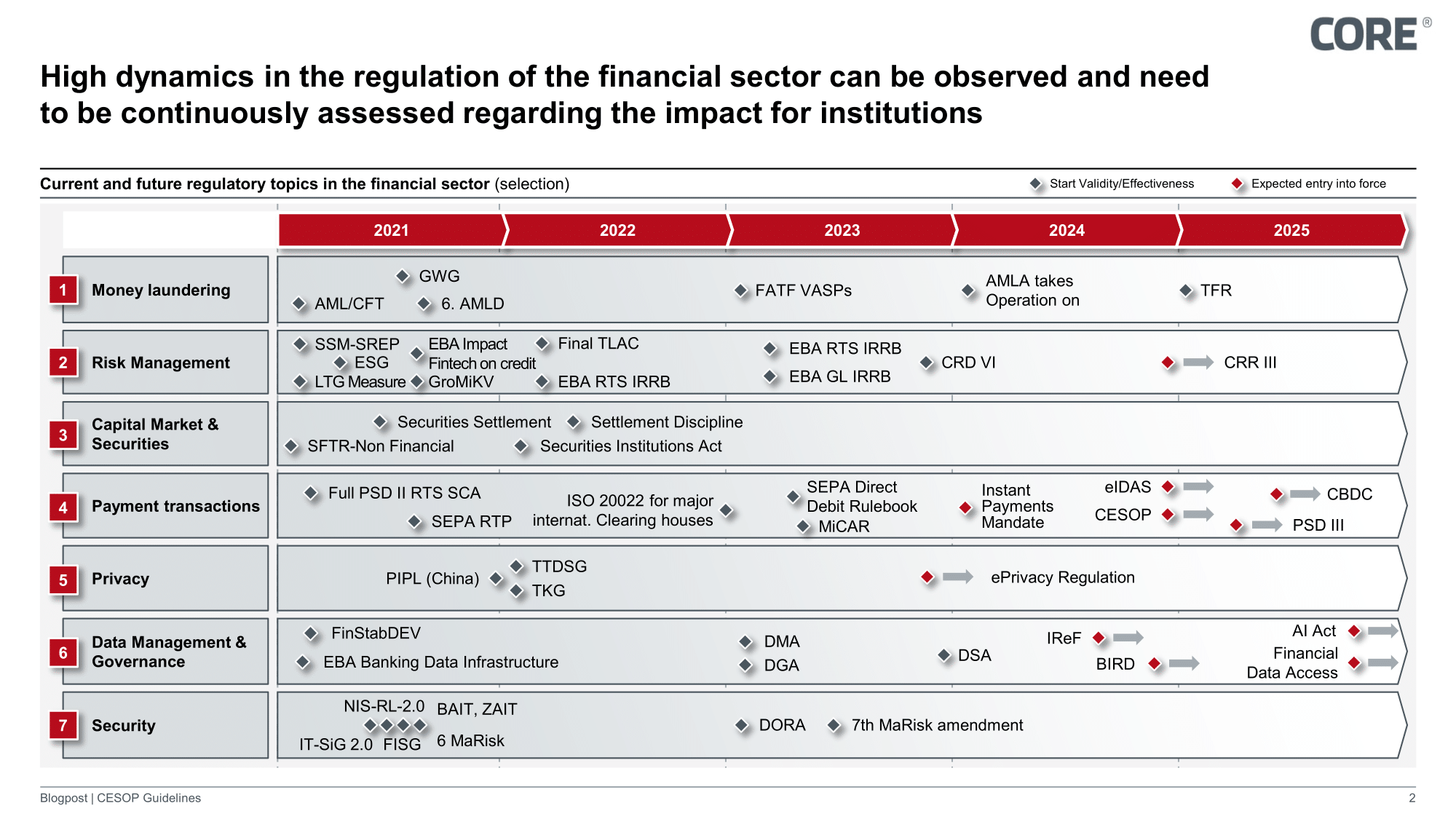

Central Electronic System of Payment Information (CESOP)

Questions? Ask our experts

Reference items

Experts EN - Ibrahim Shabea

Senior Manager

Ibrahim

Shabea

As Senior Manager at CORE, Ibrahim is responsible for a wide range of projects focused on payment transactions and digital payment solutions. Leveraging his expertise, Ibrahim engages in all aspect...

Read moreAs Senior Manager at CORE, Ibrahim is responsible for a wide range of projects focused on payment transactions and digital payment solutions. Leveraging his expertise, Ibrahim engages in all aspects of the project lifecycle, from conceptual design to the implementation of new payment procedures.

Read less