Eat or get eaten

WHY THE CONSOLIDATION IN PAYMENTS IS OMNIPRESENT & UNSTOPPABLE … AND WHY PROCESSORS SHOULD NOT FOLLOW THIS ROUTE BLINDLY

KEY FACTS

- The payment market is changing significantly; Payment transaction providers are under strategic pressure as revenue per transaction is shrinking and a technologically-induced convergence between POS (Point of Sale/sationary) and CnP (Card not present; in the following CnP is considered equivalent to eCommerce transactions) transactions is increasingly manifesting itself.

- Two primary patterns of reaction can currently be observed:

- Market consolidation by way of merger between (acquiring) processors, to generate larger accumulated transaction volumes and technical synergies (economies of scale) – significantly accelerated by private equity companies

- Expansion of processor’s service portfolios and deepening of value chain (partly also by strategic acquisitions) – whereas companies originating in the CnP sector have a relative advantage over POS providers to establish themselves successfully in both areas (CnP and POS)

- As technology is one of the main success factors in this changing market, technological aspects are a primary concern in any merger or acquisition activity. Portfolio expansion and mergers are not a success by default in this regard. Enabling and executing technical integration is key as a precondition to improving innovation capability and exploiting synergies.

- This must be ensured from the outset of a M&A deal, i.e. starting with the due diligence. A specific and significantly differing set of skills and frameworks is therefore required; deploying them right from the start is essential. Strategic fit and, above all, technological assessment should be in focus, rather than primarily financial figures. Moreover, on operative level, technical integration must be thoroughly planned and execution capacity secured.

REPORT

Non-cash payments: How it all works

The history of payment methods is almost as dynamic as human history itself. While a few hundred years ago goods were still commonly paid for in gold or silver, the introduction of checks in 1681 and card payments (first charge card in 1914, first credit card in 1958, first debit card in 1978) started an unbroken trend towards making non-cash payments an everyday occurrence and increasingly usual in everyday life. Such non-cash payments have long since expanded beyond their simple beginnings and now encompass a wide array of different card payment types (credit, debit, prepaid, …), electronic money transfer and, lately, mobile payments as well. Mobile wallets from Apple, Samsung or Google can also be added to the list of mobile payments, as the payment process behind current wallet solutions is technically a card payment based on a token. For non-cash payments, a distinction between POS payments and, since the introduction of the first online shop in 1979, distance business can be made.

Most card payments – both POS or CnP transactions – are conducted through the four-party system. The four parties are the issuer, acquirer, client and the merchant. Each party in this sophisticated system has a dedicated role which has evolved over the last 70 years:

- The client enters into a commercial relationship with the merchant by purchasing goods or services and therefore initiating a payment.

- The merchant enters into this commercial relationship with the client by handing out the goods or services after receiving the respective payment.

- The issuer (or customer’s bank/ issuing bank) hands out a credit card or debit card to the customer to conduct non-cash payments.

- The acquirer (or acquiring bank) is the merchant’s banking partner and represents the contractual and technical connection to the card acceptance network. The acquirer is not to be confused with the actual merchant’s bank and is responsible for maintaining the merchant’s account, which enables him to accept card-based payments. The acquirer, more precisely, the acquiring processor (Acquirer and acquiring processor are used as synonyms in the following) provides e.g. the merchant’s card terminal.

Schemes are a part of the overall structure of the non-cash payment system and play a special role. Card schemes (e.g. Mastercard or Visa) are so-called acceptance networks, that e.g. merchants can join via an acquirer to accept card payments from Mastercard or Visa. They determine the rules within the network and usually act as a router between acquirer and issuer.

There are also three-party systems (e.g. American Express, girocard) in which the roles of issuer and acquirer are generally combined in one party. The other considerations are based on the four-party system; however, three-party systems are affected in a comparable way.

Figure 1 gives an overview of the relationships within the four-party system and describes how a non-cash payment (for POS and CnP transactions) works in this system.

Figure 1: The payment market’s four-party system

Price calculation and invoicing in the payment system is complex and offers room for various exceptions. Simplified, however, it can besaid that each involved actor (issuer, acquirer) as well as the scheme usually retains a part of every transaction as their fee and that these fees are mostly calculated as a fixed percentage of the transaction value. The “price” of a transaction therefore not only consists of a processing fee that is retained by a payment processor. It also includes a merchant fee (retained by the acquirer), an interchange fee (retained by the issuing bank), a scheme fee (retained by respective card network, usually billed quarterly) and, in the case of foreign exchange (FX) transactions, a cross currency fee. If a gateway that is different from the actual acquiring processor is involved, additional fees might be incurred.

As mentioned above, POS and CnP payments, while fundamentally similar, are distinct from each other both in process and in underlying technology. Consequently, they represent separate market segments, each having its specialized actors. In recent years, however, a blurring of the line between CnP and POS payments can be observed. The driving force are CnP processors that aim to rapidly grow their business, to the extent that they also are offering POS solutions. Conversely, POS providers are being compelled to acknowledge the massive growth of online commerce and also offer online payment solutions.

A few examples of the above mentioned convergence in the payments sector are Alipay, Klarna or Vocalink. As for Alipay, being designed in 2004 to solve the issue of trust in eCommerce, now also offers in-store payments based on QR-codes. More and more merchants – not only in China – make use of this and accept POS payments via Alipay. The Swedish Bank Klarna started in 2005 to make online payments safer and easier for its users and has since expanded their service to payment cards (launch of Klarna Card on April 17th 2019) and much further. A last example is Vocalink, which has developed the instant settlement solution “Zapp” following its previous initiatives on real-time payments like “UK Faster Payments Service”. The “Pay by Bank” app from Zapp (acquired by MasterCard in the meantime) enables consumers to pay via a CnP transaction and a real time money transfer at the point of sale, leaping classical card based payment methods.

The payment market is facing fundamental challenges

The payment market presents a number of structural challenges, specifically to the payment processors. First and foremost, the ability to generate revenue from transaction-based fees is increasingly limited and curtailed – not only through an increasing push from the regulators (e.g. EU MIF regulation) but also by a decreasing willingness to pay for simple payment transactions. Many customers, especially large, globally active merchants, are becoming more demanding, pushing for a further decrease of transaction costs. The evolving alternative possibilities, e.g. to be able to conduct instant money transfers at the POS is doing the rest to encourage merchants in this (compare Zapp “Pay by Bank” app above). Hence revenues are under constant pressure. As we shall see in the following, this (a) might prove fatal for acquiring processors in particular, as they are faced with a disproportionate amount of fixed costs which become ever more difficult to offset. Also (b), it is becoming more and more difficult for acquiring processors to offer their clients a unique selling point.

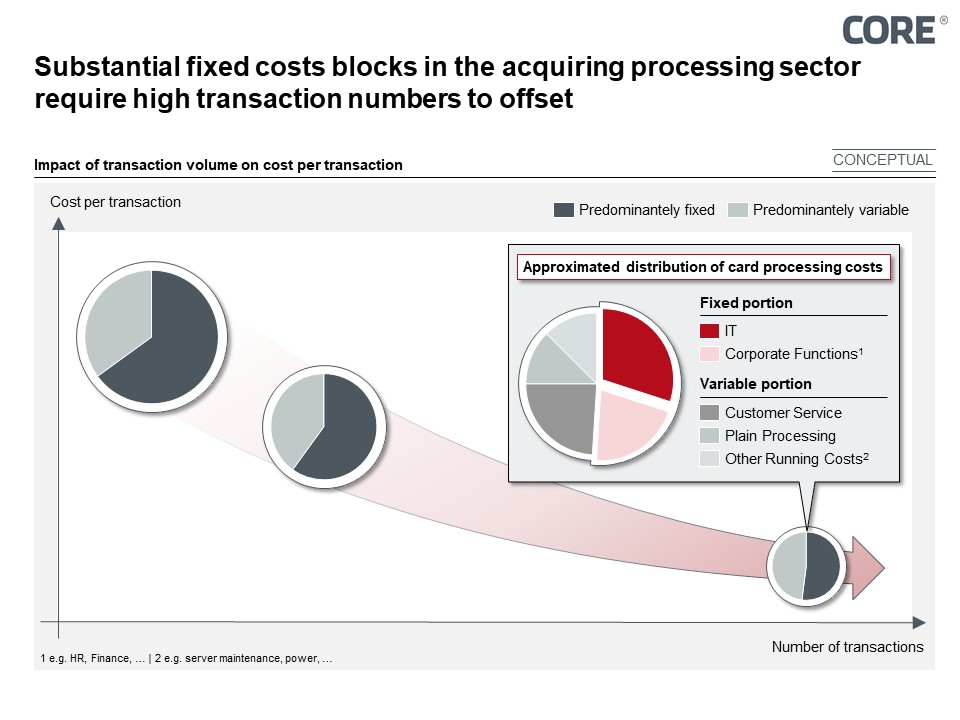

a. Acquiring costs have a fixed cost character: Payment processors already receive only a small share of the total fee per transaction and, as pointed out above, margins per transaction may be even lower in the future. On the other hand, costs are incurred by payment processors, which must be offset. For issuers, there are some largely variable cost blocks, such as onboarding and debt collection. Yet for acquiring processors, simplified, the main cost blocks are IT costs, customer service and overhead/ sales. The majority of which does not scale largely with the number of transactions. They can be regarded as quasi-fixed. Considering the pressure on revenues and in order to keep the fixed costs as a proportion of the total costs of a transaction as low as possible, acquiring processors are thus forced to constantly increase transaction volumes and numbers or rethink business models, in order to remain profitable. As Figure 2 shows, the share of fixed costs in the total costs of a transaction decreases as the number of transactions increases, but still accounts for the majority of total costs. As the same is true for all market participants, competition is increasingly predatory.

Figure 2: Acquirers’ cost distribution per transaction

Figure 2: Acquirers’ cost distribution per transaction

b. No differentiating feature: In addition to decreasing margins, acquirers are also facing the problem that it is hardly possible to differentiate from the competition, as the basic processing services are strictly delimited by the design of the four-party system. POS terminals are now almost universally adopted. The selection of the cooperating schemes was, in the beginning, a main distinguishing feature between POS processors, but this differentiation has also disappeared. Smaller market players that cannot achieve an advantage for their customers, due to a lack of a USP but also due to a lack of economies of scale, will be left behind.

In principle, CnP processors also have to face this problem. However, while acquirers can, at best, differentiate themselves by an appealing design of their terminals, CnP processors have more flexibility to create added value for their customers. For example, the ease of integration (e.g. APIs) and quality of the CnP processor’s add-on services (e.g. range of functions, analytics dashboards) play an important role.

Overall, both CnP and traditional POS payment processors are compelled to expand their business into each others areas. CnP processors start to provide POS solutions to expand their service portfolio while POS providers are emerging into the CnP sector to extend their service offering. To both, this is a way to increase their economies of scale.

Mergers & acquisitions as well as a systematic extension of services present a way out (and up) – without many alternatives

The aforementioned circumstances are well understood by most market participants. They need to grow fast in order to survive – by expanding their service portfolio, by increasing local market share or by expanding geographically. As organic growth is limited and comparatively slow, mergers and acquisitions are the tool of choice in many cases. This has resulted in an impressive series of takeovers and mergers worldwide.

Counteracting price pressure through mergers: Over the last 12 months, numerous M&A deals with transaction volumes of up to $35 billion were announced. The globally acting financial services technology company Fidelity Information Services (FIS) announced the merger with the eCommerce and payments company Worldpay for this amount in mid-March 2019. Only a few weeks before, the biggest Fintech deal to date had become known. For $22 billion, leading global provider Fiserv announced the acquisition of payment solutions provider First Data. Further big deals abound: Ingenico bought Paymark for $2.2 billion, Worldline acquired SIX Payment Services for $2.75 billion and Fiserv expanded its business by paying $690 million for Elan. Table 1 shows the above-mentioned deals and others in the last 12 months, including the stated rationales behind them.

Table 1: Mergers and acquisitions in the payments processing industry, within the last 12 months

Table 1: Mergers and acquisitions in the payments processing industry, within the last 12 months

Table 1 shows clearly that in most cases the purposes of the investment were as simple as compelling and can be summed up as follows:

- Increase the company’s size and transactions volumes

- Extend the portfolio with complementary services

- Enter into new markets

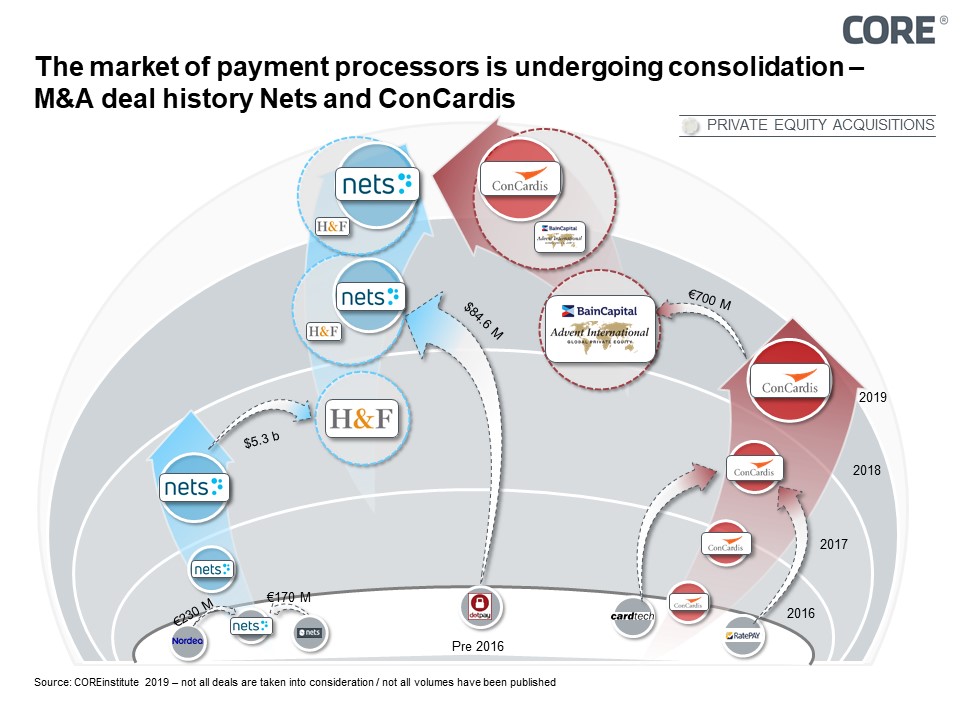

The case for payment processors to merge with others is compelling. Still, the wave of takeovers and mergers might not be rolling in with quite the same speed without the many private equity firms that recently have taken an interest in the market. In joining the run on payment processors they are further accelerating market consolidation. This can be illustrated looking at the example of Nets and Concardis.

Before Nets and Concardis – both financially strengthened by large private equity firms – merged in January of this year, each of the two companies had recently made several acquisitions already. Nets acquired Luottokunta Oy and Payzone Nordic, in 2012 and 2014 respectively. In 2017, the private equity company Hellman & Friedman laid eyes on Nets. Their offer of $5.3 billion was accepted, thus marking one of the largest European private equity takeovers in recent years. Strenghtened after this acquisition, Nets then went on to acquire the Polish company Dotpay, a leading European online payments provider, later in 2018.

Concardis is not a blank page in the consolidation business either. In 2017, both Ratepay and Cardtech were taken over by Concardis before the latter was then acquired by the private equity companies Bain Capital and Advent International for €700 million.

Figure 3: M&A deal history of Nets and Concardis

Figure 3: M&A deal history of Nets and Concardis

This consolidation trend is not limited to the European payments market: In particular India, as a very fast-growing market, has been a target as well as South America. Private equity companies have penetrated the market and may continue to move the mergers forward at a faster pace. One example is Advent International's acquisition of a majority stake (51%) in Argentina's leading payments company Prisma Medios de Pago. In 2017, India showed evidence of market expansion by European payment processors. Worldline, for example, had acquired MRL Posnet – a leading payment processor for over 18 Indian banks with an innovative terminal management platform. Ingenico, on the other hand, invested in a leading Indian online and mobile payments provider when acquiring TechProcess in 2017.

Increasing relevance by expanding services: As a consequence of current and future market conditions, and keeping in mind changing consumer preferences, traditional processors started to expand their portfolios through CnP solutions. Worldline and Ingenico, for example, both offer eCommerce solutions for online merchants.

CnP providers, on the other hand, are already trying to avoid the problem of lacking differentiation and decreasing relevance in the payment processing sector. To that end they open up for offline sales with their own POS solutions. Strengthened by the strong increase in eCommerce purchases, such processors find it easier to survive in the market. Adyen, for example, had started as an online payment processor and is now offering a wide variety of POS solutions for merchants, making use of its previously built infrastructure and application layers.

The above all taken together, it becomes quite clear that the market consolidation in the payments processing sector is by no means complete – if anything, it is likely to accelerate even further in the coming months and years. Mergers and acquisitions – and portfolio expansions – are among the few tools available for the traditional processors to stay competitive and thus become leaders in their respective regions or areas. Unless companies take active steps to merge or acquire companies themselves, they may sooner or later disappear or just be swallowed by larger players in the market. The principle “eat or get eaten” has slowly but strongly been established in this market.

Merging with others does not guarantee success

Looking at the economic success of recent M&A transactions, the picture is mixed. The following two examples of Ingenico and Fiserv (details in the appendix, table 2) outline different strategies of acquisitions and might allow for conclusions to be drawn about success factors of these deals. While Fiserv as well as Ingenico have both been very active in acquiring other companies in recent years, their share values have developed in completely different directions. The reasons for that might lie in the type and region the acquired companies are active in. The acquisitions of Fiserv were mostly in the nature of complementing or expanding their service portfolio in their existing geographical markets. Limiting itself to specific geographic regions might be due to the potentially better fit of platforms, IT architectures and regulatory requirements in known markets and to quickly increase transaction volumes on existing processing platforms. Ingenico, on the other hand, has also expanded their service portfolio while in parallel entering new global markets through their acquisitions. Ingenico has shown strong global diversification strategies, entering Asian, Indian and Nordics markets where they were either not present or only partly active through partnerships.

Arguably, the integration of acquired companies’ IT architectures and platforms as well as the realization of synergy potentials in corporate functions might proof to be easier when merging companies from the same geographical market (e.g. due to similarities in regulatory aspects, similar customer or code and API bases). While we are unable to find concrete proof for this hypothesis due to the non-disclosure of deal details, an analysis of Fiserv’s and Ingenico’s share prices shows an interesting development. Following Fiserv’s numerous mergers, its share value has increased almost exponentially since 2014 (starting from $29 in 2014 to $85 in 2019). Ingenico, on the other hand, seems to be feeling the negative effects of mergers, as there has been no positive average growth in the value of their shares (starting from $96 in 2014 to $66 in 2019). As outlined above, the reason for the different development of share prices could possibly lie in a struggle of Ingenico to integrate platforms and IT architectures of acquired companies to make use of synergy potentials.

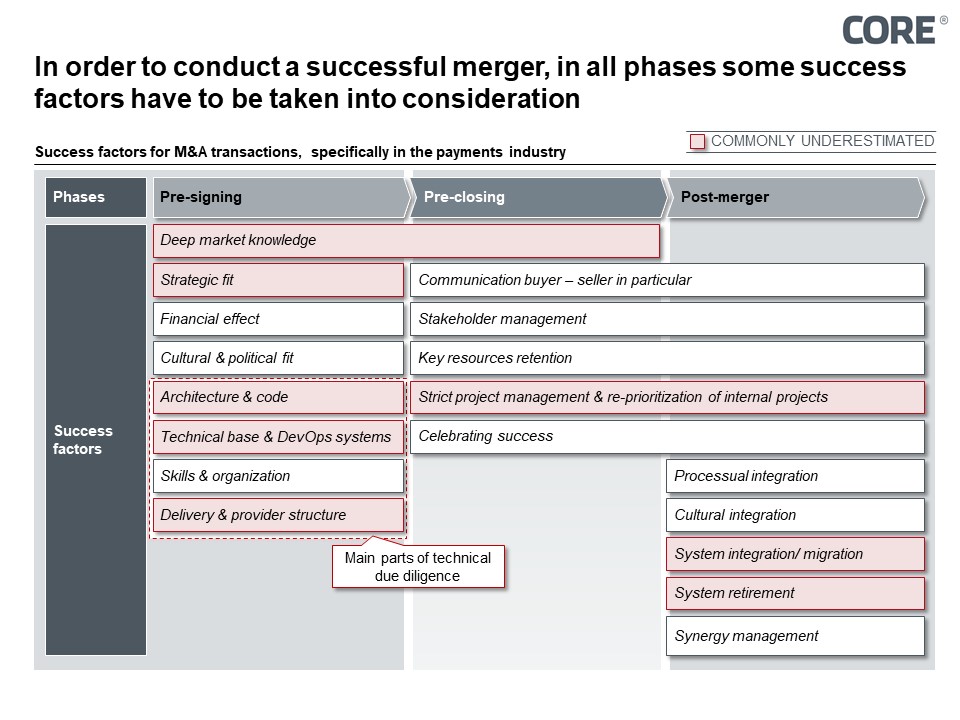

This example serves to demonstrate that great care should be taken in preparing and executing a merger or acquisition – and especially in selecting a suitable partner, a good market fit and careful consideration of respective IT and platform architectures. Figure 4 shows a selection of success factors that, in our experience, should be taken into account in the respective merger phase.

As mentioned, one key area where things can go wrong is the choice of a partner to acquire or to merge with. It is critical that a strategic and, even more importantly, a technological due diligence assessment is judiciously prepared and executed. The current due diligence process, as performed in most mergers, concentrates mainly on financial factors and calculated synergy potentials (which rarely materializes exactly as planned, unless managed actively and with the necessary background knowledge). Based on the experience from various past mergers and acquisitions, one may easily conclude that this is insufficient for the success of deals in the payments sector.

Figure 4: Success factors for conducting a successful merger

Figure 4: Success factors for conducting a successful merger

Therefore, and particularly in the pre-signing phase, both parties (not just the buyer) should focus on assessing the strategic and technological fit. It should be kept in mind that processing payments is largely an IT business and most conceivable synergies would be generated by integrating the IT systems, key personnel and respective processes. An unsuccessful merger is almost a foregone conclusion if the technological fit is unsuitable. To make it concrete, both dimensions need to be considered:

1) Strategic fit: Alignment of both companies’ strategy and portfolio is the first step to successfully choose a partner. The strategy must fit with the investing company’s growth objectives. Also, strategic and company culture should be a good match.

2) Technological fit: In addition to strategic factors, the acquired company’s architecture, system setup and respective applications have to be considered. Long-lasting and wide agreement with partner companies need to be taken into account (sourcing strategy). Prerequiste is gaining a deep understanding of the architecture of the target company and any potential impediments to growth objectives is important. For instance, legacy components might be present that require replacement. Especially in the finance and payment processing sector, the setup of technical systems is mostly similar from a structural point of view, however relying on that can be deceptive. To name just a few, the buying and selling companies should closely consider the following system components and their integration potentials:

a. Issuing processing: all systems and architecture related to issuing and maintaining cards

b. Acquiring processing: all systems and architecture related to the acquiring process (including e.g. AML, DCC, On-Us transaction functionality, …)

c. ATM support services (where applicable)

d. Reporting services

e. Fraud services

f. Scheme, clearing and chargeback services

g. Client facing software (e.g. for merchants, issuers, 3DS, …)

h. Support functions application landscape, such as: HR/ CRM/ billing and invoicing systems

Especially the acquiring and issuing processing solutions are often developed in-house or at least highly customized. They are also responsible for high processing volumes, making these two areas the most important ones for a technological due diligence.

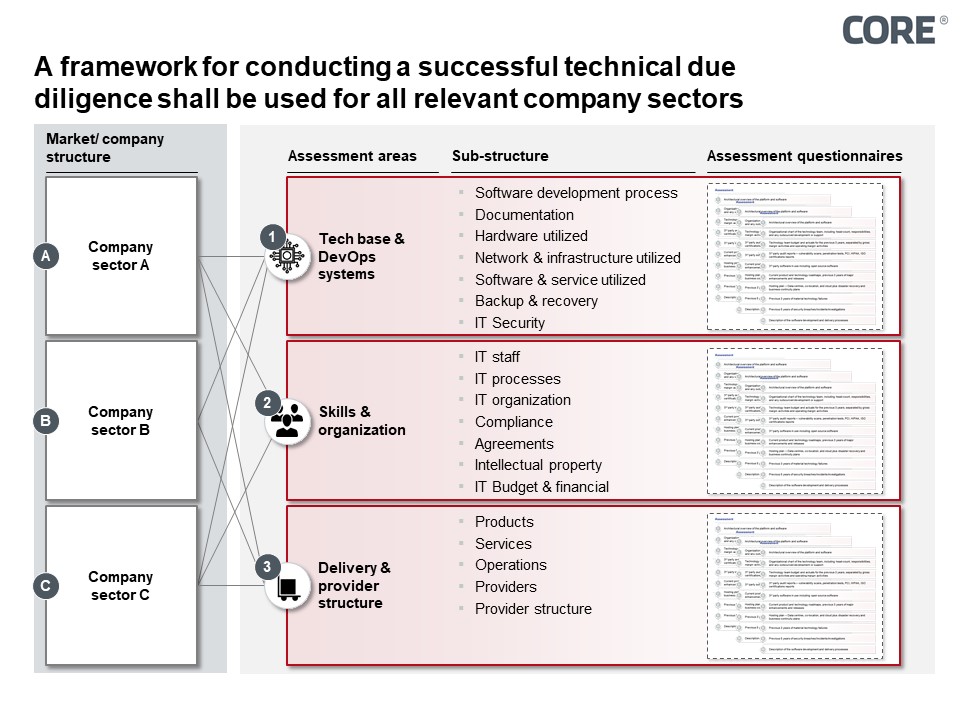

The more important technical factors for the core business are, the more important the mutual fit on a technical level becomes for the merging parties. Figure 5 shows an exemplary framework that can be utilized to conduct a technical due diligence successfully. Differentiated by market and company structure, three different assessment areas should be considered. In each of these areas a set of sub-structures needs to be assessed during a technical due diligence process.

1. Tech base & DevOps systems

This assessment area includes the software development processes, the level and quality of documentation of the technical foundation, utilized hardware, network and infrastructure and utilized software and services. Moreover, IT security systems as well as QA systems are a crucial part of this area.

2. Skills & organization

In this area the focus lies on the staff, their processes and the overall IT organization. Compliance guidelines, software agreements and intellectual property rights (e.g. not only for self-developed software) are just a few examples of elements that need to be considered.

3. Delivery & provider structure

During the delivery and provider assessment, products, services and operational structures are being analyzed. All relevant vendors as well as the overall provider structure, should be part of the assessment. This is important in order to enable a successful execution of the post-merger phase, that is, integrating the bought company and realizing synergy potentials – without being hamstrung from the outset by too many external dependencies.

Figure 5: Standardized and well-established frameworks can help during the (technical) due diligence process

Figure 5: Standardized and well-established frameworks can help during the (technical) due diligence process

Considering especially the above-mentioned application landscape, system setup and architecture, a deep analysis of realistic integration potentials is very important. Applications that do not fit together or outdated system landscapes can lead to increased integration efforts, resulting in non-achievement of mid- and long-term synergies.

Looking at success factors during the post-merger phase, it becomes apparent that mistakes are often made in the aforementioned pre-signing phase leading to subsequently increased integration efforts. Legacy systems often end up being retained and running in parallel to the new system setups. Obviously, this leads to double maintenance and reconciliation costs as well as to an increasing risk of data errors. Incompatible software architectures might even lead to an integration being impossible; developing a completely new application landscape then becomes necessary, making synergy management very complex for post-merger integration officers.

Of course the success factors discussed here are only the tip of the iceberg. Deals in the financial and payments sector are especially characterized by a strong impact of technology, accessibility of crucial domain knowledge, and sometimes complex (trans-)national regulations.

Market participants in the payments processing industry should therefore prepare themselves conscientiously and well ahead of time. Deep industry knowledge in the respective sector is essential, as well as broadening the view from a narrow M&A focus to a more strategic and farsighted perspective. It must also be ensured that strategic goals are well and fully defined and – crucially – broken down into concrete and actionable requirements, which then can form the basis of an informed due diligence. This applies in kind to other success factors, especially IT technology. Most importantly, the internal organization must be enabled to deal with these questions. Relevant know-how, capacity and coordination should be ensured well in advance. This, and a well-orchestrated cooperation between supporting advisors as well as the selling and buying company, helps to ensure the success of the deal and the integration in the post-merger phase.

CONCLUSION AND OUTLOOK

The consolidation trend in the payments market has been on full display also in the very recent past. In addition to the trend of mutual buying-up among payment processors, more and more private equity companies have clearly identified the payments market as highly relevant. This will further enforce the ongoing consolidation process and, very likely, speed it up. The market currently is in a situation where it seems improbable to survive as a medium-sized single player and where most processors are making an active effort to generate mergers in order not to be simply swallowed.

This development can be observed not only in Europe and America, but also in South America and India. The market consolidation is taking place globally; cross-continental mergers seem to be an inevitable next step. This raises the prospect of an oligopoly developing in the mid- to long-term; not entirely dissimilar to what has happened in the card scheme market, where a de-facto oligopoly already exists in some areas of the world. How that is going to affect the inner balance and future prospects of the four-party system in card payments remains to be seen.

What is clear though is that pressure on fees and margins will not ease in the foreseeable future – this pressure is constantly renewed and increased, not least by the increasing prevalence of non-cash payments, which leads to a need to process ever more transactions with less average volumes efficiently and affordably. Big online retailers with high transaction volumes such as Amazon were just the beginning.

In consequence, just growing bigger through mergers alone is not a viable long-term strategy for payment processors. The three biggest card schemes (VISA, Mastercard and UnionPay) may for now have found a way to keep emerging alternative means of payment at bay, thereby also stabilizing the four-party system. In the long term, however, it will be crucial for payment processors also to be able to innovate quickly and decisively. To achieve this goal, especially when growing through acquisitions, reaching synergy potentials in IT systems, key personnel and processes is key. To ensure reaching these goals, a thorough technical due diligence process is essential to open and prepare the technical platforms for future challenges. Enabling instant payments is just one of the challenges that are currently known. Payment processors that engage in mergers or acquisitions should therefore make the enabling of innovation one of their decisive strategic priorities in any due diligence.

SOURCES

1. History of payment methods

Infographic: The Evolution of Payment Methods

Visually 24.02.2016

https://visual.ly/community/infographic/economy/evolution-payment-methods

Infographic: A Brief History of Payment Methods

Slimpay 15.03.2017

https://www.slimpay.com/blog/infographic-brief-history-payment-methods/

2. Figure 1: The payment market’s four-party system

CORE

3. Four-party system

Visa

Website Visa (2019)

https://www.visa.co.uk/about-visa/visa-in-europe.html

Mastercard

Website Mastercard (2019) / The Mastercard Network

https://www.mastercard.us/en-us/about-mastercard/what-we-do/payment-processing.html

Credit Card Processing: A Look Inside the Black Box

Ramon P. DeGennaro 24.05.2006 / Economic Review

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=904027

4. Cost blocks of issuers and processors

COREinstitute

5. Figure 2: Acquirers’ cost distribution per transaction

CORE

6. M&A deals

FIS Buys Worldpay In $35B Cash, Stock Deal

PYMNTS.com 18.03.2019

https://www.pymnts.com/news/partnerships-acquisitions/2019/fis-buys-worldpay-cash-stock-deal/

Fiserv to Acquire First Data in $22 Billion All-Stock Deal

Anna Maria Andriotis & Micah Maidenberg 16.01.2019

https://www.wsj.com/articles/fiserv-to-acquire-first-data-in-22-billion-all-stock-deal-11547643455

Nets and Concardis today announced at Money 20/20 that the two companies will join forces to form a leading European payments player

Nets EU 04.06.2018

https://www.nets.eu/Media-and-press/news/Pages/Nets-and-Concardis-Payment-Group-Form-Leading-European-Payments-Player.aspx

Worldline presents its 2018 results and its ambitions for 2019 – 2021

Website Worldline (2019)

https://worldline.com/en/home/newsroom/press-releases-investors/2019/pr-2019_01_30_01.html

Ingenico Group reaches an agreement to acquire Paymark, a New Zealand leader in payment processing

Ingenico Website 17.01.2018

https://www.ingenico.com/press-and-publications/press-releases/finance/2018/01/ingenico-group-reaches-an-agreement-to-acquire-paymark.html

Fiserv Finalizes Acquisition of Elan Financial Services’ Debit Processing Solutions

Julie Mohn 31.10.2018

https://finovate.com/fiserv-finalizes-acquisition-of-elan-financial-services-debit-processing-solutions/

7. Fiqure 3: M&A deal history of Nets and Concardis

COREinstitute

8. Share prices Fiserv/ Ingenico

Fiserv share

Finanzen.net (2019)

https://www.finanzen.net/aktien/Fiserv-Aktie

Ingenico share

Finanzen.net (2019)

https://www.finanzen.net/aktien/Ingenico-Aktie

9. Figure 4: Success factors for conducting a successful merger

CORE

10. Success factors of payment mergers

COREinstitute

11. Figure 5: Standardized and well-established frameworks can help during the (technical) due diligence process

CORE