Digital Platform Strategy – a Catalyst for Success in the Automotive Industry

Digital Platform Strategy – a Catalyst for Success in the Automotive Industry

KEY FACTS

-

Current developments in the field of transportation present new challenges but also offer new potential for the automotive industry

-

Car manufacturers’ existing solutions form a solid foundation but are not enough in the long term

-

Solution: An overarching technical (back-end) platform as a basis for integration

REPORT

1. Technological and Sociological Developments Give Rise to Changing Requirements in the Field of Transportation

The automotive industry is currently faced with a structural shift that is primarily based on technological and sociological changes, with development driven by demographic change, urbanization and technological progress (Moore’s law). As a result, transportation needs are changing, which in turn is giving rise to altered demands on existing infrastructures. This is illustrated clearly by the prominent example of the shared economy trends in urban areas. In the context of automotive transportation, this means that customers are restricting their use of personal modes of transportation in favor of alternative options. In Germany, for instance, this trend is making itself felt in a shift of the modal split between different means of transportation.

2. New Market Potential Offered by Changed Transportation

With the increasing prevalence of alternative transportation concepts, the role of the car is changing. In the medium to long term, this development could impact the automotive industry in the form of weakening vehicle demand. By contrast, we are witnessing the emergence of new market potential, such as for providers of vehicles and infrastructures optimized for the new circumstances or for intermediaries who broker existing transport services on specially developed platforms. Additional added value can be generated by integrating services that were previously operated in parallel, such as peer-to-peer leasing of parking spaces and private vehicles, or by integrating business models that were previously largely untapped, such as the inductive charging of electric vehicles in specially designed parking spaces.

With this potential firmly in their sights, global technology corporations are increasingly muscling their way onto the market. On the one hand, they are seeking partnerships with big-name car manufacturers in order to utilize their vehicles as an infrastructure for new services. On the other, they are proceeding to develop vehicles and infrastructures for their own purposes.

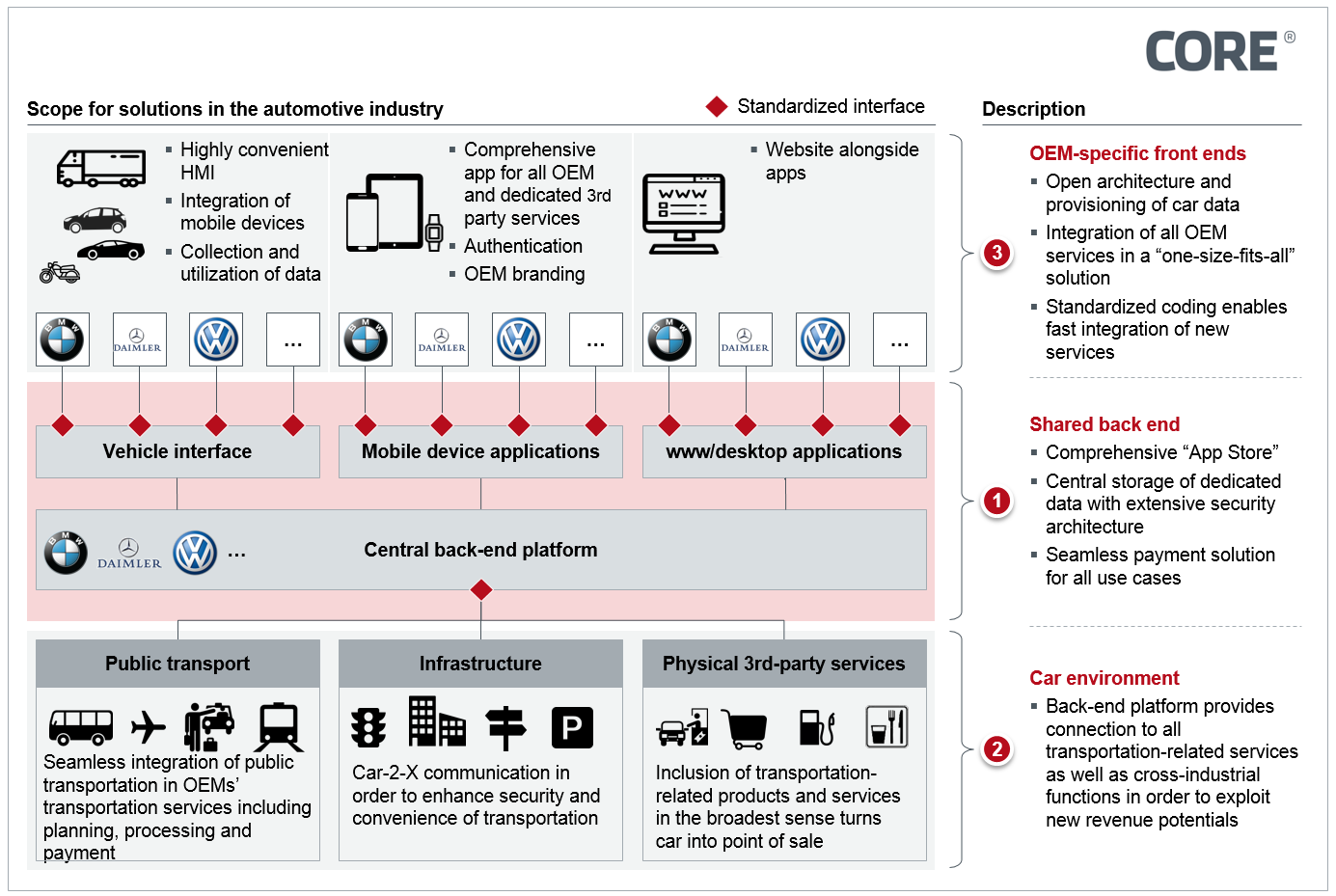

Figure 1: The digital platform strategy that car manufacturers should be aiming to achieve

3. Current Solutions from the Automotive Industry

Car manufacturers are responding to the changed-needs profile for transportation in general, and for cars specifically, at various levels (see also Digital Platform Strategy – Analogies between the Finance and Automotive Industries)

The majority of big-name manufacturers support vehicle compatibility with smartphones and apps, deliberately using this compatibility as a sales argument. For protectionist reasons, however, the supported functionality of these external applications is consciously restricted in order to minimize competition with their own products. But as the approach described hampers innovation and progress – and is therefore disadvantageous to customers – it is unlikely to prove successful in the long run.

Furthermore, the car manufacturers currently run a variety of initiatives to harness the increasing acceptance of shared mobility services, partnering not only third-party providers but also cooperating across sectors.

A prominent example is the Daimler subsidiary moovel. This transportation app links participating public transportation networks, the Daimler car-sharing service car2go, the Daimler taxi platform mytaxi and services provided by Deutsche Bahn (including ‘Call a Bike’ and ‘Flinkster’). There is also a harmonized credit card payment function for all services.

As it stands, however, the product design also illustrates the current limited outlook that is hardwired into the car manufacturers’ thinking: The app does not support car-sharing schemes provided by direct rivals such as BMW and Volkswagen. It also fails to include the majority of German public transportation networks, as well as many other existing transportation services. As a result, the moovel service is currently restricted to just a few regions and infrastructures, as well as a limited target group with dedicated travel plans.

If the app were systematically expanded to include the entire sector, the customer-focused business idea behind moovel could serve as an example of best practice for the German market. However, the potential arising from changed transportation needs is not being adequately harnessed by the isolated initiatives of car manufacturers.

The initial focus on isolated solutions has numerous causes and is not specific to one industry. One of the take-home messages from the development of the finance industry in recent years, is that protectionist strategies cannot prevent new players from entering the market in the medium term. In the short term, this means losing what were once high-margin lines of business; in the long term, there is even a risk of losing entire sections of the value chain to third-party providers.

4. Solution: A Digital Platform Strategy for the Automotive Industry

4.1 The Approach of Technology Companies

One potential solution to the problem outlined above involves restructuring/expanding the existing value chain by creating a central digital platform that can serve as the starting and focal point for transportation-related services in the wider sense of the word.

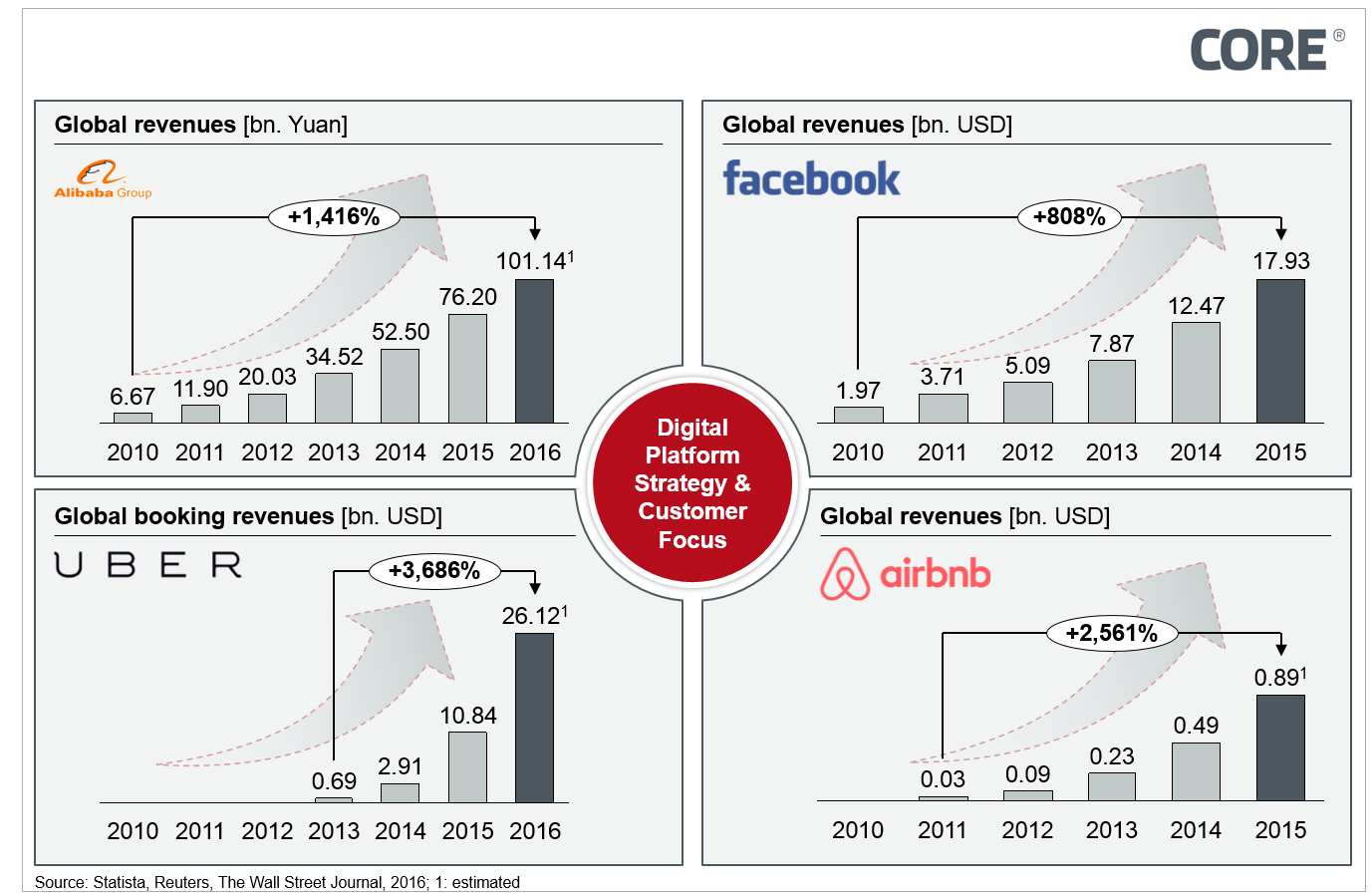

In recent years, disruptive companies have shown how successful they can be. Innovative firms such as Alibaba, Facebook, Uber and Airbnb have managed to generate considerable growth in an extremely short space of time (see figure 2). Their innovative concepts are characterized by five fundamental elements:

- Agency role: Acting as an intermediary between different interest groups

- Infrastructure provider: Provision of a flexible, high-tech infrastructure

- Framework setter: Making the rules

- Customer focus with maximum convenience

- Collecting and evaluating data for ongoing optimization and innovation

Figure 2: The disruptive companies of recent years have set themselves up as platform providers with a customer focus

4.2 Target Scenario

The role of the automotive companies is evolving from manufacturers of cars to providers of transportation and related services. This is the only way to holistically satisfy customer needs in the context of transportation and tap into new potential revenue streams.

This vision can be technically implemented by means of a digital platform strategy, which should look like the one shown in figure 1. Three fundamental functional levels should be taken into consideration:

- Manufacturer-independent, shared back-end platform – ensures shared and standardized functionality and acts as a focal point for data storage and analysis.

- Connection with the vehicle periphery – expands the range of use beyond the boundaries of the vehicle and purely digital products.

- Manufacturer-specific front-end applications – building on the shared platform, these enable manufacturers to develop their own functionality and set themselves apart from the rest of the market.

Manufacturer-Independent Back-End Platform

The manufacturer-independent platform is the nerve center of the concept. It is required to support the basic shared functionality of the platform service and to hold and administer the necessary data, such as driver data (driving style, height), vehicle data (e.g. position, speed) and driving environment data (e.g. map data, weather).

This structure enables the technical implementation of new, customer-focused services with individual added value, as vehicle, user and applications can all be integrated with each other. This generates a manufacturer-independent starting point for car-to-car communication, for example, or a foundation for peer-to-peer applications such as private leasing of the user’s own vehicle.

Another possible application is customized insurance, with customers benefiting from optimized policies on the basis of their actual journey history and their personal driving style. Generally speaking, models like this require an extensive safety system and consent for data use, with the latter largely dependent on the added value generated in each case. The insurance application mentioned above has already been put into practice in pilot projects, with acceptance achieved by means of a significant reduction in insurance premiums.

Alongside its basic function as a database of innovative services, the back-end platform can be turned into a distribution channel by adding standardized interfaces. In other words, it can function as a kind of “App Store,” where manufacturer- and device-independent applications – especially those of third-party providers – can be distributed.

The manufacturer-independent back-end platform should also provide the architecture for a further element, namely an overarching payment solution that – for the sake of user-friendliness – should be integrated in a uniform manner for payments in the manufacturer-specific front-end application, the shared “App Store” and third-party applications.

Connection with the Vehicle Periphery

An essential feature of the manufacturer-independent back-end platform is the linking of all vehicle-related services to elements of the vehicle periphery in order to design transportation solutions (with all overarching functions) that are holistically more efficient, technologically advanced and socially inclusive. To this end, a standardized interface is required that facilitates data sharing between all parties concerned.

This means breaking down the boundaries between the different ecosystems, particularly those that exist between private vehicles and public transportation systems, in order to be able to offer an optimized, highly convenient combination of modes of transportation for the travel plans in question, factoring in individual constraints (e.g. journey times and limited budgets). Alongside conventional public transportation systems, manufacturer-independent concepts for car sharing and ride hailing should also be integrated here with planning, processing and payment handled by manufacturers on a front-end basis.

A further aspect involves the expansion of communication between vehicles and infrastructure (e.g. smart traffic lights and parking spaces) by orchestrating the data on the central platform. This would optimize traffic flows and help prevent infrastructure bottlenecks, such as traffic jams and a lack of parking.

The software-based integration of third-party services in back-end platforms and manufacturer front-end platforms turns vehicles into a sales platform for purely digital products and services. If physical products and services are also to be supported at the point of sale, the vehicle has to be present in physical distribution channels. It is conceivable, for example, that shopping, fuel and take-out products could be ordered in advance and paid for within the vehicle.

Manufacturer-Specific Front-End Applications

To uphold their brand, car manufacturers can communicate to customers using an individually branded identity. For this reason, manufacturer-specific front-end applications should be developed that are tailored to the respective company and vehicle concerned but whose functionality is compatible with the manufacturer-independent platform.

For reasons of efficiency and user-friendliness (i.e. standardized processes), non-distinguishing features, such as processing and payment, can be designed in a uniform way at the front end and supported centrally via a shared platform.

Working on the premise that mobile devices – smartphones in particular – will become increasingly omnipresent, they should be the focus in terms of developing front-end applications, even though complementary websites should also be built at the same time.

There is also the possibility of integrating dedicated features into the vehicle itself in order to ensure optimum user-friendliness and safety during vehicle use. The vehicle infotainment system, for example, can be used to provide vehicle-specific features as well as access to general applications such as those installed on the user’s smartphone.

Systems should be developed that feature an open software architecture and standardized, manufacturer-independent interfaces in order to allow third-party providers to focus on developing complementary features and easily integrate these functions in the OEM front-end application. This approach should in no way be seen as a loss of the customer touchpoint. Instead, it makes it possible to provide customers with centralized and more user-friendly access to all transportation-related services, which actually helps car manufacturers retain the all-important customer touchpoint.

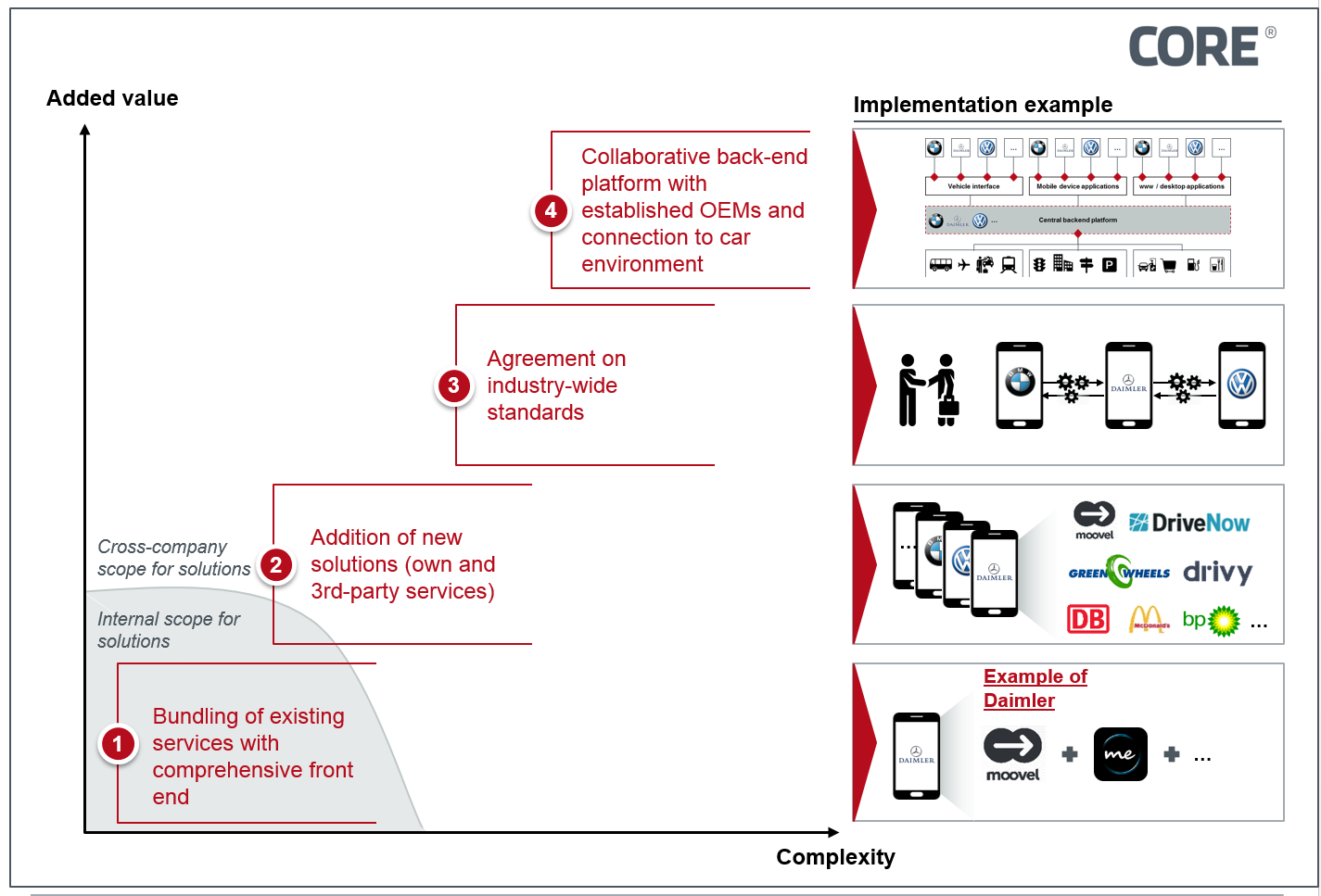

4.3 Implementation

Implementing this target scenario is a complex undertaking that presents the entire industry with considerable challenges. The car manufacturers have already addressed individual fragments such as various car-sharing initiatives, applications for mobile devices and infotainment, which all makes step-by-step implementation seem possible.

There are four key areas for action:

- Consolidation of existing services with a central, manufacturer-specific front end

- Addition of supplementary services (in-house and third-party services)

- Agreement on industry-wide standards

- Setting up of a collaborative back-end platform with established competitors and connecting this platform with the vehicle periphery.

5. Conclusion

Figure 3: Possible implementation of a digital platform strategy

The automotive industry is facing a structural realignment of existing business models and the systematic pursuit of a digital platform strategy seems a critical success factor. The most recent announcements show that these kind of platform strategies have already been put into practice: Alibaba is developing the open-source YunOS operating system for cars. The system will come as standard in the Internet Car by Alibaba and SAIC (Roewe RX5), which will go on sale in August. In conjunction with the AliPay payment service, for instance, it will be possible to complete various cost transactions from within the vehicle, e.g. paying for gas, a car wash or parking and toll fees.

Tesla, on the other hand, is going a step further and advising that vehicle capacity be fully used by means of automatic private leasing in order to optimize the environmental footprint and economic viability of each vehicle.

Projects like these suggest that automotive firms are starting to see themselves as transportation and service providers rather than just car manufacturers, even if the car will continue to play a key role in terms of meeting the demands of transportation. Even if “software alone will not get you from A to B” (Dieter Zetsche 2016), this software will decide when, how and where people use which modes of transportation in the future.

SOURCES

Shell PKW-Szenarien bis 2040

http://www.prognos.com/uploads/tx_atwpubdb/140900_Prognos_Shell_Studie_Pkw-Szenarien2040.pdf

Kampf um das beste Geschäftsmodell

BMW und Daimler lassen Apple mit iCar abblitzen

Elon Musk Just Released His Plans for the Future of Tesla

https://www.linkedin.com/pulse/elon-musk-just-released-his-plans-future-tesla-its-so-irhad-sehovic

Alibaba unveils its first smart car — and it’s available for pre-order now

Konkurrenz für die Autoindustrie: Apple macht Ernst mit dem iCar:

http://www.spiegel.de/auto/aktuell/apple-technikkonzern-will-das-icar-bauen-a-1054139.html

Google-Car: Internetkonzern präsentiert Auto erstmals Journalisten: