A New Regime in the Payment Transactions Market

KEY FACTS

-

Changes and opportunities arising from the structural change in the payment transactions market picked up by international stakeholders and, in particular, those outside the industry

-

Banks faced with a choice: proactive cooperation or protectionist defenses

-

The risk of Germany and Europe losing significance as financial centers (including regulatory mechanisms) due to new protagonists mainly from outside Europe

-

National banks in innovative areas of business are currently focused on their own institutes and singular solutions

-

The German banking industry have in place key prerequisites and instruments for the joint creation of innovative and comprehensive solutions, but no activities in this direction have yet been initiated

REPORT

1. Developments in the Payment Transactions Market

Technological progress and regulatory requirements are major drivers of change in the financial sector in general and in the payment transactions market in particular. Together, they are leading to a break with the proprietary payment infrastructures established by the banking industry and therefore driving the increasing liberalization of the European and international payment transactions market.

Figure 1: Global Creation of Payment Platforms by Technology Service Providers

Regulatory and Technological Developments

One of the main aims of the European Commission is to promote innovation and competition in the market for financial services. Besides previous and current efforts to consolidate and standardize by means of the PSD, SEPA and other regulatory requirements, the second amendment to the Payment Service Directive (PSD II) in particular marks a structural change. Among other things, it requires European banks to enable third parties access to accounts. This means the banking payment transaction infrastructure will be available to establish new business models as of 2018.

Furthermore, ongoing technological developments will also give way to the development of new business models. These include contactless communication standards (NFC, BLE, virtualization solutions for card payments, including tokenization), as well as establishing new authentication processes (biometric and behavioral).

Overview of Activities in the Field of Payment Solutions by Market Participants Outside of the Industry

Technology service providers are making use of the opportunities resulting from changes in the market and offering their customers superior solutions as compared with products offered by banks. Depending on the focus, they implement their solutions either in their hardware or in the services they provide.

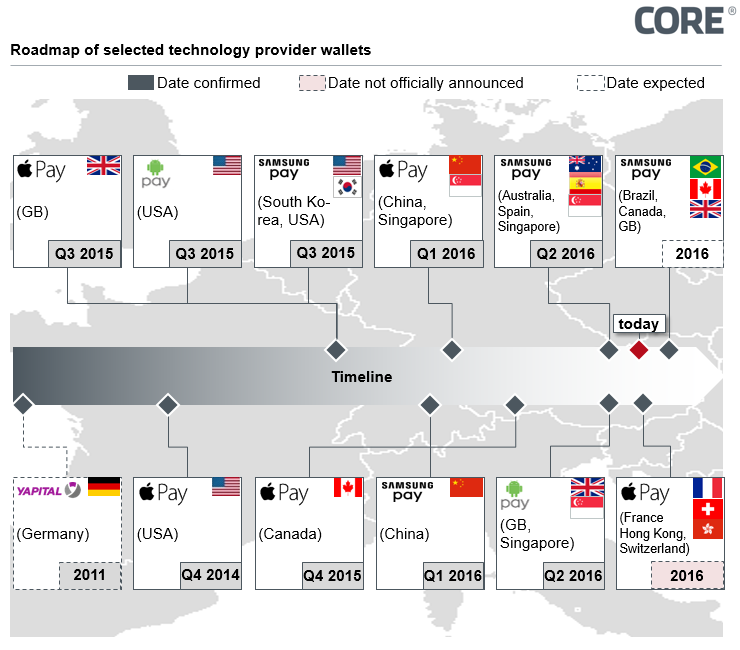

The first group comprises hardware specialists such as Apple, Google and Samsung (most recently, Microsoft too) who are rolling out their own highly user-friendly payment systems (Apple Pay, Android Pay, Samsung Pay). Firstly, the service providers put their focus on enhancing customer loyalty in order to strengthen their business model and thus achieve increased revenue with their own hardware, particularly smartphones (Samsung) or more targeted, E2E advertising (Google). Secondly, they focus on achieving ownership of their payment transaction-relevant data – an increasing sensitivity to the profitability of in-house payment handling in this context must be assumed.

