Technological domination within the publishing industry

Key facts

- Driven by technological change, consumer behaviour is changing at ever shorter intervals, thus, creating significant opportunities for low-threshold market entry and disruptive business models

- In this context, traditional publishing houses are under significant competitive pressure, as well as under the pressure to take action. The primary challenges here, are the progressive shift away from traditional (print) media, the increasing market power of technology-focused platform providers, and the business-critical dependence on historically established legacy systems

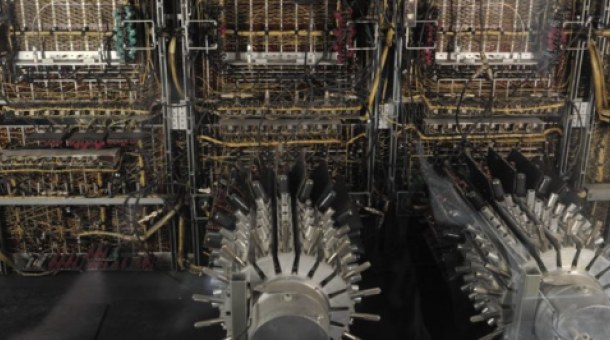

- In this context, the IT system landscapes, some of which have grown historically, are not geared to the exponentially increasing technological competitive situation. Primarily, the modern architectural approaches of loose coupling, full modularity, scalability, interoperability and specific modern architecture attribute are undermined, which is primarily due to the use of partly monolithic "all-in-one" software solutions

- In addition to the disregard for modern architectural approaches, this results in significantly higher maintenance and operational complexity, which is ultimately reflected in the cost structure. The necessary operating and run costs increase, while change budgets decrease to same characteristic value. Internal IT structures are thus becoming a business-critical risk factor

- As a result, it will be necessary to initiate a transformation in the direction of cost-effective

structures and open-market offerings. The associated technological modernization will have

an impact on the process and organizational structure and will initially require a fundamental

realignment in many places - The main challenge here is the correct identification of the adequate time frame for efficient core modernization with minimum effort. Due to the constantly rising run costs for maintaining

the status quo, a business-critical downward trend arises from the missed modernization point in time, which can only be stopped by making significant efforts - To select the correct modernization path, it is initially necessary to answer the question regarding the extent to which a unique technological selling point can be identified within the company that legitimizes the maintenance of its own infrastructure and the current number of internal IT resources

- It is advisable to evaluate the outsourcing and modernization approach along the 5 core areas

of application / services, ERP core components, infrastructure, office IT and IT resources Savings potentials of up to 50% can be realized on average, on the basis of technological modernization and outsourcing - Regardless of the respective corporate strategy, the implementation of structured technology management in the publishing industry is a sustainable necessity and should be regarded as a primary lever for the development of new business models

Technological change as an opportunity and risk of the same kind

Digitization, including the associated opportunities and challenges, is a cross-industry phenomenon that has recently become increasingly visible in analogy to other industries in the environment of traditional publishing. Driven by technological change, consumer behaviour is changing at ever shorter intervals, creating significant opportunities for low-threshold market entries and disruptive business models. On this basis, long-standing market structures are destabilized and the requirements or prerequisites for active market design are raised. As a result, it will be necessary to initiate a transformation in the direction of cost-effective structures and open-market offerings. The associated technological modernization will have an impact on the process as well as the organizational structure, and will initially require a fundamental realignment in many places. In times of hyper-personalization and real-time availability, the primary task for securing mediumterm competitiveness is to recognize the importance and urgency of this profound change and to initiate a short-term migration path to reverse the downward trend currently being observed.

Customers turn away from classic media

The steady decline in consumption of traditional media has been clearly identified and substantiated for several years. The clear shift away from print media in the direction of audiovisual sources of information was recently substantiated on the basis of the latest surveys and polls. While media consumption in Germany continues to rise on average, peaking at 620 minutes a day in 2020, consumption of print media is stagnating at a low level overall1. Of the almost 10.5 hours of daily media consumption, only 22 minutes are spent on print products, including epapers. The findings of media researchers also suggest that this trend could intensify in the near future. The authors of the ARD/ZDF Online Study 2020 observe a steady decline in text usage in the environment of the media Internet, with a simultaneous significant increase in the consumption of available audio offerings. The focus surveys conducted among the 14-29 age group show how great the dominance of audio-visual communication will be in the future.

This finding is supported by a 2019 Infratest dimap survey on preferred sources of political information among 14–29-year-olds. The survey concludes that only 24% of respondents in this age group use2 printed newspapers as their primary source, preferring online offerings of varying degrees instead.

Continuously declining circulation and sales figures are putting traditional publishing under zugzwang

This negative trend is also reflected in the print circulation figures, which have been in constant decline since 1995. Although the use of electronic offerings is increasing dynamically in the meantime, the new format alone cannot compensate for the losses in print circulation. In this context, the circulation of German daily and Sunday newspapers fell by a total of 15.2% between 2014 and 2019. However, the decline is greater if only print products are taken into account: in this case, the difference is a business-critical 22%3.

Figure 2: Revenue and circulation trends in the German newspaper market

This decline in circulation is having a significant impact on the reach-based revenue potential of established publishing houses. A closer look at the sources of revenue reveals two key points. On the one hand, many have succeeded in stabilizing circulation revenues despite the massive decline in circulation. Generous price increases in print sales, both in subscription sales (31.5%) and single-unit sales (29.8%, from 2014 to 2019, in western Germany)4 , serve as leverage for this. In the short term, this strategy certainly makes sense in order to finance the necessary expansion of new, technology-driven revenue sources. In the medium to long term, however, this trend reveals the critical dilemma facing many publishing houses: compensating for continuous volume declines with massive price increases in a market where there is great growth, especially on the supply side, undermines the nature of sustainable business models. Price leverage is thus an inherently short-lived instrument. The urgency of the situation is underscored by a second observation. The losses in the advertising and insert business essentially correspond to the decline in circulation. Unlike the circulation business, this segment has not been able to compensate for the losses. This leaves the paid content segment, i.e., revenues generated by the sale of digital media offerings, especially the e-paper and digital subscription models, as a source of hope. Although the publishing houses are succeeding in expanding modern revenue sources on a large scale, the growth of digital revenue sources can only cushion the rapid loss of revenue due to falling print circulations to a limited extent.

The bottom line is that both price increases and new digital revenue sources cannot fully compensate for the decline in revenues resulting from the loss of reach. In addition to the loss of relevance already mentioned, the reasons for this lie primarily in the intensified competitive environment, which is increasingly being occupied both by technologically advanced lateral entrants and by niche players.

Density of competition increases significantly as emerging technologies are exploited

The frequency with which new market participants appear in the mass media sector is constantly increasing; recent examples include Twitch, TikTok, and most recently Clubhouse. Platforms such as Facebook, Instagram, and Twitter can already be described as the cornerstones of the digital media landscape, and some of them are themselves struggling with migratory outflow. Primarily, the willingness of young users to try out and accept new platforms and communication channels remains high. Here, the defining characteristic of the market players established in recent years, in analogy to comparable industries, is their focus on emerging technology innovations as a significant value driver (see Publishing in transition - Technology as a success factor). In contrast to the core business of traditional media companies, the new players are focusing on efficient distribution of existing content over as large an area as possible. In this respect, they imitate platform-based business models known from other industries - for example, Amazon, Netflix, or Spotify - and benefit from similar mechanisms. In this context, alongside new platform providers and aggregators, established technology companies such as Google and Apple are also increasingly entering the media market. Their offshoots (e.g. Google News, Apple News) benefit from the enormous reach of their parent companies and can thus address a large part of the market on an ad-hoc basis.

