Digital Platform Strategy – Analogies between the Finance and Automotive Industries

Digital Platform Strategy – Analogies between the Finance and Automotive Industries

KEY FACTS

-

Just like the finance industry, the automotive industry is faced with technological and sociological developments that entail fundamental restructuring

-

Cars are increasingly being seen as means for alternative business models and proactively used by new market players

-

The battle between established car manufacturers and new providers is underway at customer touchpoints and in terms of developing a digital platform strategy

REPORT

1. First Banks, Now Car Companies?

Global financial markets are currently in a state of upheaval due to technical innovations, shifting customer needs and regulatory requirements. Established structures are faced with the challenge of defending their existing value chain against new market entrants, especially in the field of payment transactions. Financial institutions are losing their grip on the opportunity for success, namely the customer touchpoint.

The automotive industry also finds itself confronted with technological progress and new approaches to motoring that entails fundamental restructuring. Cars are increasingly being seen as a platform for new business models and are being proactively used by market players.

In a way that reflects developments in the financial sector, the battle for the customer touchpoint in and around the car is growing in importance. The race between market innovators and established players is already underway.

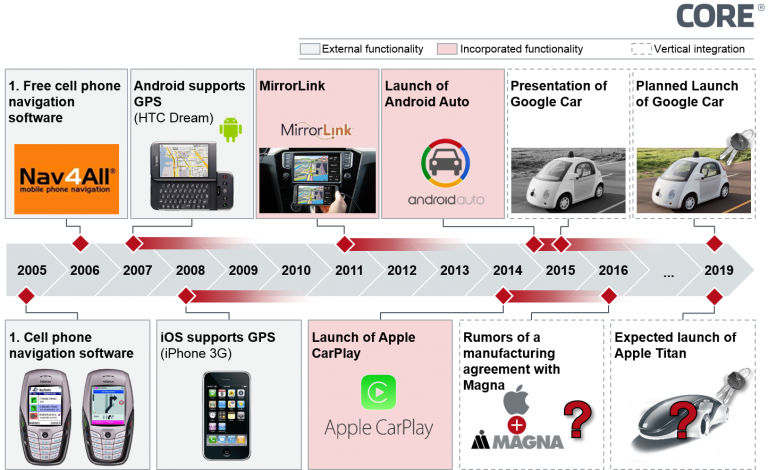

Figure 1: The stages of the ousting process in the automotive sector

2. Disruption to the Banking Industry

The transaction processing market, which had previously been characterized by risk adversity and highly stable earnings, is currently undergoing a period of fundamental transformation. New providers are forcing their way onto the market with new business models and technologies. Whereas providers of e-commerce payment processes clearly have a dominant position online, new technologies such as NFC are enabling technology companies to establish new payment services at the point of sale (e.g. Apple with Apple Pay and Google with Android Pay). The statutory regulations opening up account access to third-party service providers (“access to account”) also creates scope for the setting up of new third-party business models based on account access.

For players in the existing ecosystem, this leads primarily to the marginalization of income streams in the field of transaction processing (e.g. lost revenues in the card business). Due to the successful placement of non-bank services, there appears to be a realistic risk of losing the entire customer touchpoint in the long term. For established financial institutions, this means being deprived of access to what were once high-margin sectors. Furthermore, the industry is in danger of losing its entire value chain to new providers, leaving them to face the question of whether to go head-to-head with these new rivals or to abandon individual services.

3. Current Developments in the Automotive Industry

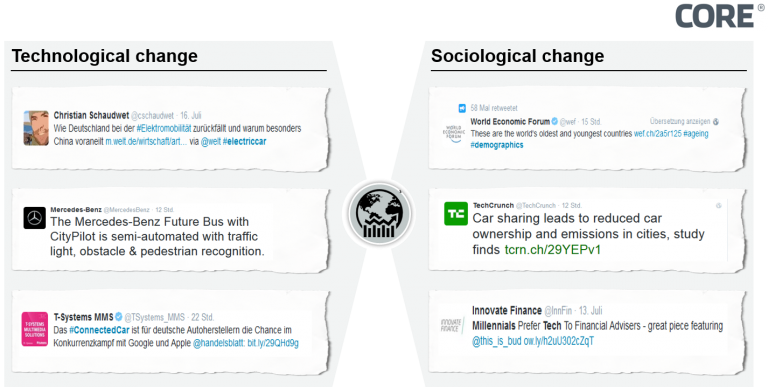

In terms of the automotive industry, it is possible to identify two key factors as drivers of change. On the one hand, technological trends including electric motoring, driverless cars, and the increasing connectivity between cars and their ecosystems are signs of change; on the other hand, sociological factors such as demographic change, increasing urbanization, the evolution of customer needs (e.g. heightened environmental awareness) and a greater affinity with technology are taking center stage. This interplay between technological and sociological developments implies changed market and customer behavior that gives rise to alternative market potential, with the development of shared mobility services as a prominent example.

Figure 2: Factors that drive change

Car manufacturers have recognized the change and are addressing it by focusing on alternative mobility concepts. Currently, however, they are tackling the new market potential with their own stand-alone solutions, such as BMW with DriveNow and Connected Drive or Daimler with Car2Go. We are also witnessing the first initiatives by companies to complement their own services by adding third-party ones (e.g. BMW ParkNow or moovel). Manufacturer-neutral services have thus far proven to be extremely diversified, however, only suitable for cooperation to a limited extent.

4. Reallocation of Roles in the Mobility Market, Similar to the Banking Industry

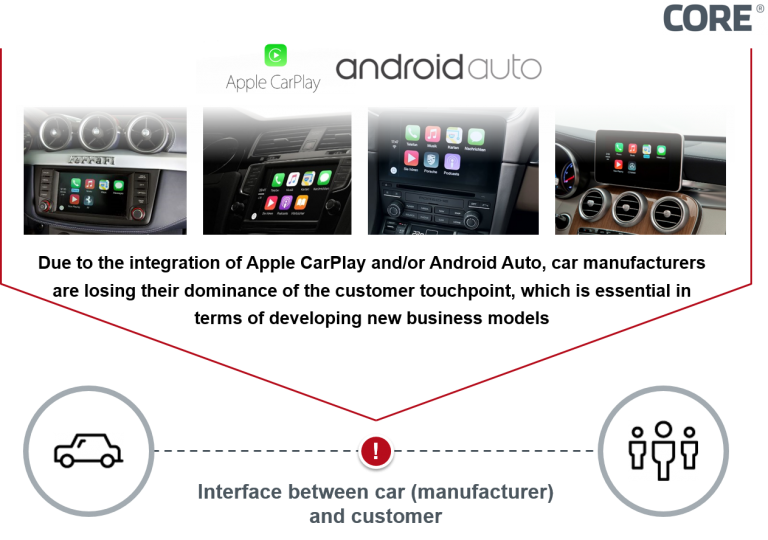

Alongside the car manufacturers and their partners, new market players – especially technology companies such as Apple with CarPlay and Google with Android Auto – are harnessing cars as a customer touchpoint for both new and existing business models and consciously positioning their services between the car manufacturers and their customers.

Figure 3: Technology companies are addressing the touchpoint between car manufacturers and their customers

The car manufacturers are therefore losing their dominance of the customer touchpoint, which is essential for tapping into new business models as part of ever-changing mobility concepts.

How can the automotive industry now position itself successfully? A purely protectionist strategy harbors substantial risks, as illustrated by developments within the banking industry over recent years:

New players harness new potential

Strict adherence to traditional lines of business, existing value creation mechanisms, reputations and developed core competencies could result in market changes being harnessed solely by new entrants. If these new entrants manage to successfully place their new products, customer access and its potential will remain closed to any subsequent providers.

The scenario outlined has become reality in various areas of the banking industry, with big-name financial institutions relying on their market position and not being open to innovative products. Driven by various fintechs, crowdfunding (e.g. Kickstarter projects) developed into a business area in its own right without any significant involvement on the part of conventional financial institutions. The emerging business sectors then remained closed to financial institutions.

New providers benefit from greater access to information

Despite the described incorporation of third-party applications within vehicles, the vehicle data still lies in the hands of the car manufacturers. As a result, the range of functions that can be covered by third-party providers is still severely limited, which prevents the complete ousting of manufacturers’ own products. This strategic advantage could be negated, however, if the third-party providers were to demand access to the vehicle data, e.g. by taking legal action.

In the banking industry, precisely this kind of measure has been taken in the European transaction processing market in the form of the Payment Services Directive (PSD II). Among other things, it requires European banks to enable third parties to access accounts (“access to account”). This means the banking payment transaction infrastructure will be available to establish new business models as from 2018.

Similar Reallocation of Roles in the Automotive Market

If new providers manage to make their new products based on customer needs and establish a car-centered platform based on a successful product, then car manufacturers are faced with the long-term risk that their vehicles will merely serve as the infrastructure. It is conceivable that prestige and brand image will cease to apply as sales arguments, mobility and its associated add-ons will be seen as the main service, rather than the vehicle.

This loss of the customer touchpoint is currently a pivotal issue in the financial industry. Providers such as Apple Pay are combining existing functions with additional services and drawing on the infrastructure of the banks in the process. As a result, the client associates the bank less and less with the services used and there is the threat of step-by-step replacement with new infrastructures or even total exclusion from the relevant sections of the value chain. In light of this, the automotive market is also facing a fundamental reallocation of roles, requiring all market players to consciously reposition themselves.

5. Potential Solutions for Car Manufacturers

In the automotive industry, the outlined ‘ousting process’ by third-party services can be summarized using three overarching evolutionary stages of integration (see Figure 1):

- New providers bring car-related functionality into vehicles from outside, e.g. smartphone-based navigation

- New providers incorporate their functionality in the vehicle, e.g. Apple CarPlay and Android Auto

- New providers build their own cars and completely replace the existing value chain – vertical integration, e.g. Apple Car, Google Car.

In order to proactively address the outlined market changes, car manufacturers must fully internalize and prioritize the resulting challenges and the need for a comprehensive rethink. The analogy with past developments in the banking industry shows that a protectionist stance and stand-alone measures merely serve to delay, but not prevent, the disruptive impacts of technological and sociological change. Instead, a sustainable strategy must be developed as quickly as possible, taking into account the need for cooperative approaches and deriving the necessary measures.

The top priority is to defend the customer touchpoint, as the data gained here forms the essential basis for product development and marketing. A necessary step involves car companies occupying an additional position as digital platform providers, as this makes it possible to harness the customer touchpoint and the information dominance (including additional data gathered) to develop additional services.

In contrast to offering stand-alone, proprietary solutions, a digital platform strategy also expands a company’s sphere of influence and thus makes it possible to proactively shape market developments and standards.

The potential offered by platform-based services is evident when you consider the most disruptive companies of recent years:

“Uber, the world’s largest taxi company, owns no vehicles. Facebook, the world’s most popular media owner, creates no content. Alibaba, the most valuable retailer, has no inventory. And Airbnb, the world’s largest accommodation provider, owns no real estate. Something interesting is happening.” – Tom Goodwin, 2015

SOURCES

AppleCar – Apple’s electric vehicle project:

http://www.macrumors.com/roundup/apple-car/

AppleCar: News, Rumors, Facts, and Information on the iCar:

Competition for the Automotive Industry: Apple Means Business with the iCar:

http://www.spiegel.de/auto/aktuell/apple-technikkonzern-will-das-icar-bauen-a-1054139.html

Google Car: Internet Company Unveils Car to Journalists:

Open Automotive Alliance Wants to See Android in Vehicles

http://www.pcwelt.de/news/Open_Automotive_Alliance_will_Android_ins_Auto_bringen-Google-8375946.html

Cost of Off-Board Cell Phone Navigation to Fall Considerably

http://www.innovations-report.de/html/berichte/cebit_2007/bericht-80967.html

Amended Guidelines for Payment Service Providers: EU Parliament Approves PSD II:

http://www.noerr.com/de/presse-publikationen/News/%C3%A4nderung-der-zahlungsdiensterichtlinie.aspx

New Regulation in the Payment Transactions Market:

http://www.coretechmonitor.com/de/neue-ordnung-im-markt-fuer-zahlungsverkehr/