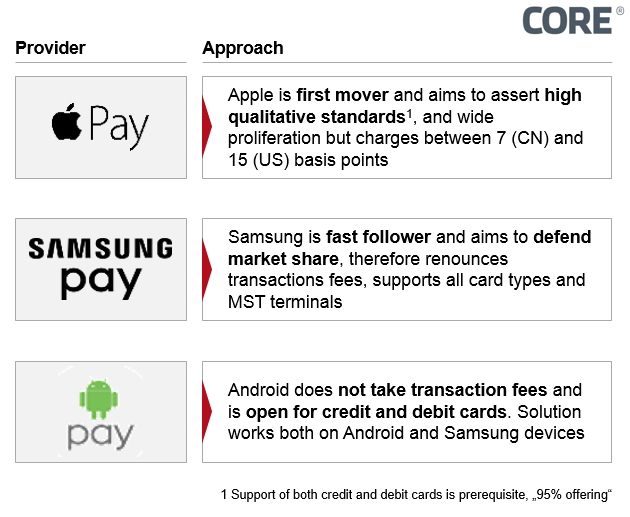

Figure 2: Focus and Objective of Technology Providers

In addition, telecommunications service providers such as Vodafone, Telefónica and Deutsche Telekom are entering the market with hardware-based concepts, i.e. in the field of smartphones with SIM-based payment solutions. In these cases, the SIM is often taken as the secure element for security-relevant data on the smartphone.

The second group comprises of providers of instant messaging services (Facebook with Facebook Messenger and WhatsApp, Tencent with WeChat) with particularly large numbers of customers, or existing models, such as AliPay. They integrate payment possibilities into their services, thus occupying the customer interface in this way. The same goes for well-established providers of customer loyalty programs, such as Payback (Payback Pay).

Credit Card Schemes as a Bridge to Infrastructure

The majority of the new services listed is based on the use of established payment transaction infrastructures owned by the Amex, MasterCard and Visa credit card schemes. This is no coincidence because the international service providers have recognized the tipping point: They are making huge investments in the transformation of their own backend structures to accommodate the new world (tokenization, digital cards dPAN; RESTful APIs) and are providing these to technology service providers through strong partnerships. This technological infrastructure is also being offered to banks for consciously low prices (sometimes even for free). The motivation behind this is clear: Acquiring ownership of the basic data streams in the payment transaction process and therefore the transfer of their business model into the new, digital world.

The result is that the market opening brought about by the regulators and the competition opened up by the technology service providers are leading to a breakup of the previous characteristics of the infrastructure. Payment options with value added are being integrated; the aim is not usually direct monetarization – rather, payment solutions are used as a leverage for other aims.

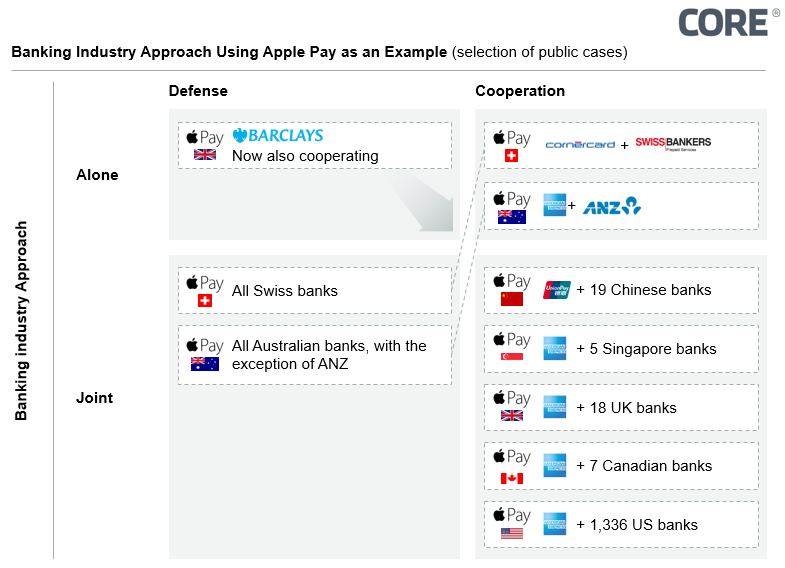

- Bank Options

On the one hand, banks are faced with the dilemma of having to offer their customers innovative solutions in order to not completely lose their custom and to keep participating in successful ecosystems, but at the same time however, keeping the customer interface in the bank’s own sphere of influence and thus not losing ownership of the transaction. In this regard, there are two different types of reactions that can be clearly observed on the market: cooperation and defense.

a) Cooperation: Banks and third-party service providers offer new services in order to proactively counter changes in the market and adopt a leading position.

Banks are increasingly working together with FinTechs with regard to payment transactions and access-to-account Solutions. One well-known example is the partnership between Deutsche Bank and various third-party service providers, which includes the aggregation process of creating an inter-bank account in the online/mobile banking frontend and offering additional services, such as a safe for documents.

Payment service providers cooperate with new payment service providers in order to guarantee and/or accelerate their market access within the EU and within Germany: The prepaid credit card boon from Wirecard makes Apple Pay possible, while the partnership between Ant Financial and Concardis makes AliPay possible.

This partnership comes with a hefty price tag for banks: the loss of the direct customer interface and sole ownership of customer data and in part, the additional services that distinguish the bank from the competition.

b) Defense

Certain competitors, which together make up the majority of the overall market, are pursuing a defensive strategy and taking a protectionist stance.

This is shown in particular in the amalgamation of the Paymit and TWINT payment systems in Switzerland: Creating a national payment system in advance of the Swiss market entry of Apple Pay, with the participation of the five biggest banks and telecommunications service providers, as well as the two biggest retailers. The defined goal is to provide a payment service that is tailored to the peculiarities of the Swiss market and with a more comprehensive range of functions than offered by proprietary systems. In this case, the media attention given to the announcements by Apple were partly used to great effect in implementing a national Swiss solution. At the same time, initial activities by Apple to break up the protectionist stance have been observed with regard to the usability of the NFC interface by third-party solutions. As a result, the Swiss consumer protection body has brought a case against Apple to open up the interface.

Figure 3: Bank Alternatives to Apple Pay

3. Effects on Germany and Europe as Financial Centers

Besides the immediate significance for the competition, the penetration of international technology service providers from largely outside the EU also has other far-reaching implications. For example, with regard to Germany and Europe as a financial center, there is the risk that payment transactions could migrate completely into the hands of US or Asian players – including a wide-scale decoupling from European or national regulation.

This trend is also reflected in the often very close partnerships between international schemes and technology providers. One such example is the market launch of Apple Pay in Australia and Canada, which Apple managed to orchestrate completely independently of the national banks by means of a sole partnership with American Express.

Similar scenarios have already been realized in partnerships between Wirecard (Boon), MasterCard and Apple. From an economic point of view, this holds the risk that Germany and Europe as financial centers may lose structural significance.

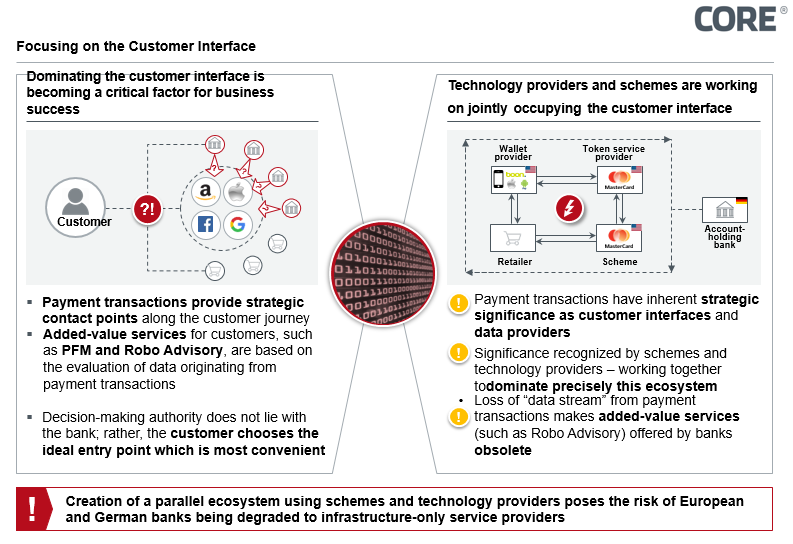

Figure 4: Approaches for Occupying the Customer Interface by Banks and Innovators

4. Approaches by German Banks

In Germany, banks are generally pursuing the approach of operating in the market with in-house solutions in competition with other market participants in the German banking industry. This can be seen in the relevant fields relating to payment transactions.

E-Commerce

The German banking industry already started out on the path towards developing and establishing the joint e-commerce payment system paydirekt several years ago. This was a major milestone in the partnerships within German banking. Some banks or banking groups, however, continue to adopt increasingly parallel or alternative solutions, such as the girocard online project.

Mobile Payments at the Point of Sale

The Genossenschaftliche and Sparkassen Finanzgruppe banking group is focusing on an NFC-based solution in partnership with telecommunications service providers Telekom and Vodafone in order to address stationary retail (mobile payments with girocard mobile). This solution is based on an NFC-enabled SIM card. Some private banks announced their initial testing phase for fall 2016, and are also working on in-house NFC-based payment systems from their own banking apps.

Peer-to-Peer Payments

Transferring sums of money between private individuals (peer-to-peer payments, or P2P), for example when people go to a restaurant together and then split the bill, is increasing in relevance and is often a strong customer loyalty tool as a result of the high frequency with which it is used. PayPal has also been offering its P2P service in Germany since 2015. The banks have positioned their own in-house solutions inconsistently in the market. DKB, for example, offers its customers the P2P solution from Cringle; Deutsche Bank will also offer a P2P solution as part of the revision of its DB mobile app. The Sparkasse group, however, plans to work with the Volksbanken Raiffeisenbanken banking group to develop their own P2P solution, Giro4Friends.

The singular solutions are unlikely to succeed as a result of the lack of critical mass and the limited scope of influence of the platforms; they will likely lead to collective failure and large-scale bad investments.

5. Solutions for the Banking Industry

Banks should focus less on the competition in terms of their actions and more on the creation of joint, more competitive systems for the German – and perhaps also the European – financial market. The prerequisites are good.

Customer Interface and Trust

Generating a critical mass with regard to customers is and remains the pivotal focus of launching new products and innovations. The established banks have a large number of customers and still enjoy utmost trust, despite the part they played in the banking crisis and their misconduct.

The paydirekt Technology Platform

In its paydirekt platform, the German banking industry has an inter-bank, joint technological basis drawing on state-of-the-art technology that can be scaled almost limitlessly and that would generally provide a large number of additional services and expansions. It would be feasible to expand it with peer-to-peer payments or the creation of a completely cardless digital mobile payment solution for use at stationary POSs. In addition, paydirekt would also be the ideal vehicle for the technical realization of the access-to-account requirements of PSD II.

Girocard Scheme

With the Girocard, the German banking industry has at its disposal a joint scheme on the German market with broad distribution and excellent acceptance. This could be used effectively and with little setup time for a joint mobile payment initiative until a cardless solution based on paydirekt could be implemented.

Conclusion

Established banks are faced with the challenge of having to completely reassess the strategic alternative of either cooperating with new service providers or adopting a defensive stance in the context of changing ecosystems. In order to shape this development, the banks will have to draw on the strengths of the entire industry. In this respect, key prerequisites have already been met; the most important thing now is to continue to develop this basis through inter-bank initiatives.

SOURCES

Payment Service Direktive II (PSD II), Richtlinie (EU) 2015/2366 des Europäischen Parlaments und des Rates, European Commission:

http://eur-lex.europa.eu/legal-content/DE/TXT/HTML/?uri=CELEX:32015L2366&from=EN

Payment Service Direktive (PSD) – Richtlinie 2007/64/EG des Europäischen Parlaments und des Rates, European Commission:

http://eur-lex.europa.eu/legal-content/DE/TXT/HTML/?uri=CELEX:32007L0064&from=EN

Single Euro Payments Area (SEPA), European Commission:

http://ec.europa.eu/finance/payments/sepa/index_en.htm

Regulation of Multilateral Interchange Fees (MIF), European Commission:

http://ec.europa.eu/competition/sectors/financial_services/enforcement_en.htm

Rundschreiben 4/2015 (BA) – Mindestanforderungen an die Sicherheit von Internetzahlungen (MaSi), BaFin:

Klage gegen Apple in der Schweiz durch Konsumentenschutz wegen Nichtnutzbarkeit der NFC-Schnittstelle durch Drittdienste: