Global, digital currency - utopia, dystopia or liberation?

AN ATTEMPT AT THE ASSESSMENT OF CIRCULATING THESES TO THE LIBRA COIN

1. Introductory remarks

The Libra Association, an organization of currently 28 institutional members from various industries, has announced the launch of a crypto currency called "Libra" in 2020. Among the independent members is Facebook, which is currently the major driving force until the official launch and is planning with its subsidiary "Calibra" to release a wallet of the same name for Libra. The project is therefore often mistakenly referred to as "Facebook currency", but the actual scope and motivation, according to the recent white paper published by the Libra Association, goes far beyond that. The following vision is postulated:

- Global and universal access for all humans to financial services by reducing transaction costs and infrastructure barriers

- Implementation in the form of a decentralised, digital currency, which aims to stimulate trade worldwide and revolutionise direct payment traffic through innovative speed, effectiveness and low transaction costs

- Many applications, such as direct bank transfers, online shopping or wage payments as well as the elimination of the need for a bank account could replace paper money, but also payment cards and enable payments to friends, employees and merchants without intermediaries and the involvement of today's stakeholders, in real time

- Equality, consumer safety and respect for the ecosystem’s integrity also play a key role

The publication of the whitepaper generated a great deal of media attention. The focus was primarily on Facebook as the driving force behind the Libra initiative. From a technical point of view, it was questioned whether the Libra Blockchain can actually be recognized as a blockchain and in which other central points the large-scale project differs from conventional crypto currencies. The explosive nature of the topic is exacerbated by the scope for interpretation due to many questions which have not yet been clarified. Conversely, this led to observers being carried away by speculation and a large number of partly speculative theses and scenarios being discussed.

With this discussion paper, the authors pursue the goal of an exact anamnesis of the facts and to place the Libra initiative in the broader context of the question that has existed for some time:

Is it necessary to create a global, digital and all-encompassing digital currency area in addition to the approximately 160 individual, national or regional currency areas?

This question is given considerable impetus by Libra's initiative as a primarily private-law firm and makes the positioning of responsible institutions urgent and mandatory. The present analysis first gives an overview of Libra and the underlying functionality, then compares the concept with the existing crypto currencies and highlights open points in connection with criticism. A selection of essential theses will be examined and evaluated. In the final part, the following points will be pondered upon as to what extent the Libra Coin is and can actually be a contribution in the context of a global digital currency, which stakeholders could be involved in finding solutions to this fundamental question, and what the objectives of corresponding committees should be.

The information published to date (including the Libra Whitepaper, technical documentation of the Libra Blockchain and State Machine Replication in the Libra Blockchain) serves as sources for the study.

2. Libra at a glance

Libra is a crypto currency based on blockchain technology. This means that the integrity of the payment network is ensured not by central trust instances, but by decentralised distribution of the system state to various network nodes and a cryptographic consensus mechanism. Since the whereabouts of each Libra Coin is known to all network nodes at all times, Libra Coins cannot be duplicated, which protects the integrity of the network and makes its use as a means of payment possible to begin with. This approach is known from other crypto currencies such as Bitcoin or Ethereum. Libra focuses intially on the peer-to-peer (P2P) and business-to-consumer (B2C) markets.

Figure 1: Transaction opportunities between consumers, traders and Libra Coin service providers

Future customers will only need a device with a functioning data connection to use Libra - e.g. a smartphone. In contrast to conventional financial institutions, neither bank accounts nor means of payment such as credit cards should be required for payments in order to process financial transactions. This is intended to remove existing barriers to payment transactions for billions of people in the long term.

In turn, companies and dealers are to be offered incentives to participate through lower transaction costs and faster processing. Libra follows an open-source approach in its development, whereby Libra-based applications such as wallets, other financial products or trading portals can be developed by anyone and integrated into the ecosystem.

While Libra is a product of the association, the first wallet comes from Facebook itself: Calibra. The Facebook subsidiary established for this purpose is intended to ensure the separation of personal user data (Facebook) and financial data (Calibra). Calibra is a so-called softwallet which is to be integrated directly into the group's existing social media channels. For example, Libra Coins could be used by end customers as P2P means of payment between Facebook and Whatsapp accounts or for payments on the Facebook marketplace.

3. Difference between Libra and other crypto currencies

In the course of the "Bitcoin hype" between 2017 and 2018, the number of available crypto currencies increased by leaps and bounds, although only a few of these coins have so far achieved market relevance as actual means of payment. The question therefore arises as to what distinguishes Libra from these existing crypto currencies and what justifies the currently observable public presence and high interest in the financial markets. The differences can be divided into six categories:

a. Governance

A major difference lies in the centrally organised, regulative body called the Libra Association. This organisation, based in Geneva (Switzerland), defines all framework conditions and objectives with a two-thirds majority, whereby all members will later be independent and equal. Until the launch of Libra in 2020, however, Calibra, as the official Facebook representative, will take the lead. The current and future members of the Libra Association deal with three main topics: steering, implementation and strategy.

Figure 2: Members of the Libra Association (as of 9.7.2019)

Their rights and obligations include, but are not limited to

- Decisive decision-making authority for the further development of the Libra Blockchain

- Responsibility of the delegation of the management of the Libra Reserve

- Granting of subsidies

- Development of the long-term strategy for the Libra ecosystem

- Operation of network nodes to run and secure the network by validating transactions

b. Membership

As of July 2019, 28 members from various industries as well as non-profit and academic organizations have already joined the consortium - so far mainly those that are based in the USA.

