The AI and Automation Imperative: Thriving in the New Era of PE Value Creation

Questions? Speak to our experts

Expert- Maxim Polikarpov

Dr. Maxim Polikarpov ist Senior Manager bei CORE mit umfassender Erfahrung in den Bereichen Strategie, M&A, IT-Integration und KI-gesteuerte Projekte im Gesundheitswesen, in der Fertigungsindustrie...

Mehr lesenDr. Maxim Polikarpov ist Senior Manager bei CORE mit umfassender Erfahrung in den Bereichen Strategie, M&A, IT-Integration und KI-gesteuerte Projekte im Gesundheitswesen, in der Fertigungsindustrie und im Bankensektor. Er ist ein zertifizierter PMP und promoviert.

Weniger lesenExpert - Nicola Deon

Nicola Deon ist Senior Consultant bei CORE. Nicola konzentriert sich auf das Projektmanagement komplexer IT-Transformationen im Rahmen von M&A-Aktivitäten, indem sie Kunden beim Management von Ver...

Mehr lesenNicola Deon ist Senior Consultant bei CORE. Nicola konzentriert sich auf das Projektmanagement komplexer IT-Transformationen im Rahmen von M&A-Aktivitäten, indem sie Kunden beim Management von Verkaufs-, Carve-out- oder Übernahmeprojekten unterstützt.

Weniger lesenExpert - Olaf Acker

Olaf Acker ist Managing Partner im Global Advisory von EPAM. Er verfügt über mehr als 25 Jahre Erfahrung in den Bereichen M&A und technologiegestützte Unternehmenstransformation und hat für fü...

Mehr lesenOlaf Acker ist Managing Partner im Global Advisory von EPAM. Er verfügt über mehr als 25 Jahre Erfahrung in den Bereichen M&A und technologiegestützte Unternehmenstransformation und hat für führende Pharma-, Medien-, Technologie- und Industrieunternehmen in der EMEA-Region, in Nordamerika und in Asien durchgängige Transaktionsstrategien entwickelt und umgesetzt.

Weniger lesenExpert - Clement Mengue M&A

Dr. Clément Mengue ist Director im Bereich Global Private Equity und M&A Strategy Advisory bei EPAM und spezialisiert auf technologiegetriebene Transaktionen und digitale Wertschöpfung. Als EMEAs...

Mehr lesenDr. Clément Mengue ist Director im Bereich Global Private Equity und M&A Strategy Advisory bei EPAM und spezialisiert auf technologiegetriebene Transaktionen und digitale Wertschöpfung. Als EMEAs PE- und M&A-Beratungsleiter verfügt Clement über mehr als 16 Jahre Erfahrung in der Beratung von CxOs und PE-Firmen in Europa, Nordamerika und Afrika bei der Durchführung komplexer M&A-Transaktionen und der Maximierung des Wertes von Portfoliounternehmen. Sein Fachwissen erstreckt sich auf die Sektoren Software, industrielle Fertigung, Gesundheitswesen und Biowissenschaften.

Weniger lesen

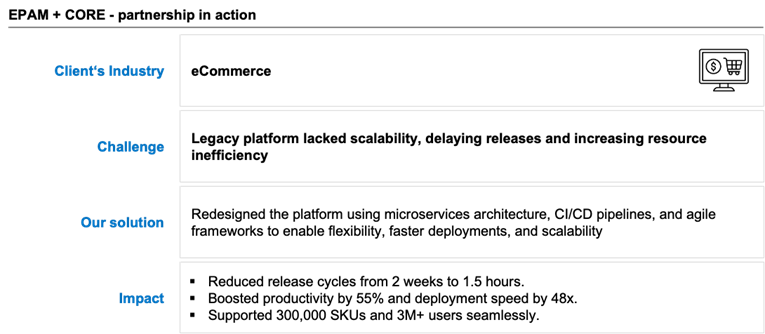

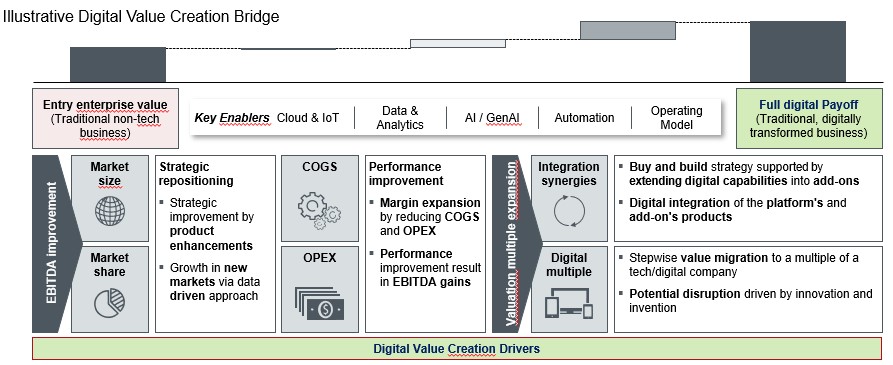

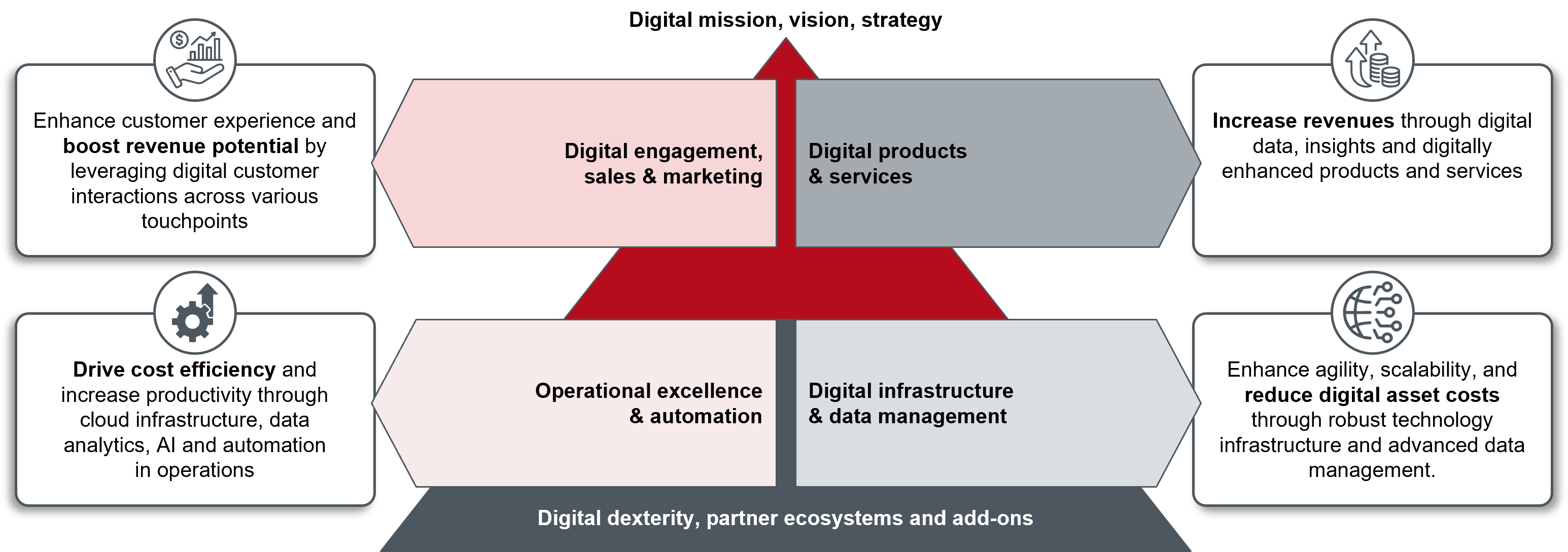

Figure 2: EPAM + CORE: Digital Value Creation Framework

Figure 2: EPAM + CORE: Digital Value Creation Framework