The Retail Payments Strategy of the EU Commission

CLASSIFICATION OF THE EU PAPER AND ITS CONSEQUENCES FOR PARTICIPANTS IN EUROPEAN RETAIL PAYMENTS

Key facts

- The EU Commission identifies retail payments as increasingly strategic and publish a "Retail Payments Strategy" to influence its pan-European development

- The core of the strategy is the development of a pan-European instant payment system, which will establish SEPA real-time payments (Instant Payments) as the new standard

- Successful implementation requires consistent adaptation of infrastructure and business processes at banks, at merchants and at the customer interface

- The use of open banking, digital identification, strong customer authentication, the access to bank accounts and to third party infrastructure will be further standardised and simplified

- Regulation of further market participants and direct access of non-banks to payment processing systems will create opportunities for payment service providers and increase competition

- In addition to support cash, the issuance of digital central bank money (CBDC) will also be examined, to ensure the diversity and sovereignty of the Euro as the only legal currency in the European payments area in the long term

- If consequently implemented, the "retail payments strategy" will have a far more disruptive potential than the recent PSD2. Hence, merchants, banks and payment service providers are well advised to take action, identify opportunities as well as risks and to play an active role in shaping new ecosystems

1. Motivation, strategy and vision of the European Commission

Payment transactions are not an end in themselves. In fact, payment is just necessary to purchase goods or services. Lawyers like to talk about the principle of abstraction and enjoy the fact that only Chuck Norris can transfer property according to §433 BGB.

Ultimately, cashless payment always means transferring money from the customer's bank account to the merchant's bank account. But what may work for eBay private sales with advance payment by bank transfer is more complex in any time-critical, automated process between two parties who initially do not trust each other. For example, customers at a cash desk do not have time to initiate a credit transfer to the supermarket and wait for it to be executed (on the next bank business day), and cashiers have no chance to identify the customer's transfer from among all the money received, confirming the transaction and then letting the customer go with the goods.

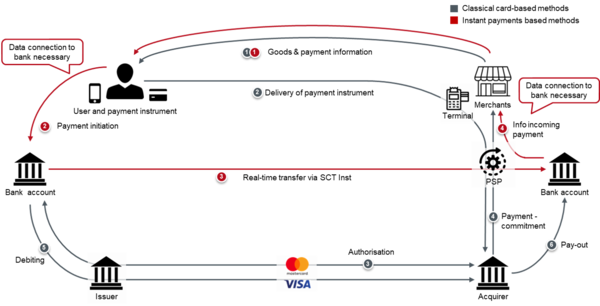

In order to enable cashless payments for POS and E-Commerce, a veritable payment industry has emerged, including a value chain and additional services, from potential reverse transactions to additional services such as embedded consumer financing. Their purpose is to simplify payment initiation for customers, to guarantee payment to the merchant at the time of purchase and to handle the actual value transfer to the merchant's bank account. In 2019, 48% of non-cash transactions in Europe were processed using this payment card principle. The merchant is therefore only entitled to get the money after the purchase and is paid-out by his payment service provider according to a fixed cycle, usually about one week after the actual card payment. However, this pay-out is then made minus fees. These include, for example, the interchange fee for the customer bank, possibly fees for wallet providers and intermediaries, service fees for the major card organisations such as Mastercard and Visa for authorisation, authentication (3D-Secure), reservation, processing of e.g. cancellations, reverse transactions, interregional transactions, even contributions to an innovation fund and, last but not least, fees for the payment service provider for the provision of terminals, access, billing, compliance fees or fees for payment methods such as PayPal or Klarna. Depending on whether the customer uses a girocard or even a corporate credit card, transaction costs - especially for small merchants with small shopping baskets - can range from a low to a mid single-digit percentage of the total turnover, of which a considerable proportion goes to large American market participants. Thus, a few large global players such as Mastercard and Visa benefit significantly from the fragmentation of European payment solutions such as Girocard/Giropay (Germany), Card Bancaire (France) or Ideal (Netherlands) and the lack of a single European system for payments at the point of sale or in E-Commerce. In addition, even national payment solutions at the POS dependent on the infrastructure of the major American card organizations to ensure the link between payment instrument, payment terminal, merchant, acquirer and issuer or to ensure acceptance abroad.

The resulting dependency as well as the outflow of value and data in the strategic sector of retail payments are the reason for the European Commission to publish a vision with 16 key actions for the next four years in a 27-page "Retail Payments Strategy".

- pan-European real-time payment solutions,

- increased competition for retail payments,

- making the payment infrastructure interoperable and efficient, and

- simplify international payments to the non-SEPA countries

... in order to establish competitive pan-European payment solutions in the sense of an "open strategic autonomy", which is embedded in the overarching "Digital Finance Strategy for Europe".

The 16 "Key Actions" can be divided into the following thematic blocks.

2. Instant Payment - "the new normal?”

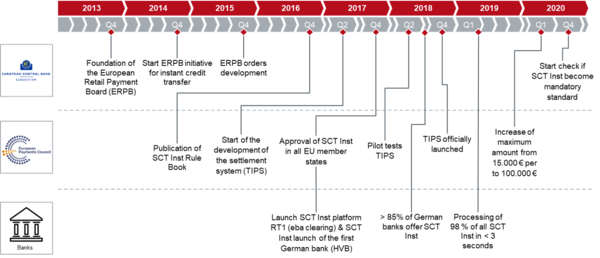

The European Commission identifies the real-time (by definition within 10 seconds) processing of credit transfers via SEPA Credit Transfer Instant (SCT Inst) as the main technical basis for the development of European, innovative and efficient payment solutions. However, the highlighted Instant Payment Scheme is not an invention but has been active since 2017 (see Figure 1).

Figure 1: Implementation milestones of SEPA Instant Payments

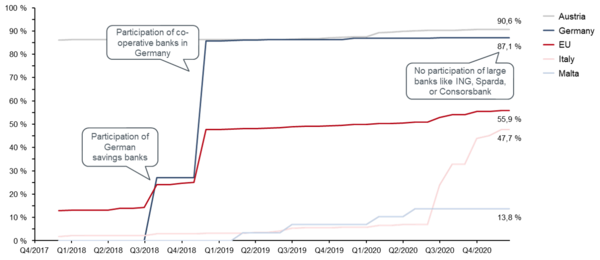

In practice, however, the Instant Payment Standard is not widespread. Only about the half of all European banks offer SEPA instant credit transfer and so the proportion of real-time transfers is currently only just under 6.5% - however, these were usually completed in less than three seconds. Although 87% of the banks in Germany are registered as participants in the SCT Inst Scheme (see Figure 2), some large German retail banks such as ING, Spardabanken, Consorsbank or the new C24 Bank are not present there. And it is also worth taking a closer look at the participants. Some banks such as comdirect, for example, offer the service completely free of charge and even initiate SEPA credit transfers automatically as SCT Inst if the recipient bank allows this. In the meantime, many - especially savings banks - have completely abolished the initial fees of up to five euros due to lack of acceptance and now offer the service free of charge. However, other banks such as HVB (€0.30 - €0.50), Postbank (€0.50), Targobank (€0.60), Deutsche Bank (€0.60) or Commerzbank (€1.50) still charge fees for each real-time transfer initiated and some banks, such as DKB, are listed as participating banks but only support the reception of SCT Inst and not its initiation. A strong growth of SEPA real-time payments is therefore currently not foreseeable due to a lack of availability, customer interest and the extra charges in Germany. It also seems paradoxical that in most cases the sender is required to pay extra for a real-time payment even though the advantage of immediate value date is with the beneficiary.

Figure 2: Proportion of banks in selected countries that can receive SCT Inst transactions as a minimum

During the period in which the SCT Inst standard was introduced, the European Parliament provided an exemption period of 3 years, after which the Europe-wide interoperability should be analysed. This period will expire in November 2020, and it is expected that the European Commission, after having carried out its examination, will declare at the end of 2021 mandatory participation in the SCT Inst standard for banks in order to ensure widespread acceptance. At the same time, the Commission recalls that all institutions participating in the Instant Payment scheme must have appropriate real-time tools for the prevention of fraud and money laundering, in line with existing legislation. For many banks, whose systems are based on legacy technology and batch processing, this could lead to massive investments in real-time message-based infrastructure and the need for 24/7 availability.

Banks, therefore, must very carefully examine the implications for their infrastructure and business processes, what it means, if all credit transfers are to be processed in real time rather than just a few individual ones. A clear strategy is also needed on how real-time transfers can be used to generate revenues and improve customer interactions that justify the investment. The first promising approaches are already visible; a simple additional pricing of real-time transfers to the end customer is certainly not appropriate, especially as the EU Commission already indicates that charges for real-time transfers should not be higher than for conventional transfers and should therefore be offered to end customers free of charge.

At least, the ECB wants to ensure full interoperability of clearing and settlement systems by the end of 2021 through TARGET Instant Payment Settlement (TIPS) and central bank accounts for banks across Europe. The main advantage of this is that banks will no longer have to provide multiple liquidity to the different instant clearing systems.

In order to make real-time payments more attractive and usable for end customers and retailers, the European Commission is considering the introduction of a Europe-wide standardised QR code for triggering real-time payments. In this context, it is also worth taking a look at the already defined SEPA Request to Pay (RTP) scheme: This scheme will be officially launched on 16 November 2020 at the time of the general SEPA rulebook change and gives merchants the opportunity to address payment requests (including the purpose of the payment) directly to a customer's bank account. Customers will then be able to pay directly (e.g. at the point of sale or during an E-Commerce checkout) without having to enter unnecessary data. After the customer has accepted the payment request, the merchant receives a message - but this does not mean that payment is final. For example, even when using SEPA RTP, the merchant must check the receipt of payment on his own bank account and, as RTP payment requests cannot be used as electronic invoice/checkout slips, they must also be created/sent separately. To identify the customer's bank account in the first step, the SEPA Proxy Lookup (SPL) scheme can be used, which is currently also not widespread. With this scheme, the customer's bank account can be identified based on a telephone number or e-mail address, e.g. to avoid entering the IBAN in E-Commerce. In theory, therefore, this opens up a wide range of attractive possibilities However, even with these schemes the challenge remains to achieve a critical mass of account-holding institutions and acceptance by the end customer. So far only HVB, Deutsche Bank and the cooperative central bank have declared their intention to implement RTP.

For real-time credit transfers, it is also noted that additional services such as the possibility to initiate chargebacks in case of fraudulent payments are important for user acceptance and the corresponding costs cannot be ignored.

Thus, in order to balance political interests ("open, strategic autonomy") with the interests of merchants (low transaction costs), the interests of banks (revenues and customer interactions) and the interests of end customers (simple and free initiation of payments - as is already the case), in addition to an overarching concept, overarching rules and contracts are needed to regulate the charging of transactions and the procedure in the event of a disputes. Even if just one interest group is neglected, the entire solution would be at risk to fail, due to lack of acceptance. Thus, a procedure that regulates the reversal of payments and safeguards payment defaults must not generate a disproportionate overhead, generating costs which in turn would mitigate the advantages of instant payments.

Other critical success factors are attractive payment instruments for end customers and industry-reliable solutions which are user-friendly and good enough to compete with existing payment methods, which are generally based on cards or direct debits. As the active initiation of a credit transfer by the customer is probably not possible without a data connection to the customer's bank, which has to be enabled by a smartphone or a special terminal, this could become the biggest challenge, but also an opportunity for banks to differentiate themselves with smooth authentication procedures and to become the bank of choice e.g. at the POS.

In order to actively generate added value for end customers, individual merchants are already trying to link the payment function with customer loyalty programmes to realise discounts or collect points in the app of the merchant or its loyalty partner. With the Lidl Plus or Payback Pay mobile apps, the first promising approaches can already be identified, into which such a real-time credit transfer solution could be integrated holistically in order to guarantee merchants a cost-effective, secure and convenient payment solution for the customer. In combination with self-checkout solutions, it would also be possible to completely replace the need to go to the cash desk, which - at least in theory - could further increase the attractiveness for customers and retailers.

Furthermore, the systems of retailers, or of the payment service providers acting on behalf of retailers, must also be able to process real-time payments from the (digital) checkout to the ERP system accordingly, in order to ensure smooth processes in stationary business or E-Commerce and thus to be able to actually exploit the full added value of real-time payments. In this respect, it is also critical for merchants to check their own systems and business processes for their real-time capabilities and to translate the identified needs into an IT strategy.

Figure 3: Example of the sequence of classic card payments versus real-time credit transfers

3. Introduction of European specifications for contactless payments

As a next step, the European Commission, is even considering to introduce a European specification for contactless, card-based payments based on instant payment itself, which can be interpreted as a separate scheme and thus as competitor to Mastercard and Visa. However, the Commission wants to take its time until the end of 2023 to develop a visible logo at the European level and to find ways to strengthen the ecosystem that has been created by then. For the interim company "European Payment Initiative" (EPI), which was founded this year by 16 European banks and banking associations, this can be interpreted as a guideline and generates impact, but according to the authors also sets a less ambitious timetable. The initiative is pushing to bundle existing national payment methods and expects this to bring benefits in terms of improved handling and greater recognisability for consumers and merchants. This is also intended to address the fact that in 2019 almost half of all registered purchases in stationary retail trade were still paid in cash and the lack of an adequate payment method was the second most frequent reason for abandoning E-Commerce orders (after high delivery costs). However, it remains unclear at this stage what advantages EPI can actually generate for customers and retailers compared to existing payment methods. The envisaged use cases and added value for end customers and merchants make the success of the initiative appear questionable.

4. Adaptation of the regulatory framework

Further incentives for pan-European payment initiatives will be provided by adapted regulation that ensures cross-border interoperability, promotes standardisation and allows low-threshold access to existing customer interfaces.

First of all, the Commission recalls the existing rules for the European harmonisation of the Single Payment Area, criticises the fact that, even this days, cross-border SEPA direct debits are partially rejected by the recipient or can technically not processed ("IBAN discrimination") and warns of corresponding violations of the binding SEPA Regulation.

The identification of end consumers, which is required for onboarding to new payment service providers, revised by the Commission that has committed to revise the eIDAS Regulation to extend its scope to the private sector. The lack of cross-border interoperability of existing authentication solutions is thus actively addressed and a solid legal framework for the use of interoperable identities is to be established by 2024. The aim is to standardise and simplify the necessary KYC to prevent money laundering and terrorist financing and to allow rapid access to new financial services.

Legislation under the second Payment Service Directive (PSD2) will also be subjected in a comprehensive review process. Based on the experience gained, measures are to be derived to simplify the access to bank accounts for regulated third parties by mid 2022. The many different standards for application programming interfaces (APIs) as well as the fallback mechanism, e.g. via screen scraping, which is often still in use, currently make access to many European bank accounts difficult for the more than 400 account information and payment initiation services. According to the EU Commission, the potential of "open banking" cannot be fully exploited at present. This is to be addressed by a "SEPA Application Programming Interfaces Access Scheme", which ultimately must be implemented by the account-holding banks and must be taken up as part of the overall IT strategy.

Barriers created by the strong customer identification (SCA), also established under PSD2, which in E-Commerce is still suspended until the end of 2020 due to poor implementation by market participants, will also be adjusted according to market needs. The aim is to establish modern authentication procedures that make strong customer authentication the standard and minimise the risk of fraud without restricting customer convenience. Older technologies, such as the sending of one-time passwords via SMS, are to be consistently replaced.

Access to relevant third-party infrastructure will also be guaranteed under non-discriminatory conditions and made available to other market participants without undue restrictions. This addresses, for example access restrictions for third parties to the NFC function of Apple devices, but may also concern voice-operated systems such as Alexa or proprietary customer interfaces of car manufacturers. It is to be assumed that the market power of individual large platform providers such as Apple, Google or Amazon and the resulting network effects are to be mitigated in order to enable easy customer access and to promote innovation even for newly developed payment systems.

In this context, the Commission also criticises the kernel for contactless payments in current POS terminals, which is usually developed by international card organisations and is critical for the establishment of new payment methods at the POS. Although a separate open kernel is currently being developed by the European Card Payment Cooperation (CPACE), even the Commission estimates that it will take several years to introduce this. Such a kernel should become a key element in the development of terminals for the retail sector which will allow an instant credit transfer to be initiated at the customer's account by means of a card-based procedure at the POS.

The Commission is also looking into the possibility of regulating other market participants and thereby increasing its influence on so-called technical service providers, platforms and equipment manufacturers in the payments value chain, who, although not themselves involved in the money flow, but have a significant influence through the creation of interfaces and infrastructure. This could affect technology providers such as Apple and Google, but also, for example, the providers of data centres for financial service providers. As a further reason, the Commission refers to a technology company that offers payment-related services and whose insolvency had a noticeable impact on other regulated subsidiaries, thus indirectly addressing the fraud scandal of the Wirecard group.

The Commission also wants to put e-money and payment institutions on an equal level and extend the scope of the Settlement Finality Directive (SFD) to them, so that they can have direct access to payment systems even without partner banks. Payment institutions with modern technology can thus play a key role in adding value to real-time payment solutions if banks are too slow to implement them properly. This could lead to exciting shifts in the payment services market, which the Commission may explicitly wish to see in the context of competition.

5. Promoting technological progress and ensuring diversity

The European Commission also uses the published "Retail Payments Strategy" as a commitment to diversity in payments.

On the one hand, the promotion of digital payments with real-time payment systems is explicitly mentioned and legislative measures are even being considered to oblige public institutions or even small merchants to accept digital payment methods. On the other hand, the Commission also stresses the importance of cash as the most important form of payments for about 30 million adult Europeans without a bank account. The European Commission is thus anticipating any critical reporting on the containment of cash and announces that, in addition to the mandatory acceptance of cash, it will also examine whether a regulation on the minimum number of ATMs to supply cash is necessary, to ensure the financial inclusion of all EU citizens. Although there is no general obligation to accept cash in Germany, only a few cafés and restaurants in large cities are known to accept only digital payment instruments. Conversely, according to the German Retail Association, more than 90% of traditional shops already have payment terminals - and the trend is rising. In this respect, no political influence is expected here in the short term.

Furthermore, the European Commission intends to research the issue of digital central bank money as a crypto-currency together with the ECB, thereby anticipating private initiatives such as Libra and thus explicitly claiming the creation of money for itself and the banks. The public consultation process was launched by the ECB on 12.10.2020, internal tests and a decision on the introduction of a digital euro are expected for mid 2021.

6. Internationalisation of the SEPA Schemes

To strengthen the euro as a currency and Europe as an economy, credit transfers to other areas of the world should be faster, cheaper and easier as well. SEPA thus should become an international standard that makes it easier, for example, for the growing group of labour migrants to transfer money to their families in countries outside the EU. This would create an alternative to money transfer services such as Western Union, with the aim of reducing the average cost of global financial transfers from currently about 7% to less than 3 %.

The Commission also stresses that the benefits of a real-time payment system are available to all Member States, irrespective of the currency. Transactions in Swedish Krona can even be processed through the TARGET Instant Payment System (TIPS). In addition to linking the instant payment systems of third countries, the Commission is even pushing ahead with the expansion of the SEPA area to include the Western Balkans and its eastern neighbourhood.

In this spirit, the European Commission is formulating its claim to declare SEPA standards as export good within the framework of the Global Payment Initiative (GPI) and to promote standardisation beyond the borders of Europe in order to shape global payments in line with the open, strategic autonomy of the European Union.

7. Conclusion, outlook and next steps

The motivation of the European Commission to promote competitive, European payment solutions in order to ensure diversity in payment for citizens and companies, to promote Europe's economic and financial sovereignty and to strengthen the international role of the Euro and the EU is understandable and worthy of recognition. However, the EU institutions see themselves only as a political catalyst and must ultimately rely on the private sector for effective implementation. Whether the 16 key actions formulated are sufficient to achieve these goals is questionable. A realistic entry scenario will probably range between two extreme scenarios:

In the best case, real-time payment processing acts as a driver for fully digital and automated business processes in banking and retail business. Customers can access their bank accounts securely and conveniently using various innovative European payment instruments to initiate real-time credit transfers at the point of sale or online check-out, which can be credited and allocated directly in the merchant's system. Transactions could then be completed within seconds without the need for a card organisation, established payment methods or acquirers. Innovative shopping solutions such as self-scanning in combination with loyalty programmes in stationary retail or E-Commerce solutions could natively integrate instant payment procedures and thus directly link customers and merchant account. For adapted market participants such as banks or acquirers, completely new business opportunities arise, but completely different from today's services. The massive investments could pay off and drive further digital solutions. For example, in the future, bills may no longer end up in the letterbox but, thanks to pan-European request-to-pay solutions, directly in the customer's payment app, where they can be paid without any media disruption and with immediate value date. Archiving services even allow the management of invoices and warranty certificates. This would reduce transaction costs for retailers, simplify accounts receivable management and minimise the risk of payment defaults. Customers would get an overview of their financial situation in real time and Europe would be less dependent on the major card organisations and platforms and would even sustainably safeguard innovation and competition by facilitating market access for new participants.

In the worst case scenario, the implementation of SCT Inst has caused massive costs for banks and merchants, took much longer than planned and complete harmonisation fails due to resistance from individual participants/countries as well as limited acceptance due to lack of added value for end customers. The large existing card organisations and platforms use this additional time to expand their market power at the customer interface. A real-time payment system would be as useless in this case as the introduction of a fast mobile phone standard à la 5G without smartphones supporting the standard. In other words, the expensive infrastructure is available but does not have use cases.

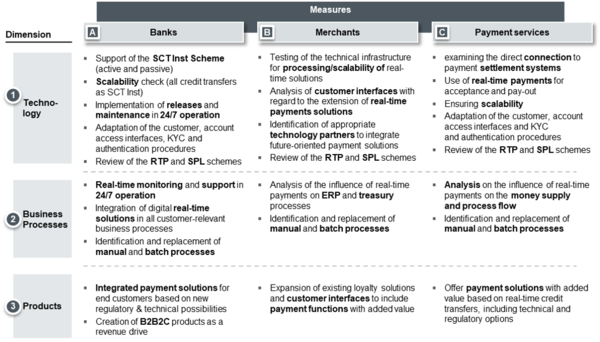

To avoid such a scenario, cooperation of all European market participants is needed to formulate appropriate rules, focus not only on policy objectives such as "open strategic autonomy", but also on the benefits for end customers (simple solutions) and the interests of banks and merchants (revenue and low cost). The published vision of the European Commission can only be a first step and the comprehensive establishment of SEPA instant payment schemes can only be a possible success factor, which in a next step must be validated with all market participants (see Figure 4):

Figure 4: Possible actions for banks, retailers and payment services

Nevertheless, banks would do well to press ahead with the implementation of instant payments and, insofar as the standard has already been introduced, ensure scalable processing in retail payment, both technically and organisationally. In this way, banks will not only forestall any regulatory measures, but will also be able to use instant payments as a benchmark for future-oriented business models, where automated execution in real time will be critical. In this context, banks should also take into account the other regulatory-driven initiatives mentioned above, such as the "SEPA Application Programming Interfaces Access Scheme", standardised identification, authentication and access of technical infrastructures of third parties, in order to not only bind their own customers with holistic solutions, but also to benefit within a framework of B2B2C business models and thus translate the regulatory requirements from a cost driver to a revenue stream as part of an overarching strategy. Especially for banks with an outdated infrastructure, there is enormous pressure to act in order to secure their own competitiveness in the long term.

Retailers are feeling the need of end customers for digital solutions much more directly and are dependent on optimised inventory and liquidity planning, especially in low-margin business areas. Before investing in new payment solutions for end customers, however, not only their own advantages in terms of transaction costs should be considered, but also the acceptance and added value for the end customer. With HIPPOS (merchant based instant payment at POS), retail associations have already published first national initiatives to shape the future of retail payments in the interests of the retail industry. The task at hand is to analyse the new technical and regulatory framework in order to develop practical solutions that focus on the benefits for the end customers. The establishment of customer loyalty systems with their own mobile applications can already be leveraged as a basis to establish such solutions in the interests of customers, retailers and banks.

Furthermore, the group of service providers without a banking licence who provide regulated payment services to merchants and end customers (payment and e-money institutions) should evaluate the new possibilities of instant payments, direct access to payment systems as well as the further regulatory driven framework conditions and see them as an opportunity to offer payment solutions independently of card organisations and banks. The expansion of technological capabilities in combination with holistic payment acceptance solutions for merchants will enable European payment service providers to capture a significantly larger share of the value chain and therefore, of the margin in the processing of payments in future. The pressure to act should in any case also be felt by these market participants.

In summary, the European Commission's considerations have the potential to change the retail payments industry in a far-reaching way. The extent to which this potential will be realised, however, is, in the authors' view, dependent on how current and future market participants shape the defined framework conditions.