The Libra Association declared its goal to increase this number to 100 members by the planned Launch of Libra in 2020. However, the requirements for participating companies are high. As a prerequisite for membership in the Libra Association, at least two of the following three evaluation criteria must be fulfilled:

- Market value/customer balance: Market value > 1 billion US dollars or

customer balance > USD 500 million - Scaling: reach of over 20 million people per year worldwide

- Brand sustainability: Top 100 industry leaders recognized by an external industry association or media company

c. User

Due to the founding members alone and especially the close connection to Facebook and the Calibra wallet, Libra has a potential frontend integration of almost 2.5 billion users worldwide from the moment of launch and thus a superior reach to all other crypto currencies. This is particularly important when it comes to solving the "chicken-and-egg-problem": a merchant will only accept a payment method if the reach on the customer side is large enough. Customers, on the other hand, generally only ask for payment methods if they can use them to pay a sufficient number of merchants. This is, among other things, one of the main reasons why very few merchants accept Bitcoin. If 2.5 billion users were connected to the Libra ecosystem, Libra could quickly become attractive as a means of payment for merchants, especially if the 'significantly lower transaction costs' mentioned in the white paper compared to traditional methods such as card payments or direct debits actually materialise.

d. Libra Reserve

The Libra Coin is a so-called "Stable Coin". This differs from most known crypto currencies by its "intrinsic" value, the Libra Reserve. This represents a kind of financial security and massively reduces the known value fluctuations of many crypto currencies. The Libra Reserve is initially fed by the membership fees of the Libra Association of 10 million US dollars "buy-in" each, as well as post-launch by the purchase of new Libra Coins.

The way it works is that for every Libra Coin exhibited, an equivalent amount of Fiat currency is added to the Reserve. If a reversal is desired, the respective coin will be destroyed and a corresponding amount in the respective Fiat currency will be paid out of the Reserve. This conversion is only permitted in both directions to authorized resellers, while the "trading" of existing Libra Coins can in principle be carried out by any network participant. Thus there is a constant parity between Fiat currencies and issued Libra Coins. As a result, Libra is potentially a valuable means of payment and not a speculative investment vehicle. However, this form of exchange rate hedging is by no means new and crypto currencies such as Tether (formerly Realcoin) pursue similar approaches, although usually only a single asset or currency is used for hedging. In the case of Tether, these are US dollars, but hedging via securities or commodities is also common.

Figure 3: Structure of the Libra ecosystem

For Stable Coins, the coupling to a large number of different currencies, and in particular Libra's approach to value creation through the reserve, has so far been unusual: The assets of the Libra Reserve are held by a geographically distributed network of custodians with investment-grade creditworthiness and invested in a prescribed selection of a diversified currency basket (Euro, Dollar, Yen and British Pound), a selection of high-yield but low-risk investment opportunities such as short-term government bonds issued by stable governments. This is intended both to reduce the volatility of the Libra Coins and to guarantee security (by reducing the probability of default and decentralising assets). Capital gains from the Libra Reserve are to be used in the following priority:

- Coverage of infrastructure costs of network nodes such as server costs

- Financing of the further development of the Libra Blockchain and promotion of Libra-related initiatives

- Payment of a "dividend" to holders of Libra Investment Token (founding members of the Association receive the same for their "buy-in")

e. Technology

With regard to the technological approach, Libra has some special features compared to other blockchains such as Bitcoin or Ethereum. In order to better understand the differences, an understanding of how a typical blockchain works in the cryptocurrency context must first be created: Put simply, a bundle of new transactions from so-called "miners" (nodes in the network) is bundled in a new "block", which in turn references the previous block. The task here is to attach it to the "chain". Which node may write the next block is determined stochastically: In order to add a new block, a complex mathematical random task (hash function, which also contains parameters from the preceding node) must be solved, which requires a lot of computing power. As soon as the first node has a result, this validates the other nodes, which in turn is very easy to do by building the hash function. If successful, the new block is accepted by the network as the new "truth", the miner receives a "reward" from the network (usually newly issued coins/tokens) and the mechanism restarts for the next block. The probability to mine a new block and get the reward depends on the available computing power of a node. Furthermore, the network can only be manipulated if a majority of the nodes ("50% + 1") fraudulently cooperate and accept a wrong result of the hash task. This consensus mechanism is called proof-of-work and is very computationally intensive, limiting the scalability and transaction speed of the system.

Libra, on the other hand, does not create blocks, but stores the complete transaction history as a distributed, continuous database in so-called "Merkle Trees". Each iteration of the database, i.e. each new "branch" is validated individually by the nodes (block size = 1), which is why Libra is technically not a real blockchain, but qualifies as a distributed ledger as described in chapter 2. Since the validation itself only ever has to take place against the predecessor branch, the consensus mechanism is considerably more efficient and conserves resources. Nor will the validation nodes receive any compensation in the form of new coins or tokens, but are to be financed primarily by the capital gains from the Libra Reserve and, if applicable, additional transaction fees in an amount not yet further specified.

Furthermore, the number of validation nodes is currently limited (so called "closed" or also "permissioned" blockchain), whereas currently only association members are allowed to operate validation nodes. This is also referred to as the "Proof of Authority".

It is also worth mentioning that within the Libra Blockchain the coins/tokens itself are not persisted, but only the transaction history is stored as a concatenation of Smart Contracts. This methodology also allows the integration of alternative coins into the blockchain, or alternative business transactions that can be modeled as smart contracts, such as securities transactions. This approach is already known from other blockchains such as Ethereum, where the development language Move, specially developed by the Libra Association and optimized for smart contract application, is provided for use with Libra.

4. Open topics and unresolved (critical) points

Despite the high volume of documentation on the Libra Blockchain, the development language (Move) and the open test environment, uncertainties remain regarding central points, which the Libra Association has not yet answered.

a. Independence and governance

The Libra Coin is to become a global digital crypto currency managed by equal, independent members. The fact that 75% of the current consortium comes from the USA, 40% of the members from Silicon Valley alone, calls this independence into question. As at today, the USA has an enormous influence on the global financial markets. This influence would be further enhanced by a global, private supercoin controlled by an American majority and would be a powerful (political) instrument.

How this power should be balanced, e.g. by a real geopolitical equality and independence within the consortium, has to be explained by the Libra Association.

b. Transaction costs

With regard to the elementary transaction costs for the users of a means of payment, only two generic statements have been made so far: On the one hand, peer-to-peer payments should be free of charge and, on the other hand, transaction fees for merchants should be very low. Further information is yet to be shared about a fee for changing from Fiat currencies to Libra Coin.

c. Libra Reserve

The organisation currently has 28 members and aims to include at least 100 companies in the consortium by the time the Libra Coin is launched. Thus the initial sum of one billion US dollars in the Libra Reserve is to be achieved. This is continuously increased by funds from newly issued coins. Part of this amount must be held for the potential redemption of coins, but a substantial part should be invested in the short term and conservatively, with capital income as the primary source of funds to cover ongoing costs and investments. This is an essential point to consider when discussing potential scenarios such as a bank run: If a critical number of authorized resellers - due to an external event such as a terrorist attack, or for deliberate reasons - want to exchange large quantities of Libra Coins back against the Reserve in Fiat currency at short notice, the Reserve could run into liquidity bottlenecks due to the fixed portion or have to refuse to exchange them. Although, an equivalent amount of capital would still be available in the Reserve in this scenario, the loss of confidence would most likely result in a collapse of the Libra Coins price. The whitepaper does not describe who could intervene with which levers in this scenario.

The investment strategy for the Reserve is currently still very vaguely described and only stipulates that a portion should be kept liquid and the rest invested in safe short-term government bonds. In addition, it is clear in which Fiat currencies the investment fund is broken down, but not their percentage allocation. Furthermore, it is not clear who selects custodians and what minimum requirements exist for them, just as little as it is unclear according to which guidelines they should invest the money. For a final valuation, the detailed elaboration remains to be seen, but it can already be stated that with the chosen investment strategy in today's interest rate environment with short-term government bonds outside the US dollar no large yields are to be expected. It can still be assumed that the custodians will also charge commissions for portfolio management. Against this background, the vision of using the capital income from the reserve as the primary source of money for operations, further development and possibly even the distribution of dividends to the members should at least be regarded as ambitious.

The Libra Coin is to be traded as “full money” in the sense of a Stable Coin. Kevin Weil, Product Manager of Calibra, stated that everyone was invited to create their own products and thereby create a new ecosystem based on the Libra Blockchain. With reference to this, the question arises as to how long the full-money model of Libra can be maintained. In principle, there is no need for change from an economic perspective, as the creation of money is still the responsibility of the commercial banks in the Fiat eco-system. If a customer wants to take out a loan, a bank can also conclude this contract outside the Libra ecosystem, convert the loan in Fiat currency to Libra and make the corresponding digital transfer. According to this theory, the Fiat currency parity to Libra Coin would not be infiltrated, even if loans were issued in Libra. If loans were to be issued directly in Libra, i.e. without the detour via Fiat currencies, and interest would also be paid in Libra, this would also have no direct influence on parity, as long as new coins for the payment of interest were only issued in exchange for Fiat currency.

The situation would be different if loans in Libra Coins could be granted by means of a multiplier effect, i.e. if the Libra Association allowed certain market participants to issue a loan of 100 Libra Coins with a meaningful capital backing of, for example, 10 Libra Coins. Whether this scenario of direct money creation within the Libra ecosystem is systemically supported and how it would be structured has not yet been substantiated by the Libra Association.

d. Technology

Libra uses a closed blockchain based on Merkle Trees in the "Proof of Authority" concept. This promises high scalability, efficiency and speed, but strictly speaking contradicts the "five pillars" of blockchain technology: open, public, neutral, resistant to censorship and boundless.

The Libra Association argues that this approach is based on the fact that there is no technical solution today that would enable a stable and sufficiently performant public blockchain for mass use. According to its own statement, however, migration to an open (permissionless) blockchain should be initiated within five years of the ICO.

The consensus methodology most likely to be considered here is the proof-of-stake approach, which has not yet been fully developed for mass production. The Libra Association has not yet indicated whether it will actually choose this method and how the migration will take place.

e. Regulatory Compliance

One of the main problems that Libra has to solve in this respect is the compliance with regulatory processes such as KYC, AML or with regard to data protection. Many people in less developed regions have no government-issued proof of identity, which is essential to maintaining adequate KYC processes by today's standards. At the same time, the Libra Association has set itself the goal of developing and promoting an open identity standard. This proof of identity should be decentralised, digital, transferable and ultimately a prerequisite for financial inclusion and competition. However, Libra has so far left open how this technical identity standard should look like on the one hand and on the other hand how it would like to create an initial connection to the Libra network for those customers without state proof of identity while maintaining the regulatory requirements. It has been announced that Libra would like to develop policies on these issues as specified by the association. The extent to which compliance with them is ensured and whether there is a sanction entity centrally orchestrated by the association remains open, however.

But not only existing technical-regulatory challenges should occupy the Libra Association. Only a few days after the publication of the white paper by the Libra Association, regulators, politicians, data protectionists, banks and central banks expressed their wishes for a special regulation of the Libra Association or even a ban of the Libra initiative.