Figure 3: Provider landscape of journalistic products

This shows that new platforms do not necessarily displace existing ones. Coexistence is possible, although the durability of this cannot be fully assessed at present. However, coexistence on its own suggests that new entrants are effectively differentiating themselves from existing offerings. For example, both YouTube and Twitch offer video content, but the platforms are aimed at two different audiences: YouTube focuses more on the passive consumer with video on demand, while Twitch focuses on the direct interaction of the media creator with his/her audience. It should be noted that each individual can be part of both target groups in a time-defined manner. As existing platforms do not disappear at the same rate as new ones emerge, the distribution of attention is continuously increasing, especially at the expense of venerable publishers. A further increase in overall media consumption is unlikely in view of the permanently high level. On the other side of the provider spectrum, new journalistic start-ups and collectives are emerging that specialize in consumers' need for in-depth research or focus exclusively on singular topics such as feminism or ecology. These niche providers are attacking established newspaper publishers in their core competence, the objective preparation and subjective evaluation of information. To the same extent that technology creates space for new providers, it is the basis for new, more complex business models that can hold their own in well-networked ecosystems. Bundled subscription models, which maximize the breadth of the content on offer and thus the added value for the end customer, are likely to be a key success factor here. What Netflix and Spotify have initiated for the film and music industry has great potential to become established in the publishing industry. In this way, platforms with a wide reach can put together attractive packages of combined content from different providers. Additive economies of scale are activated here, so that prices for the end customer are reduced and advertising revenues are maximized. For medium-sized publishers in particular, this means the gradual loss of relevance of their own front end and the associated advertising revenues.

Limited entrepreneurial success of traditional publishing is largely due to given restrictions of established legacy systems

Looking at the potential causes of this development, a deeply interwoven and complex process and system landscape has been built up over time with a strong focus on the underlying task – print journalism as efficient as possible. However, the entry into the information age and thus exponential acceleration of technological development is now driving a wedge into the media landscape. On the one hand, forward-looking experimental platforms and other new media formats are emerging that exploit the diverse possibilities of digitization to reach existing and new target groups. On the other hand, providers of classic print products are suffering a steady loss of relevance. Although there is a willingness to adapt to new developments, they are held back by the complex and cumbersome print-oriented structure and associated rigid IT system landscape. If they fail to catch up with the digital revolution, they risk slipping into irrelevance in the medium term.

A detailed look at the technological market situation reflects the findings outlined and potential causes: over many years, the "general-purpose" systems used in the publishing industry today, led by the top dog SAP, have grown into system-critical core components. Today, they cover the entire range of services along the primary business areas of ERP, reader market, advertising market, and ad market - from content creation, subscription and customer management, and logistics management to finance and controlling. However, it is also clear, that although a platform such as SAP is modular in itself, it still represents a gilded cage in a figurative sense. The integration of and interaction with third-party software is deliberately complicated and creates incentives to remain loyal to the system house. This also creates a strong dependency on the part of the customer: Only those innovations that the software provider itself considers essential will find their reflection in the system.

Legacy systems currently in widespread use are thus prevented from keeping pace with the speed of technological development by the proprietary nature of their software components. To counteract this situation, modular and scalable Software-as-a-Service (SaaS) solutions have recently become established, which allow an individual and effort-saving combination of diverse software components using standardized interfaces.

The exploitation of SaaS potential and the associated cost optimization requires technological flexibility, which largely requires the use of cloud ecosystems as the basic technological infrastructure. An examination of the market using the core criteria of interoperability and functional scope reveals a clear divide in this context: solution providers such as SAP or InterRed shine with a high functional scope and excellent adaptation to traditional editorial and publishing processes. However, the proprietary nature of their platforms keeps them from keeping pace with the speed of technological development.

Looking at the emerging market challenges of dwindling revenue streams, cyclically changing customer behaviour, exponentially increasing frequency of technical innovations, and significantly increased competitive pressure, the analysis of the respective corporate orientations within the media and publishing industry thus reveals the technology used as a success factor as well as a risk factor. In this context, the IT system landscapes, some of which have grown historically, are not geared to the exponentially increasing technological competitive situation. Primarily, the modern architectural approaches of loose coupling, full modularity and scalability, interoperability and specific modern architecture attribute are undermined, which is primarily due to the use of partly monolithic "all-in-one" software solutions. For the possible use of emerging technology innovations and consideration of the changing customer behaviour, the legacy systems are extended by additive services and adjusted within the application logic with significant effort and under consideration of partly proprietary interfaces. Due to the limited modularity and flexibility of the historical system landscapes, a large number of potentially necessary application adjustments require direct intervention in the source code of established software components. In addition to ignoring modern architectural approaches, this results in significantly higher maintenance and operational complexity, which is ultimately reflected in the cost structure. The necessary operating and/or run costs rise with in same characteristic falling change budgets. By analogy, the number of IT resources required to maintain the status quo and focus on legacy systems is also increasing. Internal IT structures are thus becoming a business-critical risk factor. Unless this downward trend can be stopped by defining a dedicated IT strategy and deriving mitigation measures, the company will move inexorably toward business-critical manoeuvrability.

Figure 4: Vendor overview foorr CCMMSS aanndd CCRRMM ssyysstteemmss

In the sense of a potential reaction pattern, the internal IT structures are partly separated from the central core business area in the form of separate subsidiaries and positioned as independently operating service providers as far as possible. However, since the primarily historically established existing systems of print publishing continue to be served and the procedural stability of flattening business areas must also be ensured in the interests of the publishing house, the probable long-term success of this orientation must be questioned, considering the prevailing density of technological competition. This type of bipolar corporate alignment thus regulates the necessary focus for the possible establishment of a competitively differentiated market positioning. Regardless of the mitigation measures selected for the organization, however, the central legacy components remain a significant risk potential that must be taken into account, so that a step-based overall system migration must be considered.

In addition to technological modernization, process and organizational structures must also be realigned in order to fully leverage potential efficiency gains

In addition to the need for technological modernization described above, it is also important to look at the current processes, workflows, and governance structures, which have grown organically over the past decades in the same way as the technological system landscape and are essentially geared to print publishing. Additively required process chains have been added on a large scale without fundamentally remodelling the already established workflows. In some cases, a strict separation of digital and print publishing and thus a parallelization of similar process chains can be identified. As a result, the necessary efficiencies and savings potential of a communication channel-agnostic orientation can only be partially leveraged.

In the course of a fundamental modernization of existing process landscapes, the necessary restructuring of internal organizational areas and areas of responsibility must also be provided for in this context.

However, before defining the possible solution space, it is essential to fundamentally understand that the existing challenges are due to cross-industry, technological causes.

Figure 5: Technology management

In principle, the aging of established IT landscapes cannot be prevented, but only delayed and limited in its effects. The aging process of IT systems is not a new phenomenon. However, its significance has increased sharply in recent years because technological innovation cycles are becoming shorter and IT systems are playing a much stronger role in value creation as the digitization of processes in companies progresses.

In this context, it is also essential to recognize that the given market requirements can only be implemented up to a certain technology barrier. In the case of dedicated technology leaps, partial modernization or expansion of existing legacy systems will not be sufficient.

Figure 6: Technology cycles depending on the respective development and aging phase

The main challenge here is the correct identification of the adequate time frame for effort-saving and efficient core modernization. The potential reasons for missed modernization opportunities are manifold, but in the final instance, in many cases, they can be traced back to the budget management that needs to be optimized. Since technology management efforts are not directly linked to higher revenue streams, the budgets required for this are increasingly reallocated to other business areas in the annual planning due to continuously increasing challenges. Due to the constantly rising run costs for maintaining the status quo, a business-critical downward trend arises from the missed modernization point in time, which can only be stopped by making significant efforts. If the modernization phase is missed, the downward trend described must be mitigated by a necessary restructuring of the core software components. Extending the existing system landscape to include modern technology components or selectively replacing them proves to be insufficient over a large area and temporarily provisional (see white paper "Anti-Aging for IT Systems - Evolutionary architecture: taking advantage of technological innovation cycles").

Figure 7: Exemplary IT budgets

In order to identify individually suitable options for action, the planned modernization procedure must be evaluated along 5 defined core areas

In order to be able to select the correct modernization path, it is initially necessary to answer the question of the extent to which a unique technological selling point can be demonstrated within the company that legitimizes the maintenance of the company's own infrastructure and the current number of internal IT resources. If the necessary unique selling propositions cannot be clearly demonstrated, the path of full outsourcing should be considered in a focused manner. In this context, it is advisable to evaluate the outsourcing and modernization approach along the following core areas:

- I. Application / services

- II. ERP core components

- III. Infrastructure

- IV. Office IT

- V. IT resources

Especially in the area of infrastructure and office IT, established cloud offerings have existed for several years, which allow the internal cost structure to be significantly minimized with increased security and scaling options. Depending on the company's internal technology stack and overarching regulatory requirements, one of the three major cloud providers Amazon Web Services, Microsoft Azure or Google Cloud should be preferred in this case due to the solution maturity and optimized cost structure. If the company already uses Microsoft-specific software on a large scale and does not have a significant degree of container-based components, then migration in the direction of the Microsoft Azure Cloud would be recommended as an example.

Figure 8: Comparison of established cloud providers

Although the same approach also applies to the application level, the correct solution model must be selected in advance and the required domain intersection defined. When considering different technological approaches with the weighting of a lean cost structure and maximum flexibility and sustainability, the cloud-based software-as-a-service (SaaS) offerings stand out in particular. Once the technical and business domains have been classified, it is possible to integrate the most suitable solution in each case in the form of the SaaS approach and to link it with other components of the overarching system landscape. In this way, existing legacy systems can be separated into individual modules and replaced by market-leading SaaS solutions.

Figure 9: Classification of technology providers

The main advantages of this solution approach are that the technological sovereignty and control can be secured within the company with a significantly reduced use of resources and that it is therefore possible to adapt flexibly and modularly to market requirements by replacing individual components.

Based on technological modernization and outsourcing, savings potentials of up to 50% can be realized

A step-based migration path should be defined here, taking into account different obligations to the software suppliers and potential customers. Other relevant planning variables are the dependency structures of the current system landscape, the degree of functional complexity and the given interoperability of existing software components. In deriving this approach, the number of IT resources involved can be reduced and increasingly focused on the management of modern technologies and DevOps task areas, away from maintenance of the legacy systems. Based on several, relevant empirical values of successfully implemented modernization projects, average cost savings of ~50% can thus be realized.

In addition to the overarching challenge of adequate technology management, internal processes and governance structures must also be aligned with modern requirements. In this context, the internal processes based on the traditional print publishing focus have been optimized in many places and selectively expanded to include the necessary digital publishing workflows. However, since this sometimes results in parallel processes of low efficiency, the first step is to align the editorial work with an omnichannel distribution of content. The basic division of purely editorial tasks and downstream optimization for each distribution channel has proven to be effective. The editors can concentrate fully on content creation in each area of responsibility under agreement of dedicated KPIs, while the exemplary page planning for the print section or the e-paper is the responsibility of a separate distribution team. This also means a move away from day-to-day content preparation for the production of the daily newspaper in the direction of continuous information preparation in compliance with agreed performance indicators. This change of direction accordingly requires a governance restructuring to be defined so that the desired realignment can also be culturally anchored within the company.

Conclusion

Figure 10: Excerpt of required modernization measures to meet strategic goals

Taking into account the changing market and customer needs, the derived challenges and possible solution options, it is primarily necessary to recognize a lack of technology management as an industry-wide cause and problem, as well as to define the necessary modernization path to reverse the downward trend in the short term. Among other things, the following objectives must be pursued:

- Significant, short-term cost reduction

- Less effort to implement new, functional requirements

- Creation of technological independence and modularity to avoid possible vendor lockin and flexible market orientation

- Higher level of efficiency and automation of required processes and workflows in terms of omnichannel distribution

- Restructuring of internal governance structures to anchor strategic realignment culturally

To initiate the required modernization path that pays off on the defined objective, the following dimensions should be evaluated in extracts and transferred into dedicated measures:

- Re-evaluation or definition of overarching, non-functional requirements

- Analysis of current system landscape and specification of a derived, modular domain model

- Conducting market research and analysis per domain in search of better alternatives more fitting to the target solution model

- Definition of notified target architecture

- Analysis and optimization of current process chains on the basis of the technological target image

- Establishment of overarching migration planning, taking into account overarching dependencies and obligations

- Cost / revenue calculation of the planned migration path

- Analysis and realignment of existing corporate structure

Even if the modernization path has to be determined individually for each publishing house due to significantly different framework conditions and diverse positions are taken on the known challenges on the basis of the respective corporate strategy, it is possible to fall back on a foundation of proven measures that have been successfully tested several times and thus significantly minimize the implementation risk.

Regardless of the different framework conditions, defined objectives, and various implementation options, one thing is certain - the current downward trend can only be stopped with the help of decisive action.

Sources

- Media Activity Guide 2020, Seven One Media GmbH, https://www.sevenonemedia.de/documents/924471/1111769/Media+Activity+Guide+2020.pdf/f5d31769-e7f0-97a4-1f7e-254d56000e59?t=1603709458463

- Woher bekommst du Informationen über das politische Geschehen in Deutschland und der Welt?, Statista,

https://de.statista.com/statistik/daten/studie/1081295/umfrage/genutzte-politische-informationskanaele-von-jungen-menschen-in-deutschland/

- Schätzung der jährlichen Umsätze der deutschen Publikumspresse mit Paid Content in den Jahren 2013 bis 2020, Statista, https://de.statista.com/statistik/daten/studie/501454/umfrage/umsaetze-der-publikumspresse-mit-paid-content-in-deutschland/

- Zur wirtschaftlichen Lage der deutschen Zeitungen 2020, Bundesverband Digitalpublisher und Zeitungsverleger e.V.,

https://www.bdzv.de/fileadmin/content/7_Alle_Themen/Marktdaten/Bericht_Umsatzerhebung_Herr_Keller_V2.pdf

Abbildung 1: CORE, ARD/ZDF-Onlinestudie 2020,https://www.ard-zdf-onlinestudie.de/files/2020/2020-10-12_Onlinestudie2020_Publikationscharts.pdf

Abbildung 2: CORE

Gesamtumsätze der Tageszeitungen und der Wochen- und Sonntagszeitungen in Deutschland in den Jahren 2009 bis 2019, Statista, https://de.statista.com/statistik/daten/studie/239831/umfrage/gesamtumsaetze-der-zeitungen-in-deutschland/

Zur wirtschaftlichen Lage der deutschen Zeitungen 2020, Bundesverband Digitalpublisher und Zeitungsverleger e.V., https://www.bdzv.de/fileadmin/content/7_Alle_Themen/Marktdaten/Bericht_Umsatzerhebung_Herr_Keller_V2.pdf

Schätzung der jährlichen Umsätze der deutschen Publikumspresse mit Paid Content in den Jahren 2013 bis 2020, Statista, https://de.statista.com/statistik/daten/studie/501454/umfrage/umsaetze-der-publikumspresse-mit-paid-content-in-deutschland/

Authors

Expert En - Artur Burgardt

Artur Burgardt is Managing Partner at CORE. He focuses, among other things, on the conceptual design and implementation of digital products. His focus is on identity management, innovative payment ...

Read moreArtur Burgardt is Managing Partner at CORE. He focuses, among other things, on the conceptual design and implementation of digital products. His focus is on identity management, innovative payment and banking products, modern technologies / technical standards, architecture conceptualisation and their use in complex heterogeneous system environments.

Read lessExpert EN - Thomas Henschen

Thomas Henschen is Managing Partner at CORE. With his many years of consulting experience in complex transformation projects, he ensures that the necessary adjustments are optimally implemented. He...

Read moreThomas Henschen is Managing Partner at CORE. With his many years of consulting experience in complex transformation projects, he ensures that the necessary adjustments are optimally implemented. He uses his comprehensive systemic understanding to occupy the interface between the business requirements and the technical constraints and to shape them in the interest of our customers.