Randal Quarles, chairman of the Financial Stability Board (FSB), an international organization dedicated to overseeing the global financial system, was the first high-ranking U.S. regulator to say it needed (new) regulation:

"Wider use of new types of crypto-assets for retail payments would justify close scrutiny by the authorities to ensure that they are subject to high regulatory standards".

On Tuesday, July 2, 2019, five US Congressmen, including Maxine Waters, Chairwoman of the United States House Committee on Financial Services, addressed the legislatures and regulators, as well as Facebook and Calibra staff, in an open letter with the goal of temporarily stopping the Libra project.

The Facebook proposal to create a new crypto currency as part of the broad Libra project raises profound questions about national sovereignty, corporate power, consumer protection, competition policy, monetary policy, data protection and more. The US regulatory system is not prepared to address these issues. Neither do the regulatory systems of other nations or international institutions.

Even Donald Trump commented less favourably on Twitter on the planned initiative. Mark Carney, Governor of the Central Bank of England, is open to the digital currency Libra, but noted that Facebook must inevitably meet the highest regulatory standards if they succeed in attracting a relevant number of users to their project.

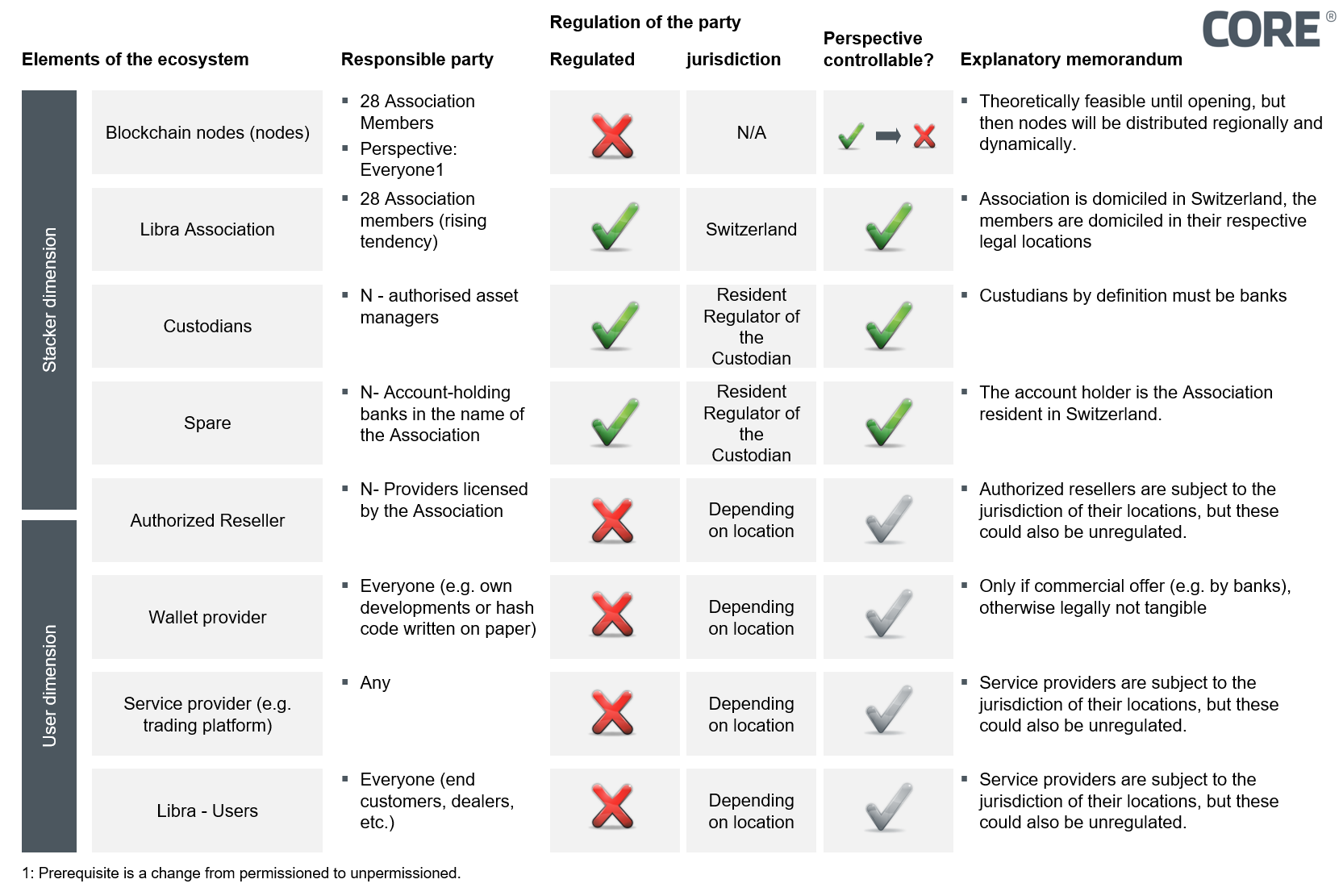

Figure 4: Regulatory evaluation of the various stakeholders in the Libra ecosystem

At the same time, the nature of the regulation to be applied is (still) largely unclear and there is a possibility that Libra will attempt to outsource this issue and the regulation in its entirety to the network participants and see itself only as an infrastructure provider without a corresponding need for regulation. This approach would not be implausible because there is no international regulation of blockchain technology and related business practices. However, an assessment from a regulatory point of view requires at least the consideration of individual subjects in the planned ecosystem. There exist differences and divisions that stand in the way of a regulation of Libra entirely. For example, certain elements would not be considered for regulation. However, individual service providers, banks, trading platforms etc. would be obliged to comply with the regulatory requirements at their headquarters, which in turn is variable due to the local independence of digital business models (cf. Fig. 4). This is reminiscent of complications with illegal film streaming on the internet: The servers of the corresponding providers are often located in countries without appropriate copyright protection, so that local regulators can only block access if necessary. However, the internet as an infrastructure for access cannot be held liable for copyright infringements.

Applied to Libra, this would mean that authorized resellers, Libra service providers (e.g. trading platforms), or custodians would be subject to regulations, while the Libra Blockchain as an infrastructure or the association as a governance body would be difficult to grasp. However, since service providers and authorized resellers in particular are virtually free to choose their legal location and can still offer their services globally, they could, for example, establish themselves in countries where there are no or only mild KYC, AML and data protection requirements.

Another topic is data protection, for European users the GDPR must be observed, for US users the US jurisdiction on data protection applies. The harmonisation of the different approaches will be at least challenging.

Libra itself refers to Swiss data protection standards with regard to regulation and appoints the Federal Data Protection and Information Commissioner (FDPIC) as the competent regulatory authority. It is also stated that the Libra Association assumes that it will be regulated by the Swiss Financial Markets Supervisory Authority (FINMA) and that it is already engaged in more in-depth discussions here as well.

However, the Libra Whitepaper does not answer the question of which further guidelines the previous components are aligned with and whether there will be regional differences. But Calibra, as the only wallet provider to date, has already revealed its plans in an interview that new customers will have to provide proof of identification issued by the state, such as a passport or identity card. It is specified that Calibra is to be compatible with the American regulations of the Financial Crimes Enforcement Network (FinCEN) for AML and for the fight against terrorist financing (CFT) as well as the requirements of the Office of Foreign Assets Control (OFAC). In addition, Calibra has applied for licensing as a "State Money Transmitter" in the USA and is already registered as a "Money Service Business" with FinCEN. They are therefore proactively approaching the US regulator, which will demand this formality due to the company's headquarters in California.

The Libra Association proclaims across the board that the vision of a global digital currency can only be realised in line with regulatory requirements and intends to cooperate with the regulators. This is confirmed, for example, by the recent postulation by David Marcus, head of Calibra on Facebook, that regulatory concerns need to be fully addressed before launch. Moreover, before Libra is launched there should be corresponding approvals, which is why he was heard by the US Senate's banking committee on July 16, 2019, for example.

A separate positioning of local regulators remains a precondition, but it is nevertheless advisable to take advantage of such invitations to dialogue in this matter in order to clarify open questions at an early stage and to derive regulatory necessities. For a launch against the resistance of national regulators, although not in the sense of the Libra vision, could be forced by the Libra Association for the reasons outlined above.

5. Five theses on Libra - Evaluation of market reactions

The media attention in the context of the publication of the white paper on Libra was mainly focused on the outstanding issues (mostly of a regulatory nature) and on the dangers that could emanate from Calibra and the Libra Association respectively. Furthermore, an attempt was made to assess the chances of success of the Libra initiative. If one emancipates the discussion from these short-term motivated topics and moves to the starting point, the underlying motive becomes recognizable. This is the question as to whether technological and social developments in recent decades have led to the need for a mass-capable, fast, secure and also more cost-effective infrastructure for global payment traffic, and whether the 160 national and regional currency areas and mechanisms continue to do justice to digital use cases and the platform economy.

This question needs to be discussed and it needs to be examined whether today's systems and established market participants meet the needs in sufficient form. The private Libra initiative was launched on the basis of the social need for a digital global currency. This fundamental question and its significant implications will be examined from different perspectives in the form of polarizing theses.

a. "Libra becomes global currency and undermines central banks worldwide"

A global currency is generally understood to be a currency which is valid worldwide and which abolishes the existing currency and exchange rate systems.

The central bank of a currency area is the institution responsible for it: (i) monetary policy, (ii) the issue of banknotes, (iii) the simplified settlement of payments, (v) the regulation of inflation according to the needs of the economy, (ix) the stabilisation of exchange rates, (x) the settlement of the balance of payments and (xii) the management of foreign reserve assets.

Assuming that the Libra Coin in its planned form would rise to become a global currency, this would - ceteris paribus - have far-reaching consequences for the states and central banks as well as the associated end consumers.

The direct and short-term consequences for final consumers, citizens and businesses could be largely positive. A reduction of the global exchange rate risks in cross-border payment traffic, as well as the possibilities of international transfers in real time, would lead to a large-scale dismantling of (payment) barriers and would probably stimulate international trade. In such a scenario, small and medium-sized enterprises, that are active cross borders in particular would be the main beneficiaries. In addition, the basis for free market participation would be laid for all people.

The disadvantages for end-users resulting from the global currency, the Libra, are largely indirect in nature and essentially consequences that would result from the undermining of central bank instruments: According to the planned model of the Libra, other currencies will continue to be necessary to fill the Libra Reserve, even in the case of an ascent to a global, digital currency. These must continue to be managed by the respective central banks. Therefore, the leveraging would not be understood as a complete curtailment of the power of the central banks, but rather as a gradual reduction of their strength of action.

This could lead to a situation in which, for example, the inflation abuse of national governments and currency regions, as is partly observed in developing and emerging countries, could be severely restricted. However, this effect can also be seen as a major disadvantage, as the central banks of the currency regions can use currency revaluations and devaluations to regulate their balance of payments and stimulate the economy. The devaluation of a currency in order to promote exports would therefore only be possible to a limited extent. In addition, the leverage of free interest rate policy for central banks would be reduced, which would make it considerably more difficult to control the investment behaviour of the economy and the consumer behaviour of end consumers. It should also be noted here that the Libra Association is also an "institution" that is difficult to control with increasing power, which is currently largely controlled by private-law and profit-oriented US companies, and is not necessarily committed to the common good of mankind.

The Libra Coin, as a globally valid currency, would thus bring great advantages for end users in the short term, but could in the long term, with increasing dominance, massively limit the central banks in their power and the flexible execution of their tasks. If Libra were indeed to become the most widely used currency in the world, a loss of the currency basket, similar to the US dollar's move away from the gold standard, would be possible and could, in extreme cases, result in a complete undermining of the central banks and the dissolution of other currencies.

But even if Libra were to reach a critical mass that would make such a scenario possible in principle, this would be opposed by various systemic resistances that would have to be actively overcome. For example, central banks could calibrate the availability of the Fiat currencies needed to purchase the Libra by pegging exchange rates or making targeted adjustments to the M1 money supply.

Furthermore, if the anchor currencies deposited in the reserve were significantly weakened by a shift in significant payment traffic volumes, this would probably result in upward or downward pressure on the anchor currencies. Subsequent price fluctuations would, on the one hand, corrupt the "Stable Coin" idea and thus the perceived trust in Libra and, on the other hand, relativise the capital gains generated in Fiat currency from the reserve - which, in turn, would directly affect the financing of the infrastructure and association.

It is unlikely that Libra will extensively undermine the Fiat currencies or the controlling functions of the central banks, at least in the short to medium term.

b. "Facebook attacks with Calibra WeChat, Google and Apple Pay"

Digital payment methods are becoming increasingly important worldwide at the PoS and in e-commerce. The market shares of the respective providers vary greatly depending on use cases and regions: In the Western world, but also in Russia and India, Google Pay and Apple Pay are among the established providers at the PoS, while PayPal has positioned itself as the market leader in e-commerce in many parts of the world.

In strong contrast to this is the Asian market, which enjoys a kind of special status with WeChat (Pay) and Alipay, since, for example, many Western services - including Facebook and Google - are blocked by the state censorship of the internet in China and as a result local alternatives have prevailed. The services mentioned show how customer loyalty and synergy effects can be exploited by centralising customers' online activities on a single platform: For example, WeChat not only offers a payment function, but also has its own App Store, news service, instant messenger, ID service and more to cover a wide range of daily customer needs. In the case of WeChat even so far that a WeChat profile is more relevant than your own website and even defines creditworthiness and social status.

Against this background it can be assumed that, following this example, Facebook strives to position itself as a central customer interface beyond social media and uses Libra or Calibra as a vehicle for this purpose. The fact that Facebook plays a leading role within the Libra Association and addresses the customer interface for payment transactions with Calibra makes this thesis plausible, especially as Calibra CEO David Marcus admits that Facebook wants to use Calibra to strengthen the loyalty of customers and merchants to the social network. The chances of success for this project are not bad, as Libra offers three advantages over Western "payment competition":

- Availability on all operating systems

- Opportunity to establish in the largely untapped African market

- Centralization of different services on one platform (cf. WeChat)

Beyond that goes the mentioned, but not further specified identity solution. The context in which this becomes relevant for wallet providers such as Facebook is not defined. The fact is, however, that existing, comprehensive data on user behavior and preferences, which are primarily monetzed for marketing purposes, would be significantly enhanced if one were able to link this data with real identities.

Whether customers will actually accept Facebook or Calibra as the (preferred) provider for sensitive topics such as payment transactions remains to be seen. The still increasing number of Facebook and Whatsapp users, despite numerous data scandals, shows, however, what influence customer added value and convenience have on the psychology of the customer and can even level security concerns.

c. "National initiatives undermine Libra as a global coin"

Just a few days after the official announcement and the live launch of the Libra website, talks were held at national and continental level to initiate countermeasures against Libra. In some cases there is an attempt to limit the power of Libra through strict regulatory measures (cf. chapter 4.e). However, it cannot be denied that Libra hits a nerve and tries to address problem areas that are insufficiently solved today, complex or only solved at high transaction costs (e.g. unbanked; international, cost-effective payment processing across different currencies, especially for digital business models). For this reason, there is also a partial response from the state that aims to install its own (multi)national crypto currencies. The aim of this strategy should be to reduce the increasingly regulation-free space of digital currencies, or to create a solution for the challenges mentioned, without handing over sovereignty to private-law companies. Politicians in Germany demanded theatter effort in the form of a Eurocoin. Similar to Libra, these crypto tokens issued by the central bank are to remain stable in value through parity with the euro. Advantage would be the possibility of the real-time transfer, which also includes Libra.

A successful establishment of a national, at best, European initiative would only partially achieve the benefits Libra promises. Since the Eurocoin in question is directly dependent on only one Fiat currency, the low volatility envisaged by Libra and addressed by the diversified currency basket could not be achieved. In addition, the cost dimension is becoming even more important: even with Libra, the idea of covering the costs of development and operation primarily through capital gains from the reserve seems ambitious. If the reserve is limited locally and thus tends to be smaller, this idea will be even more difficult to realise, which would have to cover costs for operation and further development elsewhere. Furthermore, the international applicability has to be put into perspective, because an Asian e-commerce retailer would first have to accept Eurocoins in Euro and then exchange them back into his local currency in order to be able to pay his suppliers.

The technical, political and organisational feasibility of such a project could also become a bottleneck. While Libra already has a technological base and the expertise of technology companies, a state-driven response would have to make up for this lead. Even if the technological expertise could be made available and the implementation period could be kept sufficiently short, this would require a short-term consensus within the EU with an accompanying financing plan.

Nonetheless, an initiative like Libra makes the need for alternative possibilities based on the latest technological standards to support today's use cases a given, and the instruments will evolve; currently driven by national, European, American or private-law initiatives. A global consortium consisting of various central banks and/or government institutions would have the best chance of keeping up with Libra. On the one hand, it would be a global means of payment and on the other hand, similar to the Libra Reserve, it could deposit a broadly diversified currency basket as a collateral in order to lend an intrinsic value to the digital currency. If no alternative digital currencies, states or banks try to establish themselves, Libra would have a high chance of success due to the lack of competition.

d. "Establishment of Libra as the primary means of payment in developing countries"

Libras disruptive potential could unfold above all in the developing countries. The economic area of continental Africa would be a conceivable region since it forms a self-contained system with similar problem structures across borders. In contrast to the already fully technologised regions of the world, there are still huge infrastructural weaknesses in the African states. In addition, due to the long distances between larger settlement areas, financial service providers are scarce or not to be found at all and the number of people without bank accounts is significant. Nevertheless, it is necessary to have access to financial institutions and their services, especially in view of the advancing digitalisation and networking.

As a continent, Africa occupies the last place in the ranking of Internet usage and digital presence. However, this situation is changing and the placement is not representative for all African countries. Over the past 20 years, the proportion of the total population with Internet access has risen from almost 0% to over 50% in some countries. This can be explained above all by the nationwide expansion of network coverage and the accompanying move into mobile telephony. Both are basic prerequisites for the successful establishment of Libra. At the same time, traditional payment instruments such as credit or debit cards are not yet commonplace, unlike, for example, Europe. The market is still untapped and completely open to an innovative alternative. These were also the driving forces behind the successful rise of the M-Pesa payment service. In contrast to M-Pesa, the biggest hurdle may be the initial conversion of the Fiat currency into Libra. Here, too, adequate KYC and AML processes must be adhered to. Especially in the underdeveloped regions, without proof of state identity, this could pose a challenge. A possible solution to this problem has not yet been identified.

Libra has the potential to offer a stable, fast and secure infrastructure in these regions, to ensure regulated payments and increased participation of actors in the economic cycle, which could stimulate consumption and prosperity. The political attitude of individual African states, however, speaks against such a development. The loss of sovereignty of the state currency and the associated dwindling financial sovereignty would be perceived as a threat and regulatory countermeasures by these countries could prevent the population from using Libra.

e. "Based on Libra, banks offer their own built products such as wallets and move further parts of their product range into the Libra ecosystem

As things stand today, no banks can be found within the consortium. At first sight this seems surprising, at second it seems logical. The consortium has the task of issuing a currency. However, banks have not fulfilled this task for many decades. Rather, banks work with the issued currencies to meet the needs of their customers through the use of adequate financial products.

The Libra Blockchain is based on open source technology and thus offers banks and other financial market players the opportunity to build products and services on it and to set up alternative wallets. For banks in this context, Libra would merely be a new currency on which they would build products to meet their customers' needs.

"The ultimate goal is to increase acceptance to the point where Libra can build a dynamic financial services economy, not just from Facebook, but from every other company in the world. Kevin Weil, Vice Director of Product at Libra"

There are corresponding use cases that would be attractive for banks and offer sales potential. For example, in this blog post the still unsolved problem of the change from Fiat currency to Libra was mentioned several times. This process could be solved or significantly simplified by the banks. A bank would become a member of the Libra Association or act as an authorised reseller on behalf of an existing member. In addition, a technical bridge would be necessary to transfer the money to the Libra Reserve and the coins to the wallets of bank customers. At best, a bank would integrate its wallet directly into the mobile banking app, creating an additional point of contact with its customers and giving them a Libra current account. A bank would thus add Libra to its existing Forex business and open up additional turnover potential through the exchange fee.

In addition to current accounts, banks offer their customers a wide range of other banking services. However, there are a number of reasons for the banks not to open a Libra current account or provide other existing services, such as mortgage loans based on Libra, for the time being: In the past, banks have often proven that they are well versed in defending existing businesses, but are more conservative about new applications. It can therefore be assumed, particularly in the first few years, that the majority of established banks are more likely to take protectionist countermeasures than actively participate in Libra. One example of such a measure is Credit Suisse Switzerland or its card issuer Swisscard, which completely blocks credit card payments on crypto exchanges only a few days after publication of the Libra white paper. On request, it was confirmed on the basis of risk considerations that payments to companies trading in crypto currencies would no longer be possible- however, no further explanations of these risks were given. Consequently, the link with Libra can only be presumed, although the measure as such makes the leeway of banks in this context tangible.

There are several valid arguments in favour of banks continuing to operate their traditional lending business outside the Libra Blockchain. Unlike traditional banking, a commercial bank cannot increase the amount of money at its disposal according to its business policy needs by using the money creation multiplier in the Libra ecosystem. This means that it - according to today's interpretation of the Libra idea - would have to pass on 1:1 the money of its Libra customers, which would limit the maximum asset volume in relation to Fiat currencies massively. In addition, Libra does not currently have any savings deposits with fixed maturities that would enable it to increase its lending volume through maturity transformation. This means higher expenses on the one hand and lower earnings for the banks on the other. This is compounded by the fact that banks prefer to grant their loans only within national borders, as this is the only way they have simple levers to legally enforce the debtor in the event of non-payment of principal or interest payments. Accordingly, the Libra benefits of lowered payment barriers through the abolition of currency conversions and increased transfer speeds will play a subordinate role in the lending business. Due to the changes made in this and in chapter 4 c. “Libra Reserve", banks are likely to conclude their credit agreements outside the Libra ecosystem, provided they use the Libra as a currency to create products based on it. All the more the question arises as to whether the granting of loans on a blockchain can at all be handled sensibly. Especially in the credit business the counterparties have to know each other, which will not be given by the promised anonymity on the Libra Blockchain.

Whether banks will enter the Libra world and offer their customers a simplification for switching from Fiat currency to Libra remains to be seen. However, the fact that the entire banking business will be transferred to the Libra Blockchain at short notice can be ruled out due to the current structure of the Libra Blockchain. However, it can be seen whether the restriction will remain on payment traffic in the long term.

6. Bottom line

Libra receives considerable media attention and initiates a public discussion. The Libra initiative itself can have positive effects such as the reduction of transaction costs or the inclusion of groups and individuals previously excluded from the financial system. At the same time, the altruistic vision described by the Libra Association should be viewed in a differentiated way, since the majority of its members are private, profit-oriented companies. The objectives will be diverse and may range from the planned establishment of a counterweight to WeChat by Calibra to the enrichment of existing data with identities. Whether Libra will be successful will depend, among other things, on the attractiveness of the fees, the management of the operating costs and the degree of conflicts of interest, especially within but also outside the Libra Association. It is undoubted, however, that Libra's thesis paper and vision raise a question much more far-reaching than the creation of a new crypto currency. In fact, a question with power comes to mind:

Is there a need to create a global, digital currency area spanning all currencies in addition to the approximately 160 individual, national or regional currency areas?

The technical, cultural and social developments of the last decades make such a need for a means of payment that is suitable for the mass market, inexpensive and global - simultaneously appear and seem realizable. Especially in relation to programmable money systems, constructs like Libra offer enormous potential in the treatment of digital use cases. In the area of machine-to-machine payments, for example, there is a need to catch up at the latest when services are offered to the masses without human interaction. A prominent example of this would be the current developments in the field of self-propelled automobiles, which could be mapped on a blockchain with a programmable money system. How great the need actually (already) is and whether it can be better served by a private-law initiative such as Libra or a pan-state initiative remains open, but have to be discussed. Such a development also implies an at least partial transition to full money and would in any case have a fundamental influence on the existing financial system.

However, the answer to this question should not be left to chance. Rather, a transparent and well-founded discussion would be advisable. This in turn leads to a balanced decision and structured measures with regard to regulation, legislation and promotion. The need for action now lies - above all - with banks, central banks, state institutions such as line ministries and subordinate authorities, the International Monetary Fund, the World Bank, the World Trade Organization and finally Politicians, for example in form of the G-20. These bodies should initiate a structured discussion with the aim of finding an adequate answer to the question raised above.

[The elaborations are based on the current state of knowledge, thus can and will be subject to change as the Libra project progresses]

Sources

i The Five Pillars of Cryptocurrency

https://markshirecrypto.com/cryptocurrency/the-five-pillars-of-cryptocurrency/

ii The Five Pillars of Cryptocurrency regulation

https://www.theguardian.com/technology/2019/jun/25/facebook-libra-cryptocurrency-regulation

iii Libra-letter-FINAL.pdf

https://www.citizen.org/wp-content/uploads/Libra-letter-FINAL.pdf

iv Trump calls for regulation of crypto currencies

https://www.faz.net/aktuell/cyberdevise-libra-trump-fordert-bankenregulierung-fuer-kryptowaehrungen-16281003.html

v Bank of England Governor Says Facebook’s Libra Crypto Will Be Scrutinized

https://www.coindesk.com/facebooks-libra-could-meet-highest-standards-in-regulation-boe-governor

vi Testimony of David Marcus

https://www.banking.senate.gov/imo/media/doc/Marcus%20Testimony%207-16-19.pdf

vii How Facebook wants to promote Libra

https://www.faz.net/aktuell/finanzen/digital-bezahlen/kryptowaehrung-wie-facebook-fuer-libra-werben-will-16286951.html

viii Facebooks Libra to be launched only after government approval

https://www.finanzen.net/nachricht/devisen/zeitpunkt-unklar-facebooks-libra-soll-erst-nach-behoerden-zustimmungen-an-den-start-gehen-7714807

ix Why is there not only one currency in the world?

https://www.faz.net/aktuell/wirtschaft/erklaer-mir-die-welt-8-warum-gibt-es-nicht-nur-eine-waehrung-auf-der-welt-1353489.html

x Tasks of the central bank

https://www.bpb.de/politik/wirtschaft/finanzmaerkte/51724/zentralbank?p=all

xi What Facebook plans to do with its crypto currency

https://www.faz.net/aktuell/wirtschaft/unternehmen/was-facebook-mit-libra-vorhat-16257680.html

xii Why WeChat soon overtook WhatsApp - rightly so

https://curved.de/news/warum-wechat-whatsapp-bald-ueberholt-hat-mit-recht-177171

xiii China’s Biggest Payment Firms Have No Plans to Follow Facebook into Crypto

https://www.coindesk.com/chinas-biggest-payment-firms-have-no-plans-to-follow-facebook-into-crypto

xiv Testimony of David Marcus

https://www.banking.senate.gov/imo/media/doc/Marcus%20Testimony%207-16-19.pdf

xv Facebook, Libra, and the Long Game

https://stratechery.com/2019/facebook-libra-and-the-long-game/

xvi With the "digital euro", the CDU wants to fend off Facebook money

https://www.welt.de/finanzen/article195909017/Kryptowaehrung-CDU-will-mit-digitalem-Euro-Facebooks-Libra-abwehren.html

xvii The newly formed subsidiary will build Facebook’s digital wallet

https://www.theverge.com/2019/6/18/18682838/facebook-digital-wallet-calibra-libra-cryptocurrency-kevin-weil-david-marcus-interview

xviii Card issuer Swisscard blocks Bitcoin purchases

https://www.handelszeitung.ch/unternehmen/kartenherausgeberin-swisscard-blockiert-bitcoin-kaufe